The oil price drop has precipitated a flurry of interest around enhanced oil indices since the benefits of enhancing rolls in energy are well understood from the obviously costly storage situations in oil. Below is a chart of the ten year cumulative return of the S&P GSCI Crude Oil Total Return versus the S&P GSCI Crude Oil Enhanced Total Return.

As investors have been interested in oil, questions have come up about the enhanced roll for agriculture since it can also be difficult to store. To shed some light on the return enhancement in agriculture, below is an analysis comparing the S&P GSCI Enhanced Agriculture Select and the S&P GSCI Agriculture Select. The analysis in the “select” version is easier to understand given just four commodities: Chicago wheat (wheat), corn, soybeans and sugar. The enhanced rolls are seasonal and are as follows:

- Wheat is rolled into the December contract annually during the November roll period

- Corn is rolled only to the July contract annually during the May roll period

- Soybeans follow the regular S&P GSCI roll schedule

- Sugar is rolled only to the March contract annually during the February roll period

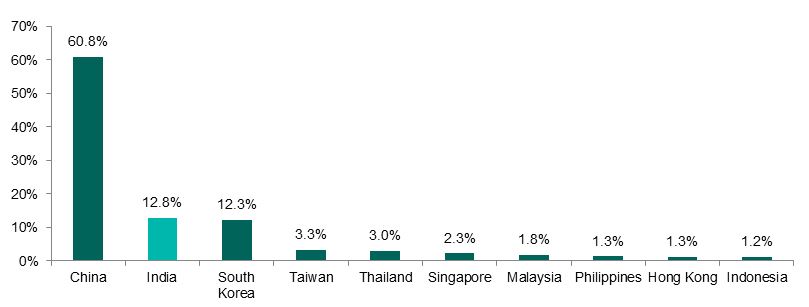

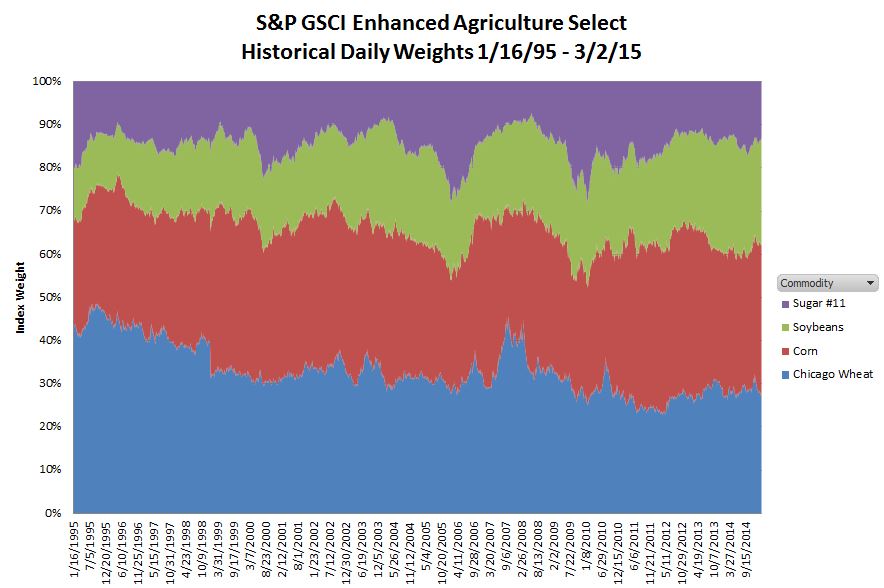

The weights are based on world production and notice through time since 1995 that wheat has decreased while soybeans have increased but corn and sugar have been more cyclical. The chart below shows the daily historical weights of each commodity in the S&P GSCI Agriculture Enhanced Select. On average wheat was 33.2%, corn 32.9%, soybeans 19.2% and sugar 14.7%. Wheat is now 27.4%, less than its historical average. Sugar is currently at 13.0%, which is also less than its historical average. Corn and soybeans are currently weighted at 35.1% and 24.6%, both above their averages.

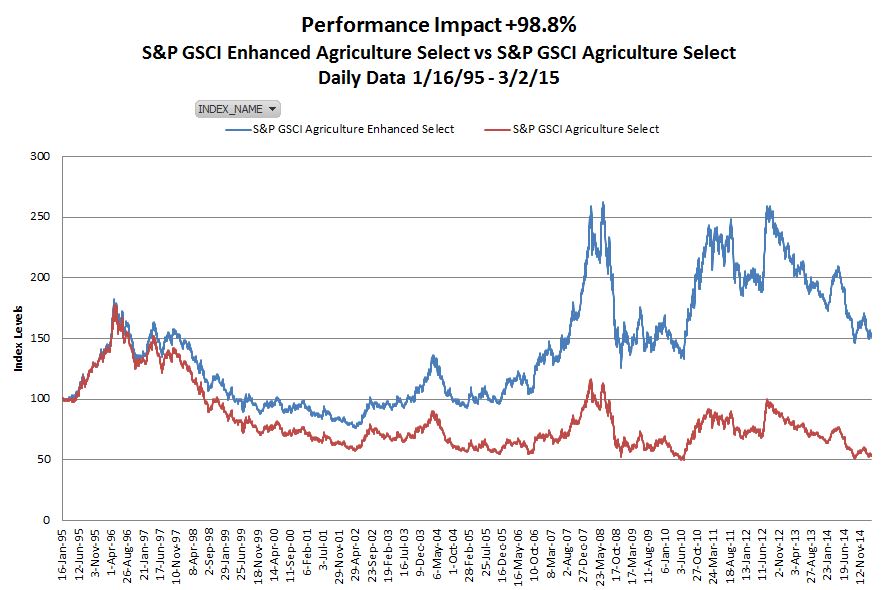

Next, the chart below shows the cumulative performance of daily index returns of the S&P GSCI Agriculture Enhanced Select and the S&P GSCI Agriculture Select. There is an outperformance of 98.8% from the enhanced rolling strategy.

This is important since there is evidence the commodities “to be grown” have fallen in price through time. One study done by Bessler and Wolff in Aug., 2014, showed “while aggregate commodity indices, industrial and precious metals as well as energy improve the performance of a stock-bond-portfolio for most asset-allocation strategies, we hardly find any portfolio effects for agricultural and livestock commodities.” Further, according to this study by Jacks, real prices for “commodities to be grown” fell by roughly 33% in real terms from 1950.

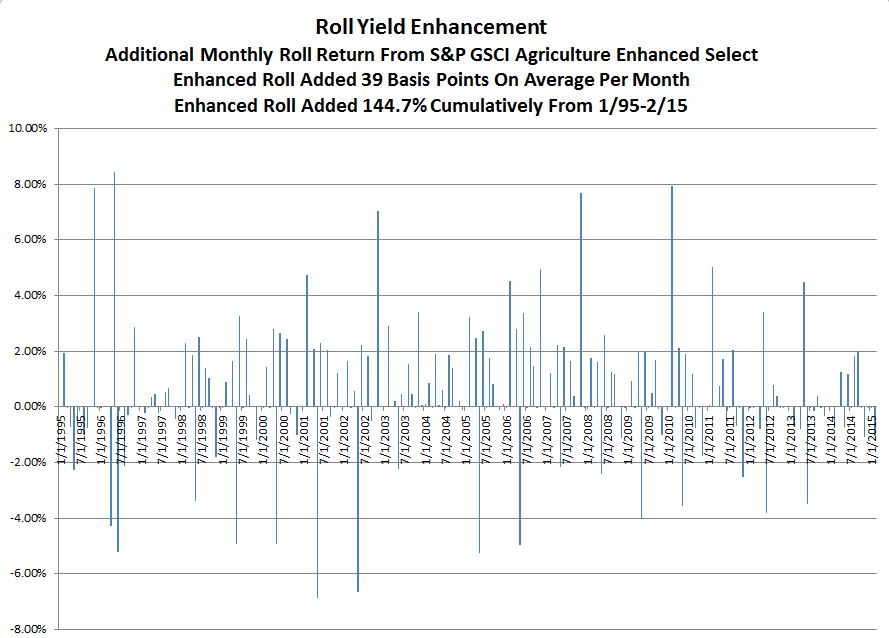

However, when the rolling of agriculture futures contracts is employed strategically according to seasonal adjustments, it has been significantly positive. The chart below shows the difference in monthly roll yield (excess return – spot) of the S&P GSCI Agriculture Enhanced Select less the S&P GSCI Agriculture Select. On average, the enhanced roll added 39 basis points per month. Cumulatively, this has compounded to add 144.7% from Jan 1995 – Feb 2015.

If Jacks is correct in pointing out the transition from fixed capital accumulation to a consumption-based economy, and suburbanization is tentatively beginning, then it may be likely to see an increase in demand for goods “to be grown” and an inflection in long-run trend. The sub-trend pricing for goods “in the ground” could be the formation of a new cycle in the medium run. So if it is time for agriculture, an enhanced roll might make sense.

The posts on this blog are opinions, not advice. Please read our Disclaimers.