S&P Dow Jones Indices announced that Apple (AAPL) will be added to the Dow Jones Industrial Average, replacing AT&T (T), after the close of business on March 18, 2015; release attached.

All data is based on last night’s close, and will be finalized after the close of March 18, 2015.

American Telephone & Telegraph was added to the Dow Jones Industrials on October 4, 1916. It was rename AT&T on April 20, 1994, and deleted from the Dow on April 8, 2004. On November 1, 1999, SBC Communications, which formerly was Southwestern Bell, one of the seven ‘baby bells’ spun-off by AT&T in 1982 (Ameritech, Bell Atlantic, BellSouth, NYNEX, Pacific Telesis, Southwestern Bell, and US West – all 7 were added to the S&P 500), was added to the Dow. On November 21, 2005 AT&T merged into SBC Communications, with SBC Communications renaming itself AT&T, which is the issue being removed now. After the change, Verizon, which was also one of the original seven spun-off, Bell Atlantic, will be the only telecommunications issue left in the Dow.

The change in membership will occur as Visa does a 4-for-1 stock split, which will have an impact on the index since the Dow is price weighted. Overall, the changes will reduce the weighting of information technology from 19.17%, down to 17.05%, since Visa’s 4-for-1 stock split outweighs Apple’s addition (even as the full market value weighting, such as the methodology used for the S&P 500, will change information technology’s market value to 30.92% of the Dow’s market weight, from the current 19.71%). Telecommunication’s index weight will be reduced to 1.80%, from the current 2.94%, as Verizon becomes the only issue representing the sector in the Dow.

As of last night’s close (3/5/15), the split, combined with the membership change, will reduce Visa’s position in the price-weighted index from #1, at their current $274.13 price, to #21, at $68.53, reducing its weighting percentage from 9.71% to 2.53%. Goldman Sachs will be take over the #1 weighting position with 7.01% of the weighting, followed by 3M (6.18%), International Business Machines (5.95%), and Boeing (5.70%). Apple will enter the index in the 5th position, accounting for 4.66%, even as it is the largest publicly traded issue by market value in the world (all subject to change based on the March 18 close).

Visa has been the best performing issue in the Dow since the close of 2013, accounting for approximately 21% of the gain. To some degree, the impact on the Dow of the split is similar to profit taking, since the gains were locked in and the issue reweighted; at the new weighting, Visa would need to decline 75% in price to negate the 21% gain it added to the Dow since 2013.

Splits in the Dow have been rare (as they have for the S&P 500 and the market in general), with the last stock split in the Dow being a 2-for-1 by Coca-Cola in August 2012, and the one before that being a 2-for-1 by Caterpillar in July 2005; I went back to 1980, but didn’t find a 4-for-1 in the Dow (S&P 5000 members salesforce.com and VF Group did a 4-for-1 in 2013). Technically, Visa’s 4-for-1 stock split will not count as a Dow split, since it occurs before the addition.

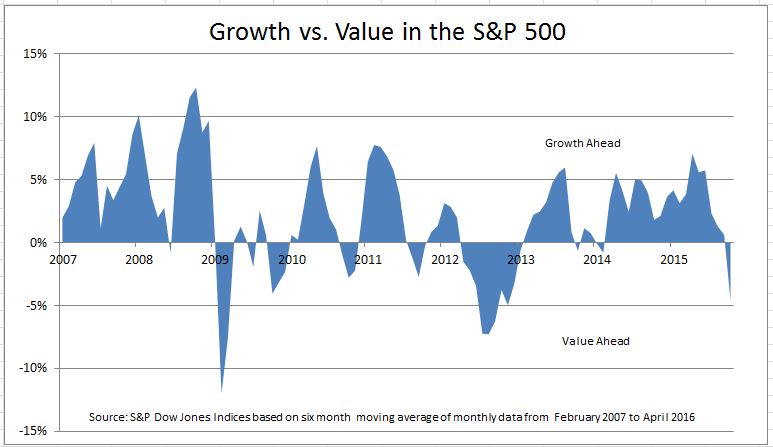

Apple and AT&T, strangely, both pay a $0.47 quarterly dividend ($1.88 annual). However, Apple, at $126.41 yields 1.5%, while AT&T, at $34.00 yields 5.5%. The change to the Dow will be a slight increase to yields (due to Visa, which yields 0.7%), as it goes from the current 2.29% to a proforma 2.33% (all 30 issues in the Dow pay a dividend). Apple, which started paying a dividend in March 2012, increased its dividend rate in April 2013 and in April 2014 (see chart – just happen to have one hanging around).

Information technology and telecommunications weighting decline, as the other sectors split the gains

Proforma Dow as of last night: Apple added, AT&T deleted, Visa split 4-for-1

Apple’s dividend history – April 2015?

Rumors and talk of Apple’s addition to the Dow have been prevalent on the Street for years, and have grown since its 7-for-1 stock split in June 2014

However, the Dow is price weighted, with Apple being 5th in the Dow, as compared to 1st in the S&P 500 (by market value) and twice that of #2 Exxon – bottom line is Apple has weight in the Dow, but it’s not the giant it is in the S&P 500, so don’t expect its impact to be the same, in either direction

———————————————————————————————————————————————————–

The analyses and projections discussed within are impersonal and are not tailored to the needs of any person, entity or group of persons. Nothing presented herein is intended to, or should be interpreted as investment advice or as a recommendation by Standard & Poor’s or its affiliates to buy, sell, or hold any security. This document does not constitute an offer of services in jurisdictions where Standard & Poor’s or its affiliates do not have the necessary licenses. Closing prices for S&P US benchmark indices are calculated by S&P Dow Jones Indices based on the closing price of the individual constituents of the Index as set by their primary exchange (i.e., NYSE, NASDAQ, NYSE AMEX). Closing prices are received by S&P Dow Jones Indices from one of its vendors and verified by comparing them with prices from an alternative vendor. The vendors receive the closing price from the primary exchanges. Real-time intraday prices are calculated similarly without a second verification. It is not possible to invest directly in an index. Exposure to an asset class is available through investable instruments based on an index. Standard & Poor’s and its affiliates do not sponsor, endorse, sell or promote any investment fund or other vehicle that is offered by third parties and that seeks to provide an investment return based on the returns of any S&P Index. There is no assurance that investment products based on the index will accurately track index performance or provide positive investment returns. Neither S&P, any of its affiliates, or Howard Silverblatt guarantee the accuracy, completeness, timeliness or availability of any of the content provided herein, and none of these parties are responsible for any errors or omissions, regardless of the cause, for the results obtained from the use of the content. All content is provided on an “as is” basis, and all parties disclaim any express or implied warranties associated with this information. The notes and topics discussed herein are intended to quickly inform and are only provided upon request. If you no longer wish to receive this information or if you feel that the information does not suit your needs, please send an email to howard_silverblatt@spdji.com and you will be removed from the distribution list. A decision to invest in any such investment fund or other vehicle should not be made in reliance on any of the statements set forth in this document. Standard & Poor’s receives compensation in connection with licensing its indices to third parties. Any returns or performance provided within are for illustrative purposes only and do not demonstrate actual performance. Past performance is not a guarantee of future investment results. STANDARD & POOR’S, S&P, and S&P Dow Jones Indices are registered trademarks of Standard & Poor’s Financial Services LLC.