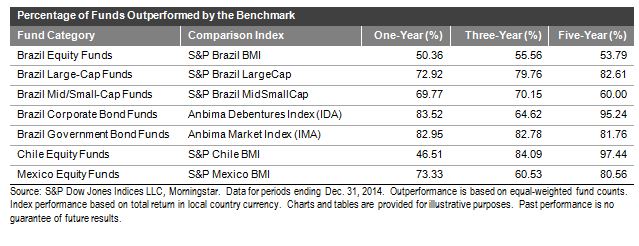

S&P Dow Jones Indices is proud to expand the SPIVA Scorecard report to the Latin America region. The SPIVA methodology is designed to provide an accurate and objective apples-to-apples comparison of active funds’ performance versus their appropriate style benchmark indices. The SPIVA Latin America Scorecard covers the Brazilian, Chilean, and Mexican markets. A summary of the year-end 2014 results in the three markets follows.

Brazil

Actively managed Brazilian funds underperformed their category’s benchmark in all five fund categories in 2014. In the Brazil Equity category, 50.36%of managers underperformed the S&P Brazil BMI for the year. Managers focusing on a particular size segment did not fare favorably, with 72.92% underperforming in the Brazil Large-Cap Equity category and 69.77% underperforming in the Brazil Mid/Small-Cap Equity category. In the fixed income categories, active managers overwhelmingly underperformed their benchmarks: 83.52% of managers in the Brazil Corporate Bond category and 82.95% in the Brazil Government Bond category underperformed their respective benchmarks in 2014. Similar underperformance for all five categories was seen over the three- and five-year periods.

Chile

A slight majority (53%) of active equity fund managers in Chile were able to outperform the benchmark in 2014. The short-term success of the managers is in stark contrast to their long-term returns, with less than 3% of active managers outperforming the benchmark over a five-year period.

Mexico

Mexican equity active managers were unsuccessful in outperforming the benchmark, with 73.33% of managers lagging the S&P Mexico BMI in 2014. Likewise, 60.53% and 80.56% of managers underperformed the benchmark over the three- and five-year periods, respectively.

Source: S&P Dow Jones Indices, LLC. Data as of April 2, 2015. Past performance is no guarantee of future results. Charts and tables are provided for illustrative purposes and may reflect hypothetical historical performance. Please see the Performance Disclosures at the end of this document for more information regarding the inherent limitations associated with back-tested performance.

Source: S&P Dow Jones Indices, LLC. Data as of April 2, 2015. Past performance is no guarantee of future results. Charts and tables are provided for illustrative purposes and may reflect hypothetical historical performance. Please see the Performance Disclosures at the end of this document for more information regarding the inherent limitations associated with back-tested performance.