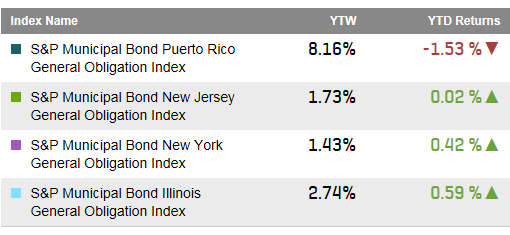

The uncertainty of the future of Puerto Rico municipal bonds continues to weigh on the municipal bond market. Bonds in the S&P Municipal Bond Puerto Rico Index have settled into an average price of just over 50 cents on the dollar with the low point of 47.27 on July 8th 2014. The index tracks over $73billion in par amount of bonds. Puerto Rico is an important segment of the municipal bond market as many of these federal and state tax-free bonds are held in State based mutual funds. While revenue bonds have held their own, year to date the S&P Municipal Bond Puerto Rico General Obligation Index has returned a negative 1.53%.

The uncertainty of how New Jersey will handle its financial future has resonated with the bond market. While Illinois gets a lot of press it is New Jersey general obligation bonds that are moving more like Puerto Rico bonds in 2015. The S&P Municipal Bond New Jersey General Obligation Index has seen its weighted average yield rise by 21bps in 2015 eerily similar to the rise of yields in the S&P Municipal Bond Puerto Rico General Obligation Index which have moved 22bps higher. The comparison is unfair of course. The weighted average yield of the S&P Municipal Bond New Jersey General Obligation Index ended at 1.73% up from 1.52%. The yields of bonds in the S&P Municipal Bond Puerto Rico General Obligation Index ended at 8.16%. Meanwhile, the yield of the S&P Municipal Bond New York General Obligation Index has dropped by 6bps to 1.43% and the yield of the S&P Municipal Bond Illinois General Obligation Index also has shown an improvement of 3bps to end at 2.74%.

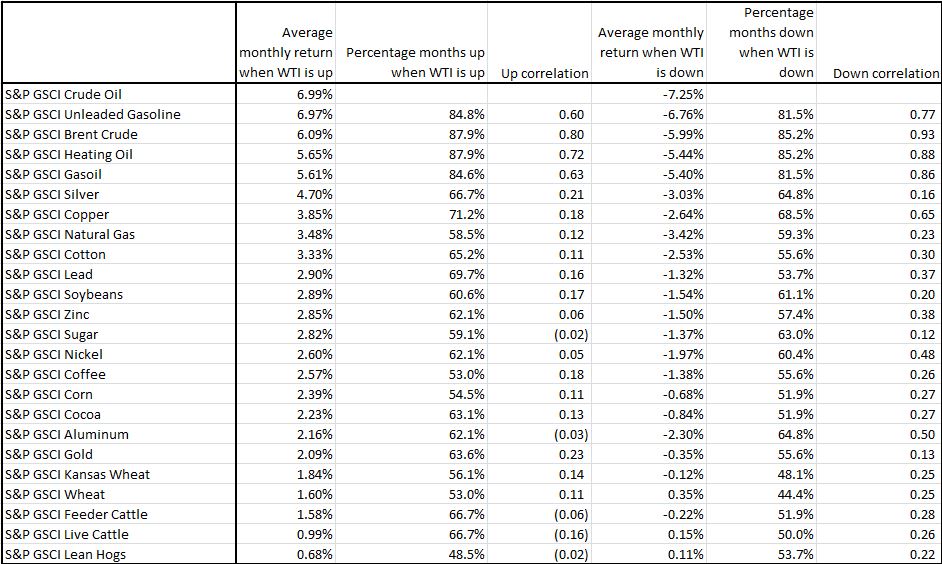

Yields and Total Returns of Select State Municipal Bond Indices

Source: S&P Dow Jones Indices LLC. Data as of February 20, 2015.

The posts on this blog are opinions, not advice. Please read our Disclaimers.