In the Islamic Finance News Report “China- the time is now”, it highlighted a few initiatives that demonstrated the rising momentum of Islamic finance in China, see examples below,

- Chinese brokerage Southwest Securities forged a partnership with Qatar International Islamic Bank to pave the way for Islamic finance transactions in the country. The Qatari bank confirmed with IFN that it will leverage on this MoU to develop an Islamic finance framework for China.

- Chinese banking giant, the Industrial and Commercial Bank of China (ICBC), also the world’s largest bank by assets, through its leasing arm entered into a collaborative agreement with the Islamic Corporation for the Development of the Private Sector (ICD), which is targeted to focus on multiple lines to develop Islamic capabilities and opportunities.

Separately, there is news that HNA Group, owner of Hainan Airlines, is planning on issuing USD sukuk. It would be the first Islamic financing deal by a mainland Chinese company. Chinese property company, Country Garden Holdings, also plans a sukuk programme of at least RM1 billion. Since sukuk is a viable option in a diversified funding approach, more Chinese companies could be expected to tap into the sukuk market.

As of Sep. 10, 2015, the YTD total return of the Dow Jones Sukuk Index is 1.39%. Among the rating-based subindices, the Dow Jones Sukuk A Rated Total Return Index has outperformed and gained 1.43% YTD as of the same date.

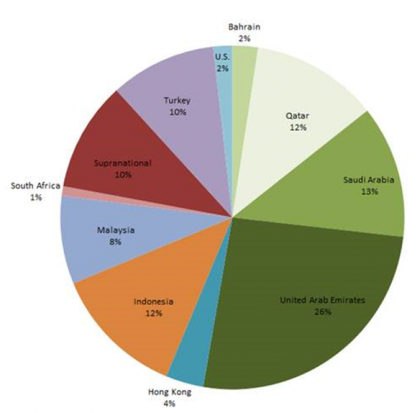

In terms of new issuance, a total par amount of USD 9.5 billion sukuk was added to the index YTD. Sukuk from United Arab Emirates and Malaysia both contributed USD2.75 billion. Hong Kong issued another USD 1 billion five-year sukuk in June, which reaffirmed Hong Kong’s ongoing commitment to developing Islamic finance in the region. Currently, sukuk from the GCC represent 53% of the overall market exposure (see Exhibit 1). Interesting to note, the new issues in the index were all launched in the second quarter, while recent primary activities have been muted on the back of market uncertainty.

Exhibit 1: Market Exposure by Par Amount of the Dow Jones Sukuk Index