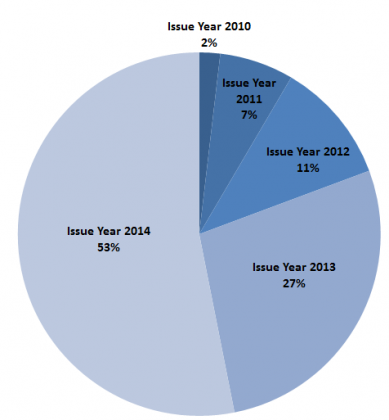

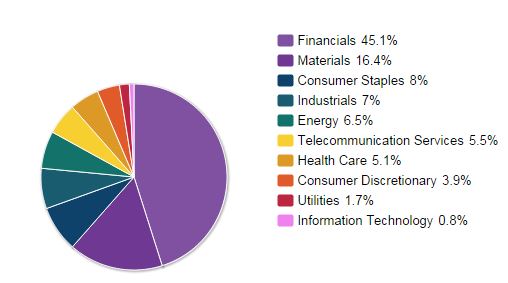

This week I am in Australia meeting with investors about commodities. Usually when I visit a heavy natural resource producing country, the conversations flow easily since the locals understand commodities. We have been discussing farms, coal, iron ore and tin – subjects that engulf the culture of the locals. The Australians seem to know all about the public companies and private deals and are comfortable about the commodity exposure in their portfolio via their stock market, the S&P ASX 200. You can see in the chart below that 16.4% of the Australian stock market is in Materials and 6.5% is in Energy.

Given this profile, many Australian investors dismiss commodities as an asset class since they feel they already have exposure through equities. Although the local commodities consist mainly of dry bulks like coal and iron ore that are not yet part of the global futures markets that make up the asset class, there is a great barrier to overcome the perception that the Australian stock market is highly correlated to global commodities.

In order to test the potential benefits of commodities to Australian investors, we evaluated diversification and inflation protection, the benefits many international and domestic US investors realize. The results were different than what I expected.

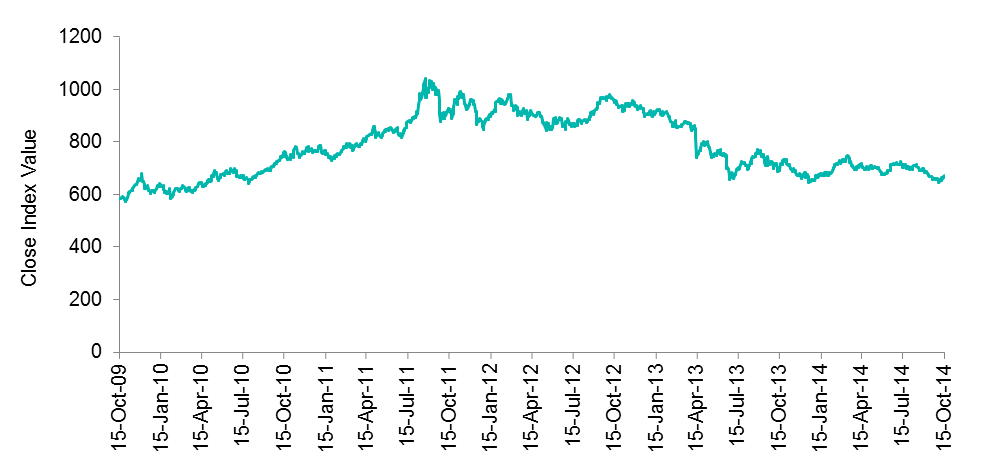

First, the correlations of commodities to two major stocks BHP and RIO were only 0.16 and 0.18, respectively. That is not terribly surprising since these companies don’t produce agriculture or crude oil and also since coal and iron ore are not in the commodity benchmarks. What was surprising is that the US stock market is over 3 times more correlated to commodities than the Australian stock market and that Australian stocks never saw a correlation spike from the global financial crisis.

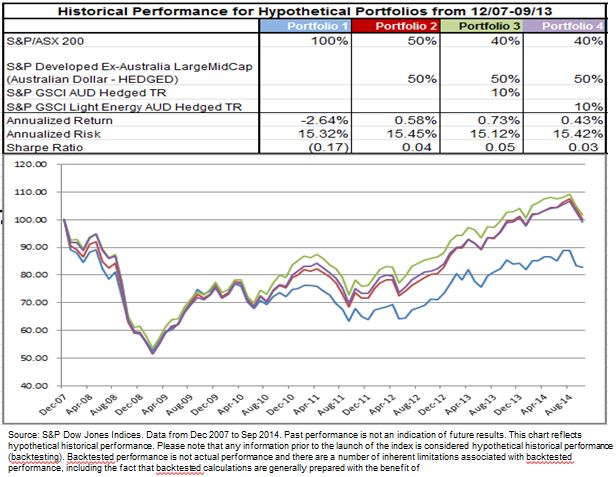

The next question is whether the low correlation of 0.135 between the S&P ASX 200 and the S&P GSCI can overcome the low returns of commodities post the global financial crisis for an increase in portfolio efficiency. While commodities didn’t add much to the Australian stock portfolio, they didn’t hurt. That is impressive even with a major allocation of 10% through the worst drawdown in history.

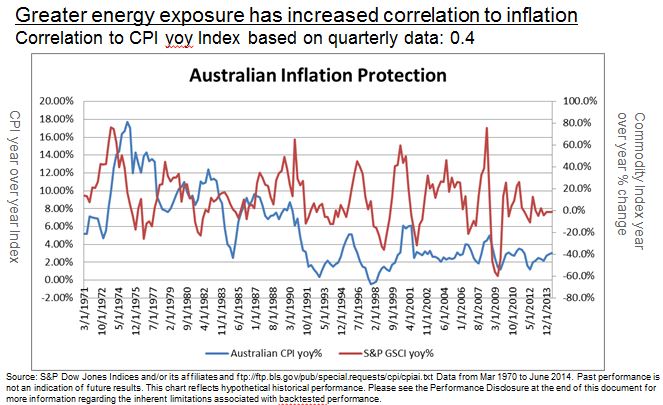

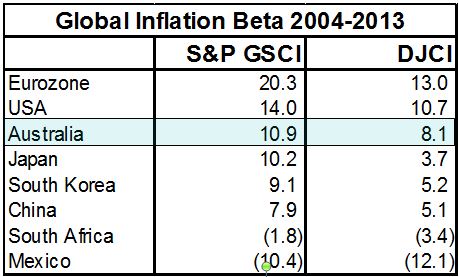

Notice the heavier oil in the S&P GSCI helped more than the more well diversified S&P GSCI Light Energy. Another question around oil is whether the global commodity basket hedges inflation in Australia given the market doesn’t produce much crude oil. This answer wasn’t so surprising since it it not quite as strong as the inflation protection for Europe or the US, but for a small investment, it is still possible to get a great inflation protection as shown by its inflation beta.

In conclusion, commodities as an asset class as represented by the global futures market has historically provided the diversification and inflation protection specifically to the Australian market. The great barrier to commodity investing in Australia shouldn’t be so great, especially with the offering of products that enable the locals to access this market.

The posts on this blog are opinions, not advice. Please read our Disclaimers.