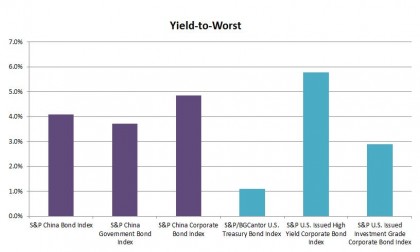

Global investors continue to explore investment opportunities in China onshore bond market. Chinese bonds undeniably offer higher yields than other major bond markets. As of Nov 5, 2014, the yield-to-worst of the S&P China Bond Index stood at 4.09% with a modified duration of 4.15, see Exhibit 1.

Exhibit 1: Yield Comparison

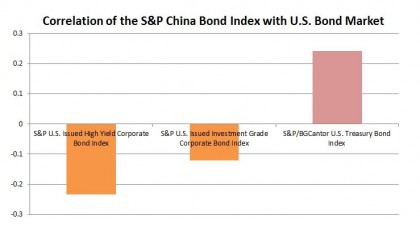

More importantly, investing into Chinese bonds adds diversification benefits to a portfolio through the exposure to local rate, credit and currency. According to the S&P China Bond Index, the Chinese bonds have historically exhibited low to negative correlations to U.S. bonds.

The correlation between the S&P China Government Bond Index and the S&P/BGCantor U.S. Treasury Bond Index, considering monthly returns since Dec, 2006, is 0.25. And if we look at the corporate bond sector, the correlation between the S&P China Corporate Bond Index and the S&P U.S Issued Investment Grade Corporate Bond Index is -0.15, while its correlation with the S&P U.S Issued High Yield Corporate Bond Index is -0.22, see Exhibit 2.

Exhibit 2: Bond Market Correlation

The Chinese bond market has outperformed the U.S. treasury and corporate bond markets year-to-date as well. As of Nov 5, 2014, the S&P China Bond Index delivered a YTD total return of 10.08%.

Want to find out more about the S&P China Bond Index? Please click here.

The posts on this blog are opinions, not advice. Please read our Disclaimers.