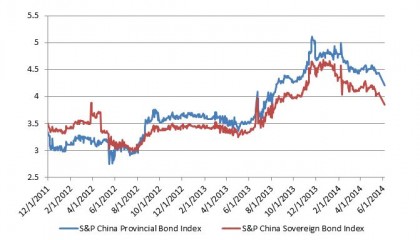

Leveraged loans or Senior Loans once an obscure area in Fixed Income space has seen real growth in assets inflow in last couple of years. Lipper reported a 95 week of net inflows in loan funds that ended in April of this year. What are senior loans and what makes them so attractive in this market.

Senior secured loans: Leveraged Loans or senior loans are on top of a company’s capital structure so they are the first to be repaid before other debt obligations and equity holders.

Higher yields: Most of the debt issued under this category is below investment-grade, thus the securities have higher than comparable investment grade instruments.

Floating rate: Coupon is floating rate, generally pegged to 3 month LIBOR resetting quarterly or on a preset frequency with 0.25 duration, thus the interest rate risk is minimum.

Diversification: Since the instruments are floating rate and get reset as the interest rates rise, it provides a good diversification for a traditional fixed income portfolio.

Recognizing the importance of this asset class, S&P Dow Jones Indices developed the S&P Indices Versus Active (SPIVA) Scorecard dedicated to Senior Loans. SPIVA Scorecard measures the performance of actively managed floating-rate loan funds vs. their benchmark, the S&P/LSTA U.S. Leveraged Loan 100 Index. Here are some of the stats:

- Active funds fared well over the 12-month period ending Dec. 31, 2013, with the majority of active funds (60%) outperforming the benchmark.

- However, when viewed over medium- to long-term, three- and five-year horizons, 61.54% and 90.48% of the active loan participation funds underperformed the benchmark, respectively.

- Over the past five years, the number of loan participation funds has nearly doubled, from 21 to 40, which is a testament to the growing popularity of the asset class.