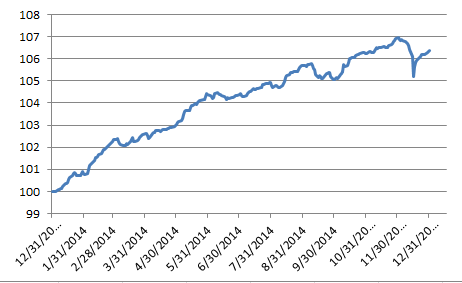

The Dow Jones Sukuk Total Return Index (Ex- Reinvestment) delivered a total return of 6.37% in 2014, which outperformed its 0.23% gain in the prior year; see Exhibit 1 for the index performance.

Exhibit 1: Total Return Performance of the Dow Jones Sukuk Total Return Index (Ex-Reinvestment)

With the continued growth in the sukuk market, the total market value tracked by the index rose 32% to USD 48 billion, as of December 31, 2014. Comparing the new issues in 2013 and 2014, both the count and the size grew; the average sukuk deal size reached 880k, see Exhibit 2 for the comparison.

Exhibit 2: New Issues Comparison

|

2013 |

2014 |

|

| Total Count |

13 |

16 |

| Total Par Amount |

10,800,000,000 |

14,100,000,000 |

| Total Market Value |

10,714,815,969 |

14,655,559,089 |

|

Average Deal Size |

830,769,231 |

881,250,000 |

Source: S&P Dow Jones Indices. Data as of December 31, 2014. Charts are provided for illustrative purposes.

Looking at the new issues in 2014, the biggest sukuk issuer was IDB Trust, totaling 3 billion, followed by Saudi Electric, totaling 2.5 billion. There were new entrants in the sovereign sukuk space, such as South Africa (issued 500mio) and Hong Kong (issued 1 billion), and the returning issuer Indonesia (issued 1.5 billion).

The posts on this blog are opinions, not advice. Please read our Disclaimers.