What are the potential benefits of a sector neutral approach to S&P Dividend Aristocrats? S&P DJI’s Rupert Watts and State Street Global Advisors’ Colin Ireland explore the construction and range of potential applications for the S&P Sector-Neutral High Yield Dividend Aristocrats.

The posts on this blog are opinions, not advice. Please read our Disclaimers.How Sector Neutrality Influences Risk/Return in S&P Dividend Aristocrats

Using the News to Select a More Stable Path to the S&P 500

Energy Pumps up the S&P GSCI and Markets Go Cuckoo for Cocoa

Getting to Know the S&P 500 in Hong Kong

Meet the S&P 500 Dynamic Intraday TCA Index

How Sector Neutrality Influences Risk/Return in S&P Dividend Aristocrats

- Categories Equities

- Tags diversification, ETFs, high yield dividend growers, indexing, large-cap equities, Mid-cap equities, quality dividend growers, Rupert Watts, S&P 1500, S&P 400, S&P 500, S&P 600, S&P Composite 1500, S&P Dividend Aristocrats, S&P Sector-Neutral High Yield Dividend Aristocrats, sector-neutrality, sectors, small-cap equities, U.S. Equities

Using the News to Select a More Stable Path to the S&P 500

- Categories Multi-Asset

- Tags AI, daily risk control, Equity, FIAs, fixed income, Fixed Indexed Annuities, GICS sectors, machine learning, multi-asset, news sentiment, RavenPack, risk control, S&P 500 RavenPack AI Index, S&P 500 RavenPack AI Sentiment Index, S&P 500 Sectors, sector rotation, target volatility

Meet the S&P 500 RavenPack AI Index, a multi-asset index that applies a news analytics algorithm powered by RavenPack to select S&P 500 sectors with the strongest news sentiment for use in its sector rotation process. The index combines U.S. equities and fixed income, complemented by a daily risk control mechanism that seeks to maintain a target volatility of 5%.

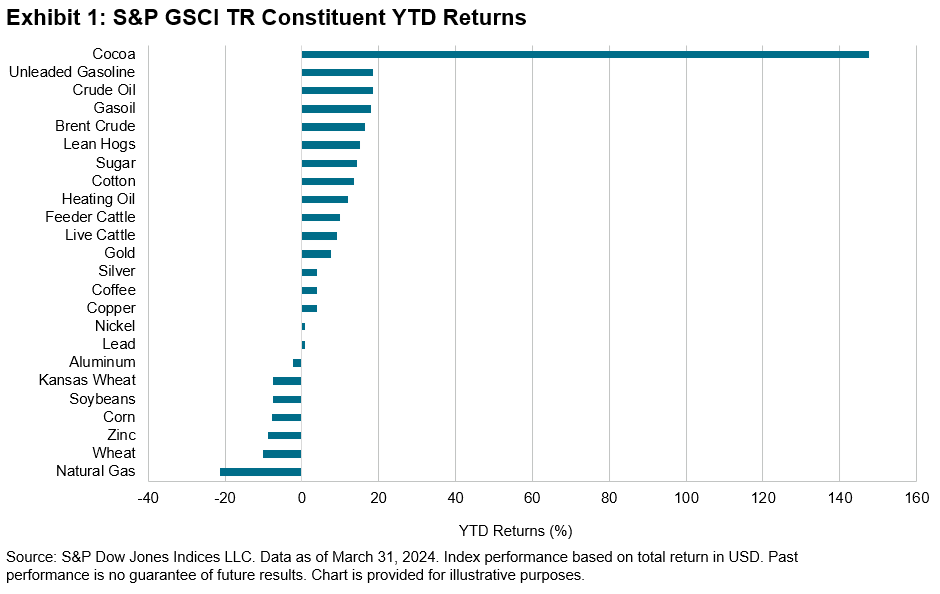

The posts on this blog are opinions, not advice. Please read our Disclaimers.Energy Pumps up the S&P GSCI and Markets Go Cuckoo for Cocoa

“I think it’s from all those dog-gone cocoa beans. Hey, by the way, did you guys know that chocolate contains a property that triggers the release of endorphins? Gives one the feeling of being in love.” -Willy Wonka, Charlie and the Chocolate Factory (2005)

Inflation presented a direct hit to consumers at the pump, with gasoline futures moving in near lockstep with oil. Petrol prices from crude, gasoil and gasoline rose 16%, 17% and 18% YTD, respectively. The S&P GSCI All Crude, which makes up over 42% of the broad index, is trading at a six-month high on the back of production cuts by OPEC+. These cuts offset yet another record in U.S. crude oil production, according to the Energy Information Administration. Strong petroleum performance led the S&P GSCI to an 10.4% YTD return, a solid start that perhaps is overshadowed only by the S&P 500® at all-time highs. At S&P Global’s recent CERAWeek event, leading commodity market participants engaged in discussions ranging from energy transition to geopolitics. Nickel is at the center of both, due to its importance as a primary metal for electric vehicles. Indonesia accounts for over half of nickel production and is pushing for an OPEC+ style cartel to manage future supply. The S&P GSCI Nickel continues to lag the broader commodity market, down 6.7% for the month and 33% lower over the past year.

Cocoa futures hit an all-time high as a perfect storm fueled prices. Poor weather in West Africa’s prime cocoa growing region continues to be ravaged by El Niño weather patterns. Crop yields dropped over 10% due to extreme rain, then drought, in 2023. This acutely impacted growing regions beset by ageing trees near the end of their fruit bearing life and further strained by black pod disease, a fungus killing cocoa trees. Chocolate demand driven by Easter holidays in the west pushed demand expectations to 370 thousand tons more than the 2024 supply, according to the International Cocoa Organization. Pricing surged beyond USD 10,000 per ton and were up 147% on the year.

Gold is another commodity hitting record highs this month. The perceived safety of gold continues to attract assets in an environment dominated by war, political upheaval and central bankers balancing inflationary concerns against continued economic growth. Unlike its digital upstart Bitcoin, gold has been transported across political borders for millennia, acting as a hedge against global economic uncertainty. This century, gold continues to outpace the S&P 500, with an average annual total return of 8% for the Dow Jones Commodity Index Gold compared to 7.4% for the S&P 500.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Getting to Know the S&P 500 in Hong Kong

Why is the S&P 500 relevant to markets around the world? Take a closer look at this iconic index with S&P DJI’s Priscilla Luk and Hang Seng Investment Management’s Yvonne Ngai, including its role in our daily lives and some key highlights about why the S&P 500 is widely regarded as the best single gauge of U.S. large-cap equities.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Meet the S&P 500 Dynamic Intraday TCA Index

Combining a trend-following mechanism with the ability to rebalance up to 13 times during the trading day, this innovative multi-asset index seeks to provide a more stable volatility experience by leveraging the next generation of risk control technology.

The posts on this blog are opinions, not advice. Please read our Disclaimers.