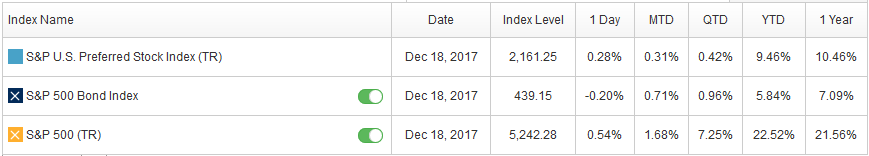

The S&P 500® was up 22.1% YTD as of Dec. 19, 2017 (including reinvested dividends), and international stocks were generally even more kind to USD investors (S&P Global Ex-U.S. BMI Gross Total Return [USD] was up 26.3% YTD). However, in most types of accounts we do not get to keep gross returns. Capital gains and dividends are sheltered from immediate taxation in traditional retirement accounts, such as 401(k)s, but are ultimately taxed at (presently unknown) future income tax rates.

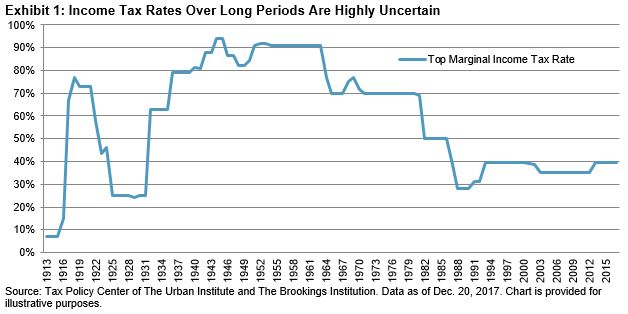

Retirement savers must consider an extremely long horizon, encompassing career-long wealth accumulation as well as in-retirement decumulation. Diversifying account types in order to help manage future income tax liabilities may be worthwhile, especially considering that new federal income tax legislation is expected to significantly add to the nation’s outstanding debt and may also exacerbate income inequality. These two catalysts could eventually produce a political or economic reaction that could result in significantly higher income tax rates down the road.

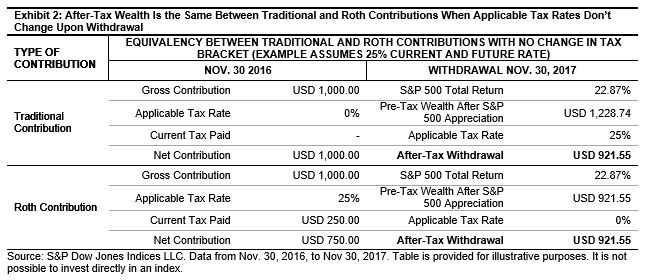

If it were known with certainty that neither the income tax code nor one’s tax bracket would change, it would make no difference in final wealth whether one made traditional tax-deductible contributions or non-tax-deductible Roth contributions. For most people, it is a safe assumption that before-tax income is likely to be lower during retirement than when they worked. So in the context of stable tax law, traditional tax-deductible contributions make sense. But because future tax law is not known, the trade-off between making traditional or Roth contributions is about hedging one’s bets with respect to future tax liabilities.

The lower current marginal income tax rates become, the less valuable current income tax deductibility is and the more valuable locking a future tax rate of 0% through the use of Roth accounts is. Currently, rates are heading lower in the short term, but in the longer term, they may need to revert back to prevailing levels or higher. For retirement savers, this represents a significant potential future liability as they draw down traditional retirement savings. The size of the liability is not known because future tax law is not known.

Some retirement plan participants have access to Roth 401(k) accounts, while others may be able to contribute to Roth IRA accounts. The general consensus is that contributing enough into a traditional or Roth 401(k) to get a company match is a good idea. Beyond that, one may want to give some thought to diversifying account types. Because they are not taxableRothupon withdrawal, Roth accounts are not subject to required minimum distributions. That makes them ideal for providing some flexibility when managing income taxes during retirement.

The posts on this blog are opinions, not advice. Please read our Disclaimers.