- Last week saw the yield of the S&P/BGCantor Current 10 Year U.S. Treasury Bond Index close 1 basis point tighter than the 2.61% that started its week. Thursday was the only day in which the yield moved significantly as yields tightened by 5 basis points in reaction to the weaker than expected Retail Sales release. Treasury bond prices were stronger for the Monday opening as increasing tensions over the latest Iraq situation have bumped up demand for quality assets. In reaction to the situation that has been steadily increasing, oil prices were the early mover as the S&P GSCI All Crude (TR) Index saw its largest year-to-date one day jump of 2.39% last Thursday and returned 4.21% for the week. A full-on flight to safety trade has not started given the current political situation though with the suspected number of short market trades in place, if an unwinding trade were required it could have a quick and strong impact to rates. Like the Ukraine crisis, investors wait and watch to see the level of involvement required by foreign governments.

- In addition to keeping an eye on the Middle East, the forward U.S. economic calendar contains some key indicators. Today kicked off with the Empire State Manufacturing Survey stronger than expected reporting 19.28 versus the expected 15.0. Industrial Production month-over-month for May also was higher than the surveyed level of 0.5% at a 0.6%. Though today’s manufacturing and production results were muted by an announcement by the IMF (International Monetary Fund) that its U.S. growth forecast had been cut. Anticipation awaits the release of U.S. CPI on Tuesday which is expected to be a 0.2% month-over-month. This indicator has been on the rise since February’s 0.10%. Year-over-year is currently at 2% and if higher could indicate that inflation is accelerating faster than the Fed anticipated. Housing Starts (1029k, expected) and Building Permits (1050k exp.) will also be released on Wednesday. The end of the week has the largest potential to impact the markets as the Fed will conclude its meetings with its FOMC Rates Decision on Thursday. This coupled with Friday’s Initial Jobless Claims (2600k, exp.), the Philly Fed Business Outlook (14 exp.) and May’s Leading Indicators Index (0.6% exp. vs. 0.4% prior) makes for a hectic week.

- The S&P U.S. Issued High Yield Corporate Bond Index continued to outpace its investment grade counterpart by closing the week with a return of 0.25% for a year-to-date return of 5.15%. New Issuance also continued at a healthy pace as issuance in names such as DaVita Healthcare, Ferrellgas, Gibson Energy, iStar Financial and Virgolino de Oliveira Finance came to market.

- The investment grade segment of the corporate bond market also saw a significant number of new issue deals in household names such as Citigroup, Home Depot, John Deere, Johnson Controls and New York Life. The S&P U.S. Issued Investment Grade Corporate Bond Index returned 0.11% for the week which helped whittle down the negative month-to-date return of -0.61%. Year-to-date the index has returned a positive 4.86% though this is down from its end of May high of 5.64%.

- Like investment grade corporate bonds, preferred securities have given up ground as well. The S&P U.S. Preferred Stock Index’s (TR) year-to-date is down from its May month-end year-to-date high of 10.4% and has presently returned 9.73%. For the week, preferred’s returned 0.04% but are still down -0.6% for the month. The S&P 500 was also down for the week returning -0.63%, its first negative weekly return since May 9th.

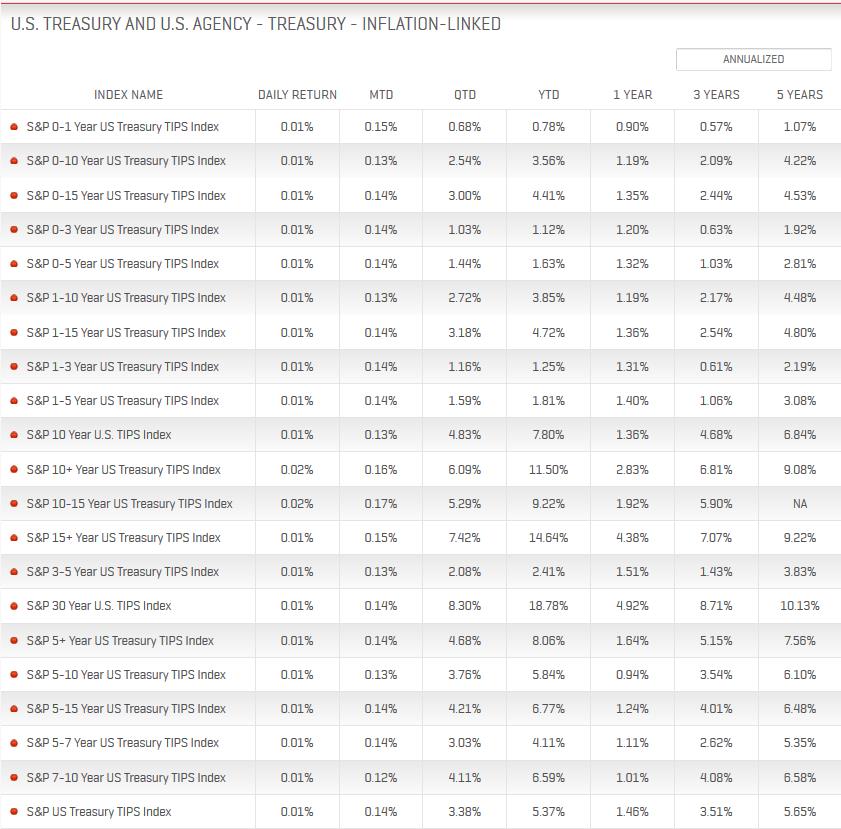

Source: S&P Dow Jones Indices, Data as of 6/13/2014

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Source: S&P Dow Jones Indices, June 11, 2014

Source: S&P Dow Jones Indices, June 11, 2014