Popularized by Warren Buffett, the term economic moat refers to a company’s sustainable competitive advantage that allows it to preserve market share and generate high profits over the long term. In this analogy, companies are compared to medieval castles surrounded by deep and wide moats, which protected the castles from attack.

In the same way, economic moats protect companies from competitors and other external threats by making it difficult for the competition to replicate or challenge their position in the market. There are several potential sources of an economic moat including network effects, economies of scale, strong brand recognition and high switching costs.

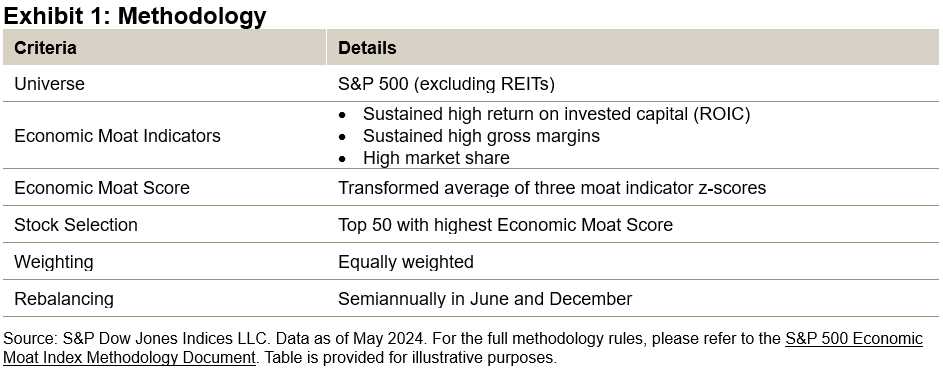

We believe that available financial statement metrics can be used to identify sustainable economic moats; furthermore, that a purely quantitative approach helps overcome the limitations of a subjective selection process. Earlier this year, S&P DJI launched the S&P 500® Economic Moat Index, which seeks to identify companies with lasting competitive advantages. In this blog, we will introduce this index by reviewing its methodology and historical performance.

Methodology Overview

No single quantitative measure is the sole indicator of an economic moat. Instead, multiple metrics must be used with careful consideration as to how they complement one another. Our research identifies three core metrics by which companies should be assessed: high ROIC, high gross margins and high market share. We will examine each of these metrics more closely in a subsequent blog.

Consistency is another key aspect that should be considered when identifying economic moats. Many companies may be able to generate high returns in the short term, but the ability to do so on a consistent basis is indicative of a wide moat. Hence, the metrics should be analyzed over multiple periods.

The final selection is based on the average of these three Economic Moat Indicators, known as the Economic Moat Score. The top 50 companies are selected and then equally weighted to help avoid concentration risk and to place each company on equal footing.

Performance Review

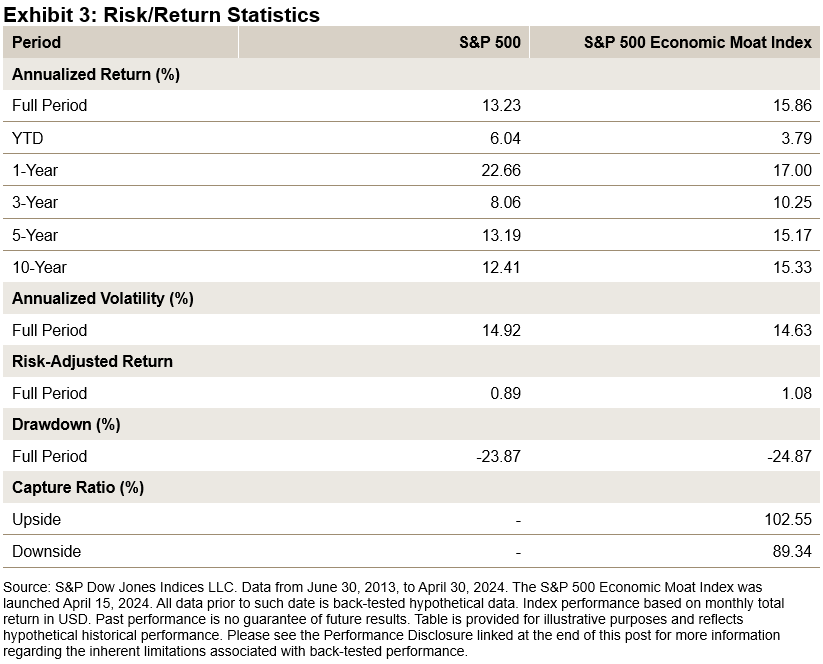

Back-tested data show that the companies with the widest economic moats generated significant outperformance since June 30, 2013 (see Exhibit 3). Over the full period, the S&P 500 Economic Moat Index outperformed the S&P 500 by 2.63% annualized.

Furthermore, the index has exhibited defensive characteristics as evidenced by its reduced volatility and downside capture. This is expected since companies with wide economic moats tend to be higher quality and better able to weather periods of market stress and uncertainty.

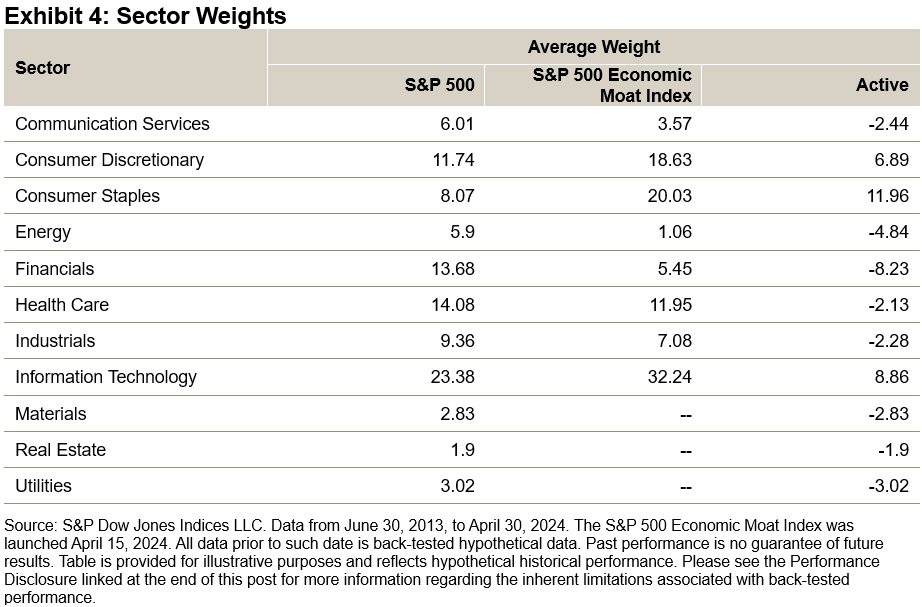

Historical Sector Weights

Let’s now examine the average sector weights in Exhibit 4. Historically, the S&P 500 Economic Moat Index has seen its largest sector overweights in Consumer Discretionary, Consumer Staples and Information Technology. Its most notable underweights have been in Energy and Financials.

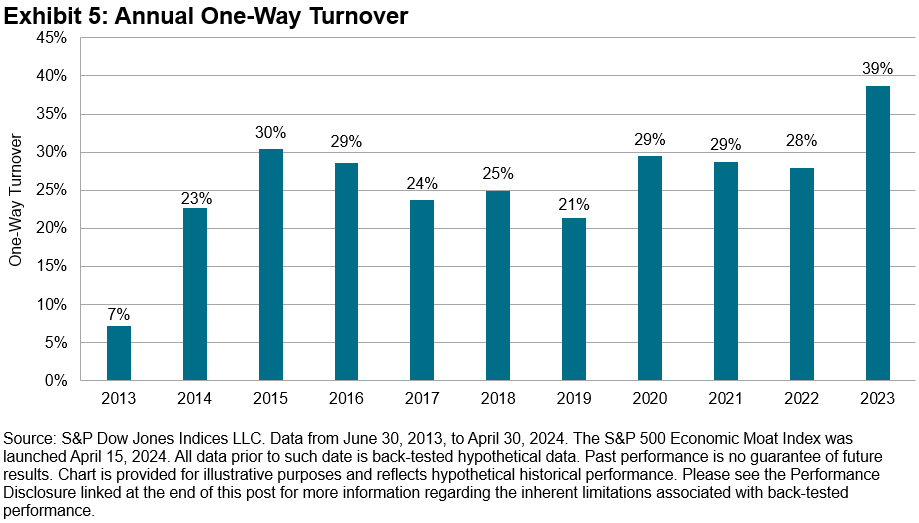

Historical Turnover

Let’s now review another compelling feature of this index: its low turnover. Across the full back-tested period, the index averaged 27.01% one-way turnover, which is low relative to other factor-based indices.

Conclusion

S&P Dow Jones Indices is pleased to continue its index innovation with the launch of this new index into our factor family. For those seeking to track high quality companies with a history of long-term outperformance and defensive characteristics, the S&P 500 Economic Moat Index may be an appealing option to consider. Please stay tuned for future blogs in this series that will delve into the individual economic moat indicators in greater detail.

The posts on this blog are opinions, not advice. Please read our Disclaimers.