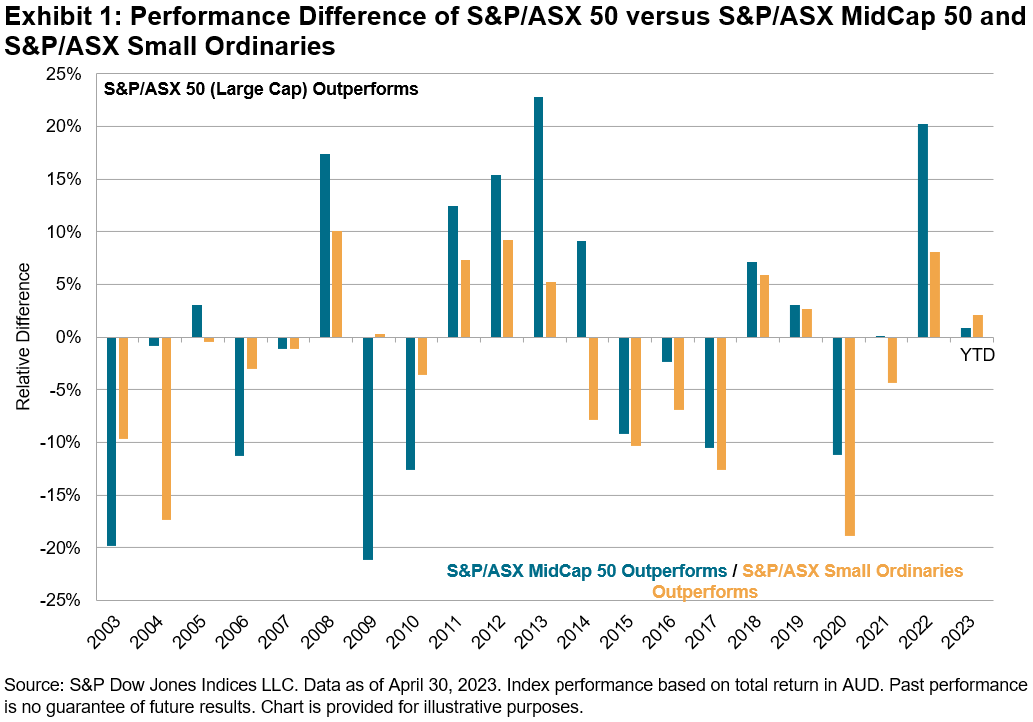

Transparency is commonly seen as a key principal of sustainable investing,1 helping investors understand companies’ sustainability profile and sustainable investment strategies, as well as potentially contributing to investor impact.2 Sustainability is also multifaceted, illustrated by the differences in many of the Sustainable Development Goals (e.g., no poverty and life below water represent very different goals) and mathematically demonstrated by weakly correlated, or uncorrelated, corporate sustainability KPIs (see Exhibit 1).

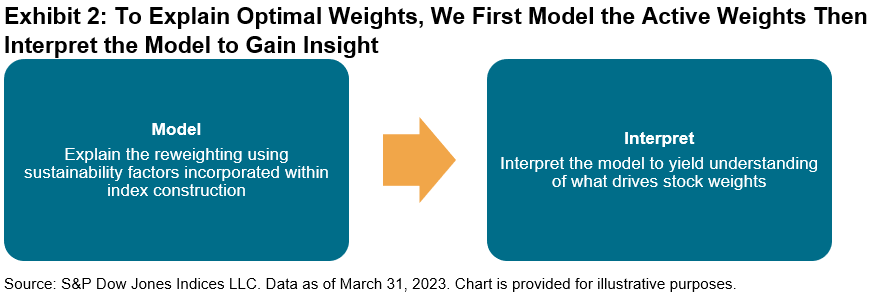

While addressing multiple uncorrelated goals defines the sustainability problem well, this raises a challenge from an index construction and transparency perspective. The simplest methods are highly transparent but may lack ability to capture the multifaceted nature of sustainability with precision. Alternatively, optimization is excellent at meeting multiple objectives simultaneously; however, it raises a transparency challenge. We propose tackling this challenge with our “weight attribution” methodology, allowing the best of both worlds: sophistication of index construction with transparency of weight allocation.

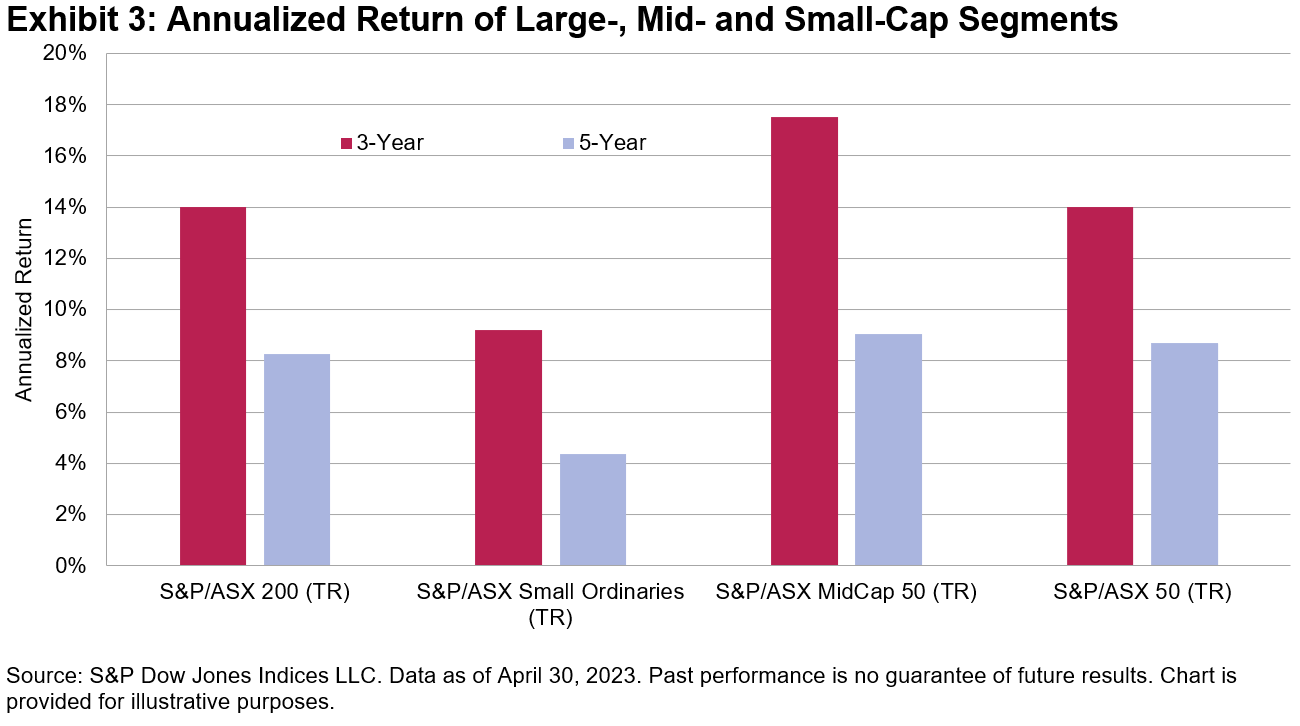

Weight attribution aims to explain active weights within an index, using relevant data points. This model is interpreted, leading to understanding of which factors are influencing stock weights and to what extent (see Exhibit 2).3

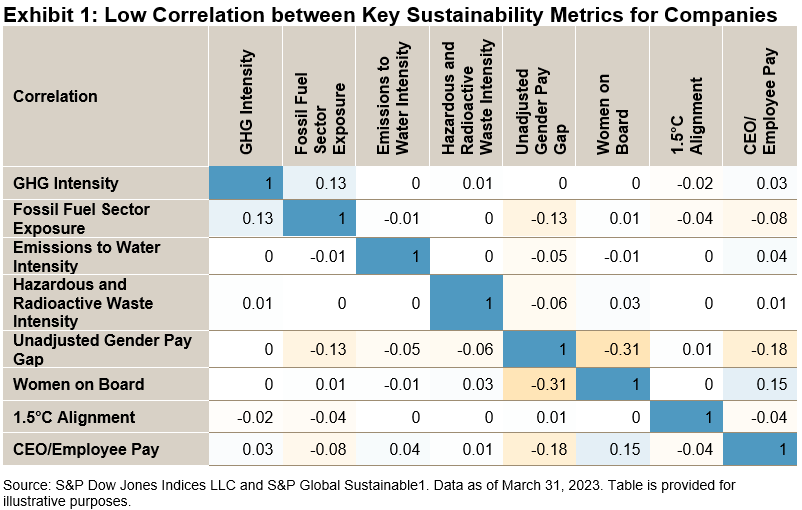

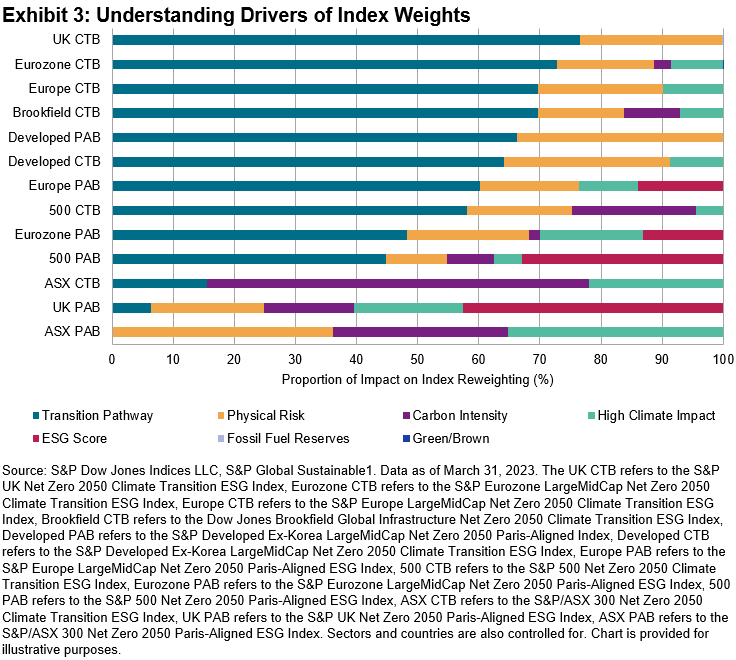

We use the S&P PACT™ Indices (S&P Paris-Aligned & Climate Transition Indices) to demonstrate transparency gains from weight attribution. Seven sustainability metrics are included in the optimization, leading to the question of what really drives the weights of companies. Exhibit 3 shows the interpretation, which yields understanding of the relative importance of sustainability factors when reweighting the indices.

In this example, we see similarities across regions, with the “Transition Pathway” being the most important factor driving weights. The S&P/ASX 300 Net Zero 2050 Climate Transition ESG Index, S&P/ASX 300 Net Zero 2050 Paris-Aligned ESG Index and S&P UK Net Zero 2050 Paris-Aligned ESG Index are different here, where the transition pathway constraint was softened. We also gain an understanding of how other sustainability factors drove weights of stocks within the indices, providing much needed transparency to optimized weights.

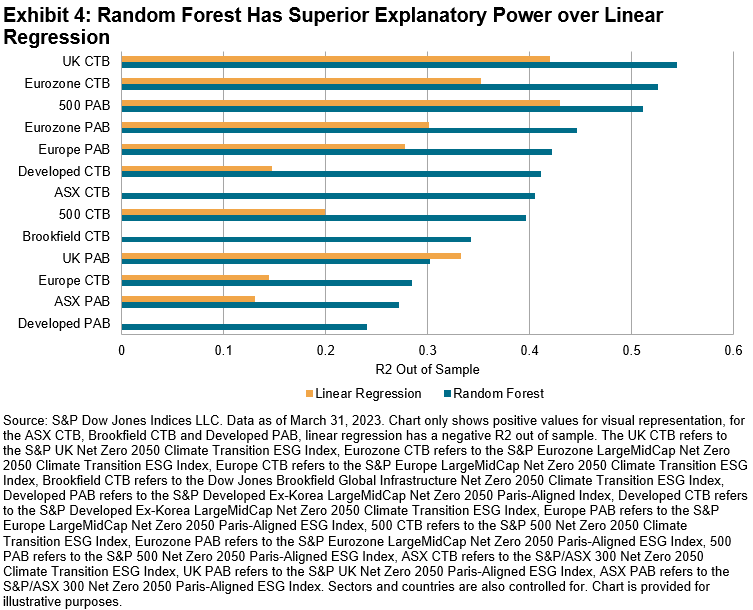

Model selection: in modeling the active weights, the random forest algorithm is preferred over other models due to the following benefits:

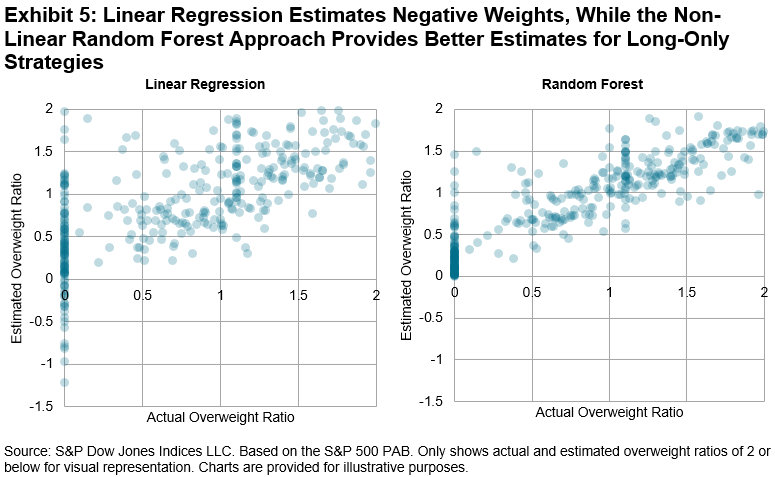

- Stronger explanatory power than linear regression (see Exhibit 4), likely caused by the ability to capture non-linear relationships between weights and sustainability factors. In particular, random forest works well for long-only strategies, where linear regression predicts negative weights, which cannot be possible (see Exhibit 5);

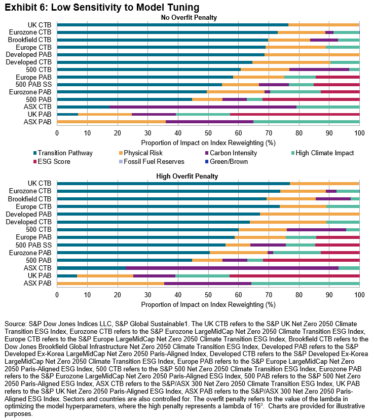

- The outcome has low sensitivity to model tuning (see Exhibit 6) and is less prone to overfitting than other tree-based or non-linear models; a common property by design.4

Weight attribution can bring transparency to optimized indices, which can capture the multidimensional nature of sustainability well. This can help market participants understand sustainable investment strategies and potentially contribute to investor impact.

1 Peterson, Douglas L, “Transparency and Impact: The Essential Principles of ESG,” S&P Global, 2022.

2 Kolbel, Heeb, Paetzold and Busch (2020) outline what they consider “determinates of investor impact”. Transparency may aid these impact mechanisms.

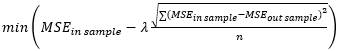

3 The model’s hyperparameters are tuned using a Bayesian optimization, utilizing the following utility function:

Where MSE is the mean square error, lambda is a scaling factor and a 5-k-fold cross-validation is used for the out of sample MSE. Model interpretation uses SHAP values. SHAP values aim to understand the marginal contribution that each feature makes to the predicted outcome of a model (in the example used, the impact a climate/ESG factor has on the reweighting of stocks within S&P PACT Indices).

4 López de Prado, Marcos, “Advances in Financial Machine Learning,” Wiley, 2018.

The posts on this blog are opinions, not advice. Please read our Disclaimers.