Commodity indices have seen tremendous success as investors look for asset diversification in their portfolio; simple exposure to the asset class; or even a hedge against inflation. Historically, the main commodity indices have been very much US centred and predominately denominated in USD. Why? The main reason is that these indices use exchange traded commodity futures to base their prices on and for many years, these have been listed in the US on US exchanges. Over recent years however, there has been a strong growth in volumes on non-US exchanges, and this has been particularly the case in agricultural derivatives. Europe for example has a physical wheat market which is over twice the size of that in the United States; however due to the lack of a reliable commodity futures contracts in Europe for many years, it was difficult to gain appropriate exposure. This has changed dramatically since the Common Agricultural Policy (CAP) stopped artificially supporting prices in grains in Europe in the early 2000’s. Since then, the Europeans grains futures markets were able to develop.

Nearly 10 years on and the European Wheat and Rapeseed contracts, operated by NYSE Liffe (NYSE Euronext group), have literally exploded and established themselves as global reference prices for European Wheat and Rapeseed.

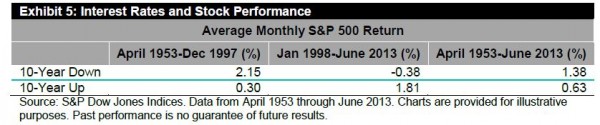

S&P’s recently launched WCI was one of the first global commodity indices to understand this and has included these contracts, as well as our soft commodity contracts out of London, into their indices. With this index investors can now obtain easy exposure to these major trading flows in Wheat and Rapeseed.

S&P Dow Jones Indices is an independent third party provider of investable indices. We do not sponsor, endorse, sell or promote any investment fund or other vehicle that is offered by third parties. The views and opinions of any third party contributor are his/her own and may not necessarily represent the views or opinions of S&P Dow Jones Indices or any of its affiliates.

The posts on this blog are opinions, not advice. Please read our Disclaimers.