How do active managers in Latin America stack up to their benchmarks? Discover the key takeaways from the latest SPIVA Latin America Scorecard with S&P DJI’s Tim Edwards and Ericka Alcántara.

Tag: SPIVA Latin America Scorecard

The recently published SPIVA® Latin America Year-End 2020 Scorecard shows that the volatile environment of 2020, though potentially favorable for high-conviction active managers, did not necessarily translate into success for active managers.

SPIVA scorecards measure the performance of active funds against an appropriate benchmark. For Latin America, S&P Dow Jones Indices began publishing the scorecard in 2014, covering Brazil, Chile, and Mexico.

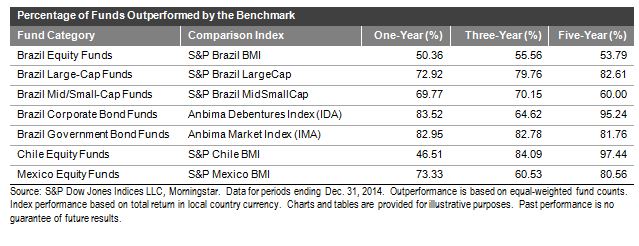

As of year-end 2020, all categories across all three countries underperformed their benchmarks over the 1-, 3-, 5-, and 10-year periods. These results contrasted those of the SPIVA Latin America Mid-Year 2020 Scorecard, in which Brazilian active managers in the Brazil Equity Funds, Brazil Large-Cap Funds, and Brazil Corporate Bond Funds categories managed to take advantage of the circumstances and outperform over the one-year period (see Exhibit 1).

Median fund managers across all the categories in the report underperformed their benchmarks over 1-, 3-, 5-, and 10-year periods (see Exhibit 2). However, in five out of seven categories, active managers in the first quartile beat their benchmarks over the one- and three-year periods (see Exhibit 3). Top-performing managers in the Brazil Equity Funds category were even able to outperform over the 10-year period.

As evidenced by SPIVA scorecards, the majority of active managers underperform most of the time, especially across the long-term time horizon. Is outperformance luck or skill? Stay tuned for the upcoming Latin America Persistence Scorecard.

We recently published our industry-famous SPIVA report for the Latin America region. SPIVA, which stands for S&P Indices Versus Active, analyzes the performance of actively managed mutual funds against their respective category benchmark. In the case of Latin America, S&P Dow Jones Indices began publishing the scorecard in 2014, covering Brazil, Chile, and Mexico.

The SPIVA Latin America Mid-Year 2020 Scorecard shows that the majority of active equity managers in Chile and Mexico failed to outperform their benchmarks over 1-, 3-, 5-, and 10-year periods, even when the first half of 2020 offered abundant opportunities for active managers. The dispersion and volatility of the S&P Latin America BMI’s constituents remained above the historical median for four of the six months.1

However, Brazilian active managers in the Brazil Equity Funds, Brazil Large-Cap Funds, and Brazil Corporate Bond Funds categories managed to take advantage of the circumstances in the short term. We have seen this outperformance by active managers on a short-term basis in the past as well.

A compilation of the Latin America SPIVA scorecards from year-end 2014 to mid-year 2020 show that when observing one-year periods, Chilean active managers outperformed in December 2014; Brazilian active managers outperformed in one or more of their categories in June 2015, December 2015, and June 2016; and the majority of Mexican equity active managers were able to beat their benchmarks in December 2019 (see Exhibit 1).

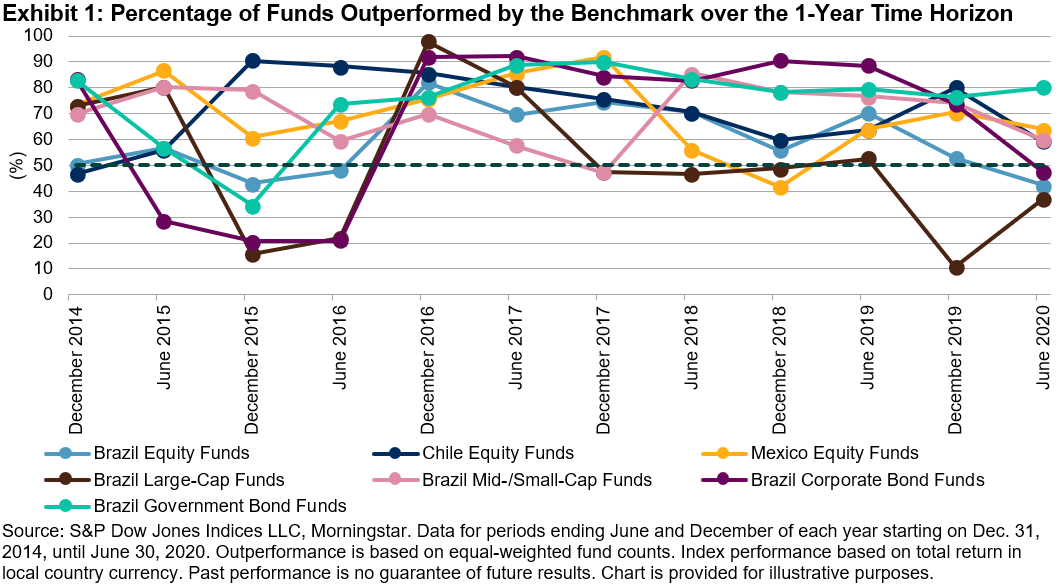

However, when compared with a longer time horizon, say a three-year period, we see that the percentage of active managers outperforming goes down.

However, when compared with a longer time horizon, say a three-year period, we see that the percentage of active managers outperforming goes down.

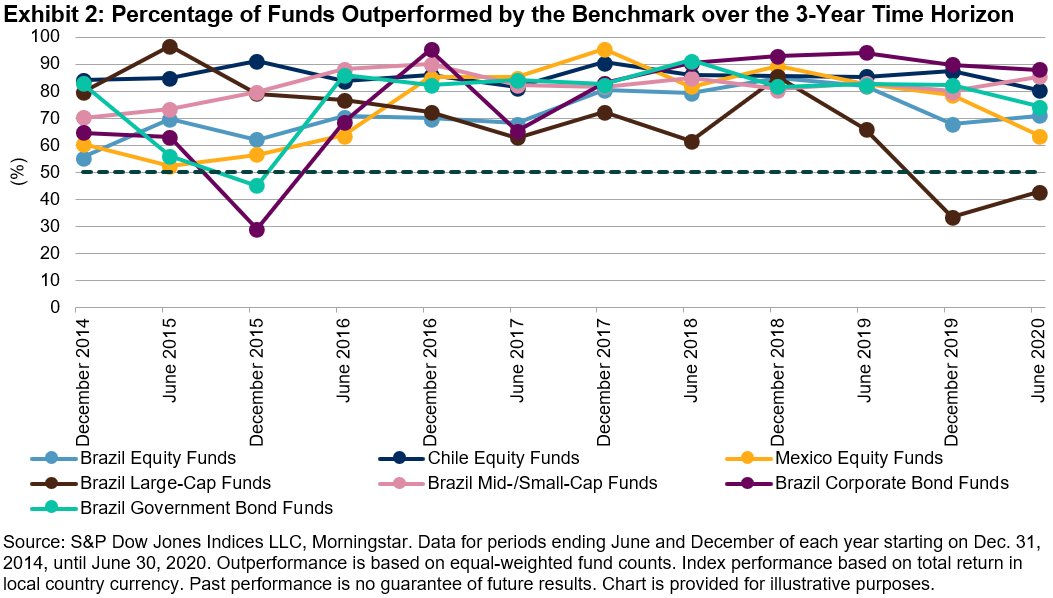

And when considering even longer time periods, like across a five-year period, the majority of active managers in all categories for all three countries were outperformed by their benchmarks.

And when considering even longer time periods, like across a five-year period, the majority of active managers in all categories for all three countries were outperformed by their benchmarks.

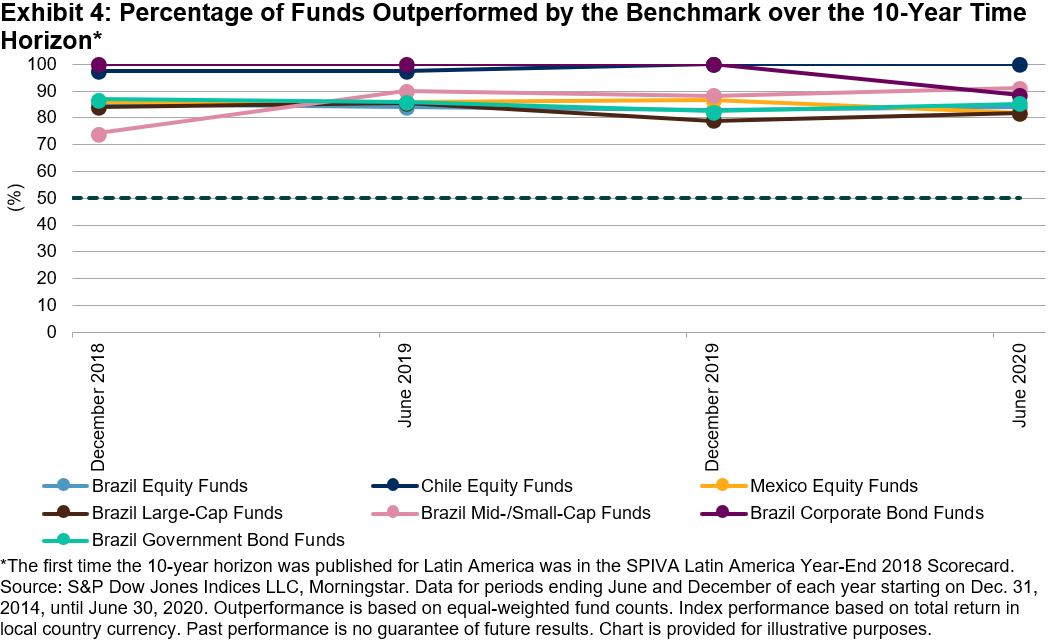

Lastly, for the 10-year period observed, the percentage of funds outperformed by their benchmarks converged in a range above 70%.

Lastly, for the 10-year period observed, the percentage of funds outperformed by their benchmarks converged in a range above 70%.

As evidenced by the SPIVA scorecards, the majority of active managers underperform most of the time, especially across long-term horizons, demonstrating how difficult is to consistently beat the benchmark.

As evidenced by the SPIVA scorecards, the majority of active managers underperform most of the time, especially across long-term horizons, demonstrating how difficult is to consistently beat the benchmark.

1 Index Dashboard: Dispersion, Volatility & Correlation: January 2020; February 2020; March 2020; April 2020; May 2020; June 2020.

The last few days have been a feast of entertainment for the sporting enthusiast; the Champions League Final, the Monaco Grand Prix, and the NBA Conference Finals were all on the menu. While the sports represented are distinct, these events have something notable in common: the persistence of their participants. The same two teams reached the NBA Finals for the fourth consecutive year, the Champions League was won by the same team for the third year in a row, and the Monaco Grand Prix title went to a driver from a team that has regularly featured in the upper echelons of the sport. In other words, in the sporting world, past performance has been a reasonable guide to future results.

One possible explanation for this persistence is that championship teams possess more skill than their competitors, and that, at the highest level of athletic competition, success depends importantly on skill. Indeed, we might take the persistence among winners in football, basketball and motor racing as evidence that these activities reward – and are dependent upon – the skill of the participants. (This very question – the relative importance of skill vs. luck in sporting outcomes – has actually been litigated for darts, pinball, and poker.)

In the popular imagination, active investment management mimics the engaging combination of luck and skill that sport can provide. Certainly, the fame and fortunes accrued by the most skillful athletes are comparable to those of the most successful active managers. But has the performance of active managers shown a similar degree of stability?

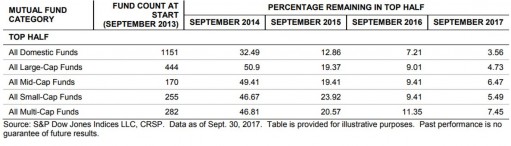

Over the last few years, S&P Dow Jones Indices has published a series of “Persistence Scorecards”. Initially focused on the persistence of returns of domestic U.S. equity and fixed income managers, these scorecards have been extended to cover Australia and, most recently, Latin America. The results in each of these markets are clear; active managers have found it extremely difficult to consistently outperform their peers. For example, Exhibit 1 shows that only 3.56% of the 1151 domestic U.S. equity funds whose returns were above the majority of their peers in the 12 months ending September 2013 could boast of a similar achievement at each September in the four consecutive years. For context, the probability of flipping a coin and getting four consecutive heads is 6.25%.

Exhibit 1: Performance Persistence of Domestic U.S. Equity Funds.

This is by no means the first time that sports and the investment management industry have been considered side by side – Charles Ellis’ brilliant analysis is required reading in this regard. While skill appears to be rewarded in sports, the evidence suggests luck dominates in the investment management industry. Hence, investors may find it worthwhile to recall the sentence inserted into many a prospectus: “past performance is no guarantee of future results”.

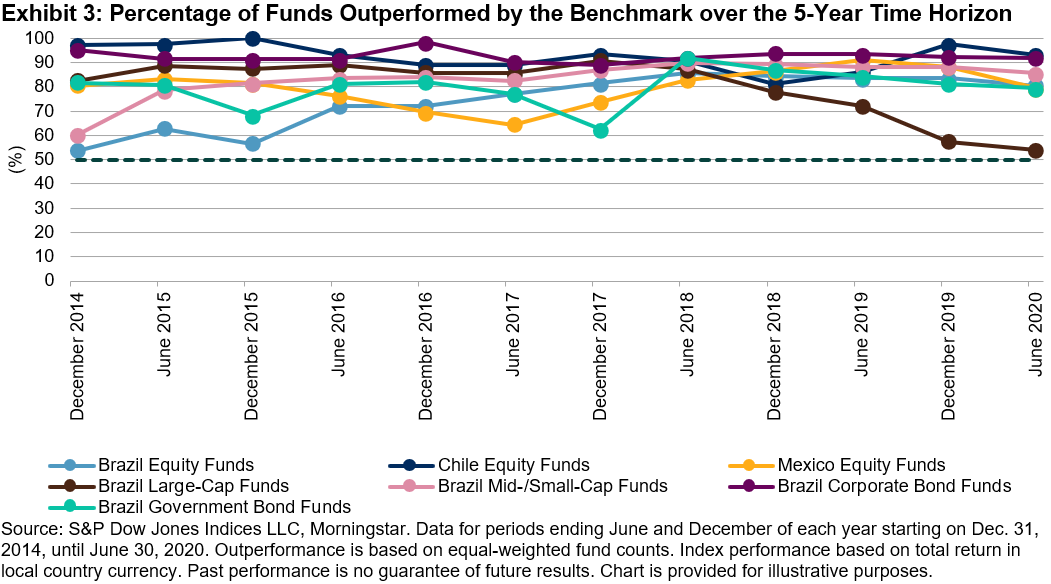

S&P Dow Jones Indices is proud to expand the SPIVA Scorecard report to the Latin America region. The SPIVA methodology is designed to provide an accurate and objective apples-to-apples comparison of active funds’ performance versus their appropriate style benchmark indices. The SPIVA Latin America Scorecard covers the Brazilian, Chilean, and Mexican markets. A summary of the year-end 2014 results in the three markets follows.

Brazil

Actively managed Brazilian funds underperformed their category’s benchmark in all five fund categories in 2014. In the Brazil Equity category, 50.36%of managers underperformed the S&P Brazil BMI for the year. Managers focusing on a particular size segment did not fare favorably, with 72.92% underperforming in the Brazil Large-Cap Equity category and 69.77% underperforming in the Brazil Mid/Small-Cap Equity category. In the fixed income categories, active managers overwhelmingly underperformed their benchmarks: 83.52% of managers in the Brazil Corporate Bond category and 82.95% in the Brazil Government Bond category underperformed their respective benchmarks in 2014. Similar underperformance for all five categories was seen over the three- and five-year periods.

Chile

A slight majority (53%) of active equity fund managers in Chile were able to outperform the benchmark in 2014. The short-term success of the managers is in stark contrast to their long-term returns, with less than 3% of active managers outperforming the benchmark over a five-year period.

Mexico

Mexican equity active managers were unsuccessful in outperforming the benchmark, with 73.33% of managers lagging the S&P Mexico BMI in 2014. Likewise, 60.53% and 80.56% of managers underperformed the benchmark over the three- and five-year periods, respectively.