This week’s FOMC minutes revealed that almost all the members of the committee agreed that it was not yet time to begin tapering the Fed’s asset purchases. Many committee members urged additional caution, and advocated waiting until more concrete evidence about the economy’s recovery was available. The report continued to explain that the members generally supported Fed Chairman Bernanke’s “contingent outlook”. The Fed’s inaction shows that its members are comfortable with waiting patiently as the economic recovery unfolds. Come the September FOMC meeting, however, and the Fed may begin to change its tune.

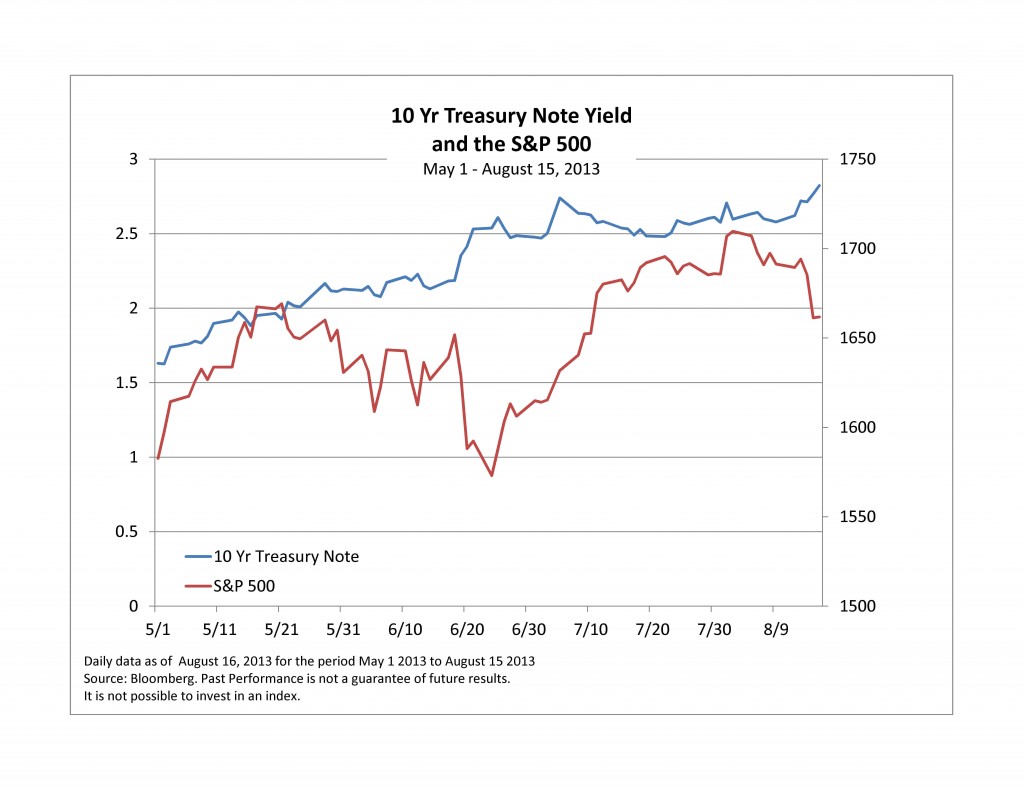

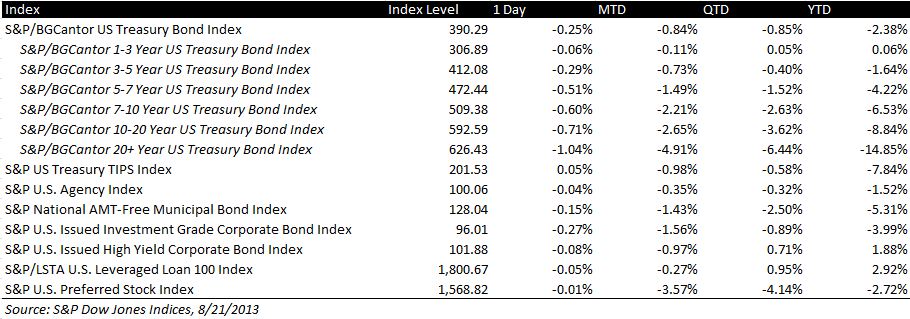

The bond market, which was already struggling to keep its head above water, took a dive after the FOMC minutes were released, as many investors took them to mean the central bank would begin cutting back on its bond buying program as soon as next month. The S&P/BGCantor U.S. Treasury Bond Index ended down 0.25% for the day, on top off its -0.84% loss month-to-date. Between the slow drawn-out economic recovery and heightened expectations surrounding the timing of the Fed’s tapering of its asset purchases, bond market yields have risen significantly. As the Fed scales back, and eventually ends, its stimulus, yields will continue to rise. Also, the Fed will likely keep the short-term Federal Funds Rate near zero at the start, if not all the way through the tapering process. The combination of these two events means that the yield curve should steepen with anchored short-term rates and increasing intermediate to long term rates. The yield of the S&P/BGCantor 7-10 Year US Treasury Bond Index is 36 basis points wider month-to-date, and long duration indices have been performing poorly as well, as seen by the maturity sub-indices of the broad S&P/BGCantor U.S. Treasury Bond Index in the table below. Unfortunately for investors the curve steepening is likely to continue, even as yields on long duration investments have become attractive and the continuing increase in rates pushes prices downward. Sticking with short durations, or implementing a laddering strategy out to the middle of the curve, will help. As short bonds in the laddering strategy mature, the money can be reinvested at the long end of the ladder and capture higher yields in a rising rate environment, while the short end of the ladder stay consistent as long as the Fed keeps the front end near zero.

Source: S&P Dow Jones Indices as of Aug. 21, 2013. Tables & Graphs are provided for illustrative purposes. This table may reflect hypothetical historical performance. Past performance is not a guarantee of future results

The posts on this blog are opinions, not advice. Please read our Disclaimers.