European bonds markets had a lot to take in last week. For the most part, they all responded with a downward price reaction regardless of risk profile, with the exception of Greece. The ECB left monetary policy unchanged. Eurozone inflation for May climbed to 0.3%, indicating that QE is having the desired effect. Greece chose to bundle its June payments to the IMF into one payment scheduled for June 30, 2015, buying them more time to negotiate their debt obligations. Last, strong employment numbers out of the U.S. pointed to possible Fed rate hikes, which is always a catalyst for a bond market sell-off.

This reaction indicates that, despite continued uncertainty out of Greece, the European bond market is turning away from a “flight to quality” stance. This could be due to a perception that Greece is on the right track to meet its loan obligations, and/or it could be due to improving economic signs both in Europe and in the U.S. Spain and Italy, two countries tied to the “risk-on“ trade, also moved down in tandem with the countries associated with the “risk-off”/“flight to quality” trade like Germany.

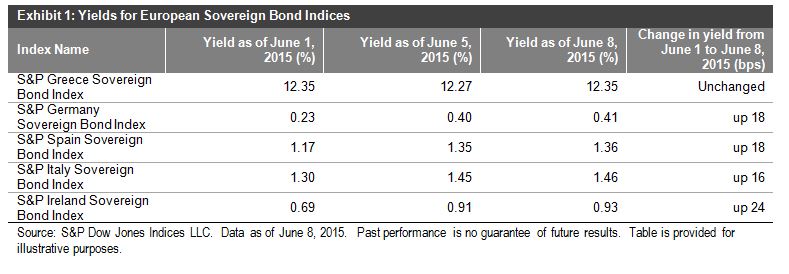

If we look at data from the close of June 1, 2015, to the close of June 8, 2015, yields on most European government bond markets significantly widened (while bond prices went down). The S&P Germany Sovereign Bond Index and the S&P Spain Sovereign Bond Index both widened 18 bps, the S&P Italy Sovereign Bond Index widened 16 bps, and the S&P Ireland Sovereign Bond Index widened 24 bps, while the S&P Greece Sovereign Bond Index ended unchanged for this period after tightening 8 bps on Friday.