The proverb “do not put all your eggs in one basket” is what diversification achieves when it comes to investment. A portfolio can be diversified by investing in multiple asset classes, such as stocks, bonds, real estate, commodities, etc. A diversified portfolio helps improve the risk/return profile of the investments.

In capital markets, diversification refers to both the security level and sector level. Security-level diversification refers to having different securities in a portfolio so that no single security makes up too large a percentage of the portfolio. Sector-level diversification goes a step further, meaning that the portfolio should be distributed among multiple economic sectors and not be restricted to one or few sectors. Since different securities and sectors may underperform or outperform during different periods, it is often best to avoid concentration of investment into similar stocks or sectors. Instead, a portfolio may benefit from a focus on different sectors, with the aim of including the best securities from each sector. A diversified portfolio is likely to not only minimize risk but also ensure lower volatility in the portfolio.

The S&P BSE SENSEX is a highly diversified index and its 30 constituents provide exposure to 10 major sectors: utilities, telecommunication services, information technology, industrials, healthcare, fast-moving consumer goods (FMCG), finance, energy, consumer discretionary, and basic materials.

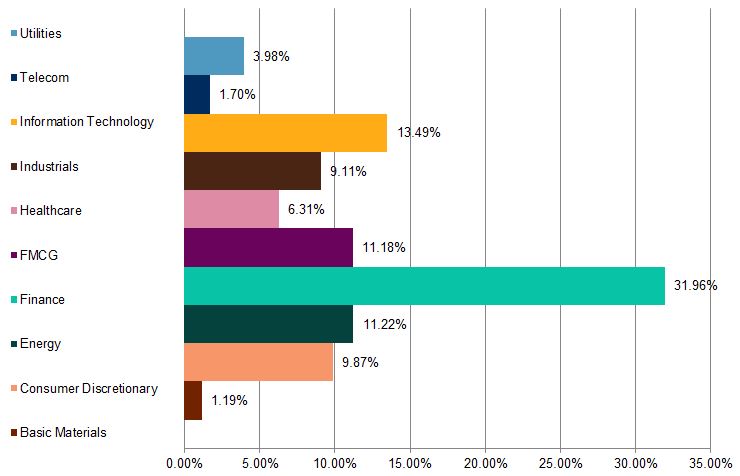

It is difficult to track all sectors and securities on an active basis; one option to consider is investing in index linked Exchange Traded Funds (ETFs). This can result in investments that not only have a diversified portfolio, but also a cost-effective one, as the cost of index linked ETFs tends to be comparatively lower. Exhibit 1 depicts the sector composition of the S&P BSE SENSEX as of March 31, 2017.

Exhibit 1: S&P BSE SENSEX Sector Composition

Source: S&P Dow Jones Indices LLC. Data as of March 31, 2017. Chart is provided for illustrative purposes.

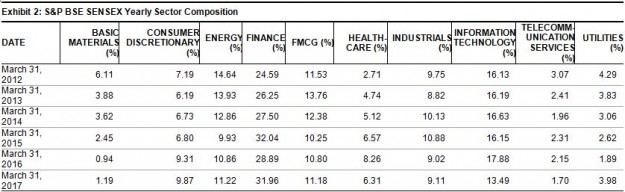

Source: S&P Dow Jones Indices LLC. Data from March 31, 2012 to March 31, 2017. Table is provided for illustrative purposes.

Exhibit 2 shows the weight of each of the 10 sectors in the S&P BSE SENSEX from March 2012 to March 2017.

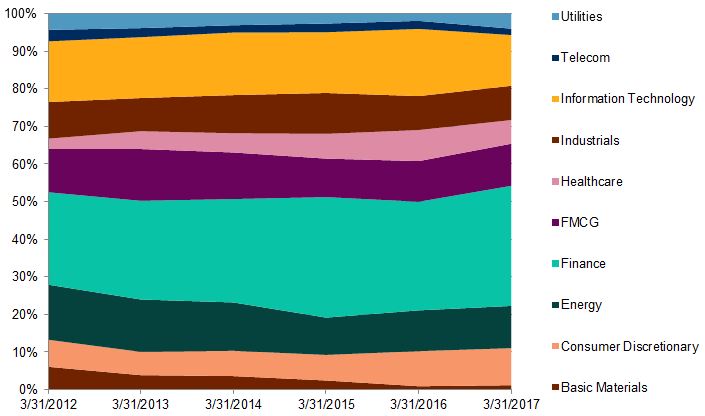

Exhibit 3: Pictorial Chart of S&P BSE SENSEX Yearly Sector Representation

Source: S&P Dow Jones Indices LLC. Data from March 31, 2012, to March 31, 2017. Chart is provided for illustrative purposes.

Exhibit 3 is a pictorial representation of Exhibit 2. This exhibit shows how the 10 sectors of S&P BSE SENSEX have changed from March 2012 to March 2017. From Exhibit 2, we can see that the finance and information technology sectors have consistently had higher weights. From Exhibit 3, we can also see that the weight of the basic materials sector has decreased substantially since 2012.

To summarize, we can state that an equity portfolio may benefit from diversification across securities and sectors.

The posts on this blog are opinions, not advice. Please read our Disclaimers.