Some American football coaches are fond of citing the maxim that the best offense is a good defense — because even if your offense is having an unproductive day, a good defense means that you’re always in the game.

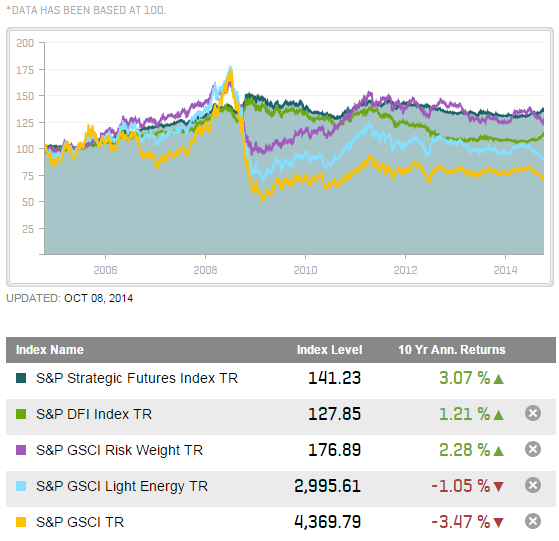

A related principle applies to investing — in some environments, the best way to win is not to lose. The first half of October has been such an environment, as defensive indices, laggards in 2013 and for the first three quarters of 2014, have finally come into their own. The chart below shows how dramatic the reversal of fortune has been:

Index First 3 Qs October to 10/13 YTD

S&P 500 8.34% -4.88% 3.06%

S&P 500 Dividend Aristocrats 6.52% -2.99% 3.33%

S&P 500 Low Volatility 7.54% -1.46% 5.97%

S&P Dynamic VEQTOR 4.05% 0.03% 4.08%

We’ve chosen, admittedly somewhat arbitrarily, only three defensive indices, which achieve their defensive character in different ways. The S&P 500 Dividend Aristocrats Index comprises stocks which have increased their dividends for at least 25 consecutive years, and can be thought of as both a yield and quality play. The S&P 500 Low Volatility Index holds the 100 least volatile stocks in the S&P 500 and tries to exploit the so-called low volatility anomaly. Dynamic VEQTOR is a multi-asset index which owns both the S&P 500 and a long position in VIX index futures.

What these indices have in common is that they offer protection from declining markets and participation in rising markets. We hasten to say that it’s not complete protection and it’s not full participation — they can still lose money when the market goes down (as, indeed, the Aristocrats and Low Vol did in early October), and they will typically lag a rising market (as all three indices did in 2013). But for investors who like the idea of attenuating the downside, and are willing to pay for it by forgoing part of the upside, such defensive indices can provide a very attractive pattern of return.

All three indices lagged their parent S&P 500 through the first three quarters of 2014, all three mitigated the market’s decline during the first 13 days of October, and all three are, perhaps somewhat improbably, ahead of the market on a year-to-date basis. Of course, that tells us nothing at all about the course of future performance. What the first 13 days of October gave, the next 13 could take away. But in the meantime, investors who opted for a defensive index strategy are getting what they paid for.

The posts on this blog are opinions, not advice. Please read our Disclaimers.