“He conquers who endures.” ~Persius

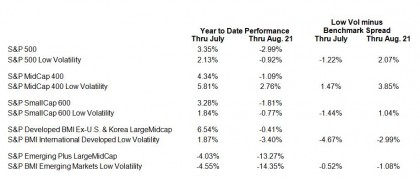

Weak markets tend to make low volatility indices shine. As a strategy that attenuates the performance of the broader market, the S&P 500 Low Volatility Index had lagged the benchmark S&P 500 by 1.22% from the beginning of 2015 thru July 31. As of last Friday, the tide has shifted in favor of low vol. In the U.S., our low volatility indices for large, mid-, and small-cap stocks all outperformed their benchmarks for 2015 through August 21. Abroad, the S&P BMI International Developed Low Volatility Index has done the same.

Below are the summary performance for a few low volatility indices and their benchmarks.

The posts on this blog are opinions, not advice. Please read our Disclaimers.