Do you know what is inside that seemingly copper penny? It may be more valuable than you think. I’ll give you a hint: It rhymes with think.

Inside the industrial metals, we usually speak of copper and aluminum, especially in the context of the spread trade where it seems aluminum is perpetually more abundant than copper. Also, copper has a reputation, though not well-deserved in my opinion, of predicting the health of the economy, earning a nickname of “Dr. Copper.”

However, this year, nickel has taken center stage as the new gold for 2014 as Indonesia bans exports in an effort to grow its domestic stainless steel industry. It is unusual to see nickel in the spotlight given most people are unaware of its common applications, but the YTD return of almost 40% is hard to ignore. ZInc is not unlike nickel in that its main use is as an alloy, used mostly to strengthen the stars of the show.

Did you know Zinc is the primary metal used in making American pennies? 97.5% of every penny made since 1982 is zinc. Zinc is found almost everywhere in daily life: in every cell of the human body, in the earth, in the food we eat and in products we use such as sunblock, cosmetics, automobiles, airplanes, appliances, batteries, musical instruments, surgical tools and zinc lozenges. Further, zinc is the third most used nonferrous metal (after aluminum and copper), of which the U.S. consumes more than one million metric tons annually; the average person will use 730 pounds of zinc in his or her lifetime, according to the U.S. Bureau of Mines.

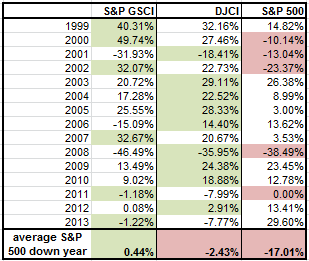

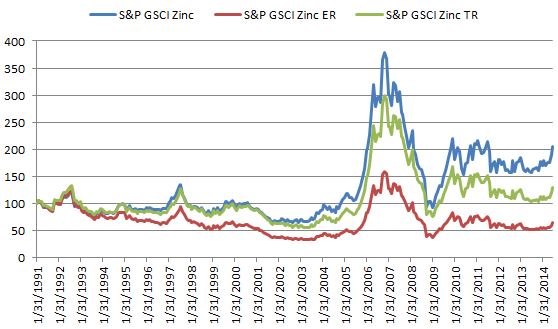

In the DJCI and S&P GSCI, zinc is weighted just like the alloy it is, about 2% in DJCI and less than 1% in S&P GSCI. However, it is now becoming noticeable for its returns. For the first time since 2005-06, there are two consecutive months where the total returns are greater than 7.5% in each month – June and July through the 25th. The S&P GSCI Zinc index levels are now at the highest in 3 years.

Zinc is the best performer in the indices in July MTD, bringing its YTD performance to 14.8%, which is strong but not a standout in a year like 2014. Generally low inventories coupled with recent strong Chinese industrial demand growth is driving the price increase. Data from last Monday showed China’s zinc imports rose 123.55% in June year on year to 68,475 tonnes. Also, zinc prices have been driven higher this year by a paucity of big mine projects just as existing mines such as Century in Australia dry up.

The posts on this blog are opinions, not advice. Please read our Disclaimers.