“I think it’s from all those dog-gone cocoa beans. Hey, by the way, did you guys know that chocolate contains a property that triggers the release of endorphins? Gives one the feeling of being in love.” -Willy Wonka, Charlie and the Chocolate Factory (2005)

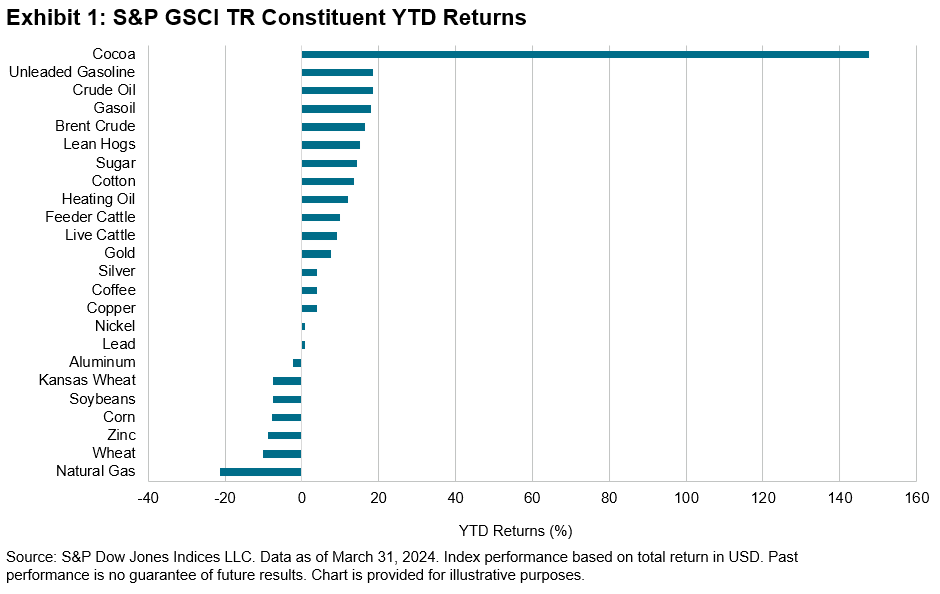

Inflation presented a direct hit to consumers at the pump, with gasoline futures moving in near lockstep with oil. Petrol prices from crude, gasoil and gasoline rose 16%, 17% and 18% YTD, respectively. The S&P GSCI All Crude, which makes up over 42% of the broad index, is trading at a six-month high on the back of production cuts by OPEC+. These cuts offset yet another record in U.S. crude oil production, according to the Energy Information Administration. Strong petroleum performance led the S&P GSCI to an 10.4% YTD return, a solid start that perhaps is overshadowed only by the S&P 500® at all-time highs. At S&P Global’s recent CERAWeek event, leading commodity market participants engaged in discussions ranging from energy transition to geopolitics. Nickel is at the center of both, due to its importance as a primary metal for electric vehicles. Indonesia accounts for over half of nickel production and is pushing for an OPEC+ style cartel to manage future supply. The S&P GSCI Nickel continues to lag the broader commodity market, down 6.7% for the month and 33% lower over the past year.

Cocoa futures hit an all-time high as a perfect storm fueled prices. Poor weather in West Africa’s prime cocoa growing region continues to be ravaged by El Niño weather patterns. Crop yields dropped over 10% due to extreme rain, then drought, in 2023. This acutely impacted growing regions beset by ageing trees near the end of their fruit bearing life and further strained by black pod disease, a fungus killing cocoa trees. Chocolate demand driven by Easter holidays in the west pushed demand expectations to 370 thousand tons more than the 2024 supply, according to the International Cocoa Organization. Pricing surged beyond USD 10,000 per ton and were up 147% on the year.

Gold is another commodity hitting record highs this month. The perceived safety of gold continues to attract assets in an environment dominated by war, political upheaval and central bankers balancing inflationary concerns against continued economic growth. Unlike its digital upstart Bitcoin, gold has been transported across political borders for millennia, acting as a hedge against global economic uncertainty. This century, gold continues to outpace the S&P 500, with an average annual total return of 8% for the Dow Jones Commodity Index Gold compared to 7.4% for the S&P 500.

The posts on this blog are opinions, not advice. Please read our Disclaimers.