Despite the headline news on India’s high deficits and low economic growth, the Indian bonds remain very popular among investors who hunt for yields. Let’s be realistic, while a 10 year U.S. Treasury Bond pays 2.7%, a similar maturity of Indian sovereign Bond is offering a yield of 8.8%!

The S&P BSE India 10 Year Sovereign Bond Index measures the performance of the current India on-the-run sovereign bond, with fixed coupons and having remaining maturity close to 10 years. The index is created as an independent benchmark to meet strong investor demand in India sovereign bonds.

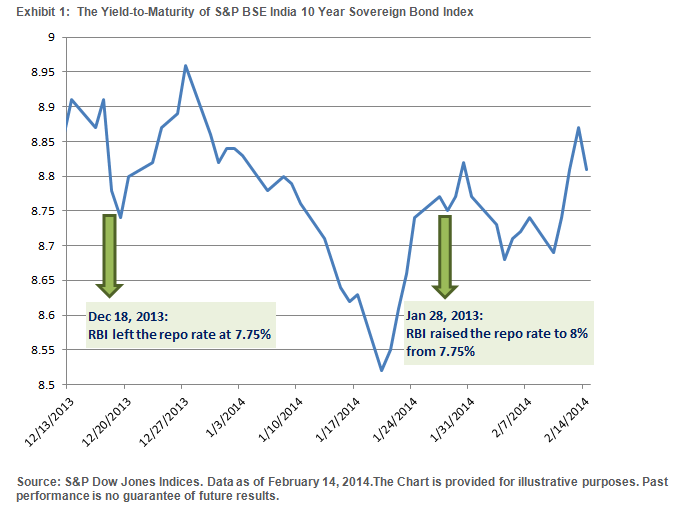

As presented in Exhibit 1, the index’s yield-to-maturity demonstrates the sensitiveness to the interest rate decision by Reserve Bank of India (RBI). On Dec 18, 2013, as RBI unexpectedly left the repo rate at 7.75%, the 10 year benchmark yield fell from 8.91% to as low as 8.52%. Subsequently, on Jan 28, 2013, while it is largely anticipated there would be no change, RBI surprised the market again by hiking its repo rate by 25bps to 8%, as it raised the concern of the high inflation. The index yield-to-maturity currently stood at 8.81%, as of Feb 14, 2014.

While the inflation is a sensitive issue, another key concern may arise from the general election to be held in May 2014. Regardless of the surprises, or the volatilities, the risk appetite for the Asian local currency bonds continues to be very solid, which implies the investors are happy with the risk premium they are receiving.

Note the Standard & Poor’s Ratings Services affirmed the ‘BBB-‘ long-term and ‘A-3’ short-term unsolicited sovereign credit ratings on India as of November 7, 2013.