The first half of 2022 brought steep and broad-based losses for Australian equity indices of all stripes. On a relative basis, however, active Australian Equity General funds had a decent start to 2022; as our SPIVA® Australia Mid-Year 2022 Scorecard reported, a (slim) majority of active managers in this category outperformed the S&P/ASX 200. Unfortunately for their investors, good times for active domestic large-cap funds didn’t continue into the second half of the year. While the recovery in Australian equities in H2 2022 ensured a positive return for Australian Equity General funds across all quartiles on an absolute basis, over three-quarters of them failed to beat the S&P/ASX 200, bringing the full-year underperformance rate to 58%.

One of the challenges faced by active managers in H2 was the nearly identical performance of the major equity segments: while equal weight, value, growth, mid caps, small caps and the largest of blue chips all had distinct return patterns in H1, their gains were almost indistinguishable in H2.

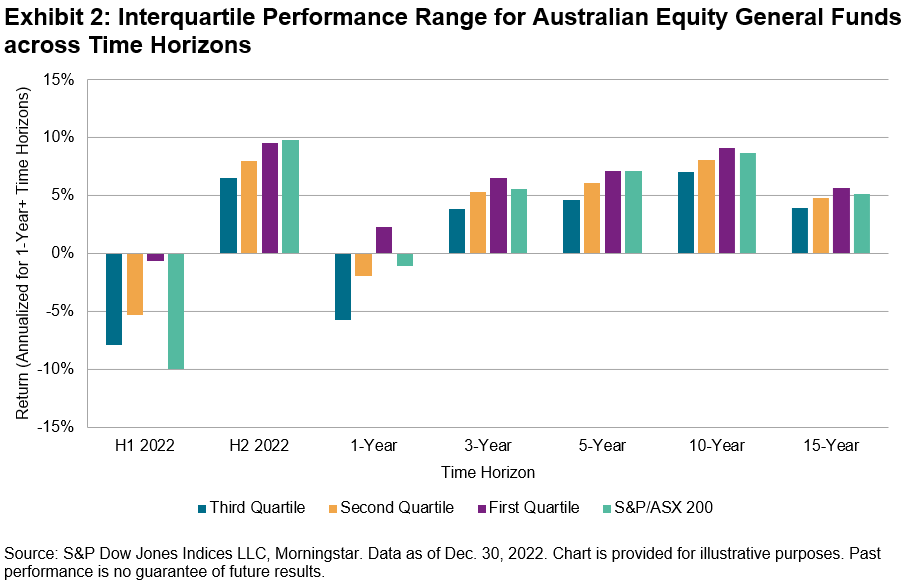

As Exhibit 2 shows, the near uniformity of equity returns in H2 was reflected in the relatively narrow range over which active Australian Equity General returns were scattered: their interquartile range was just 3%, less than half the 7% seen in H1. It is also noteworthy that, in H2 2022, even funds in the top quartile would have lagged the benchmark. Given the changing market environment over the year, it might be no surprise that few active managers were able to adapt and navigate the churning winds: historical evidence suggests that it is hard to find active managers who are able to beat the market persistently.

Overall, the market conditions of 2022 offered a particularly interesting test for the proponents of active management. A global equity downturn gave those who could play “defense” a chance to shine, while the relative performances of different market segments offered plenty of opportunity for outperformance. While it cannot hope to settle the debate, the SPIVA Australia Scorecard brings transparent and objective assessments of active fund performance, using industry-standard benchmarks to better inform investors about where active management has been “working” over short- and long-term periods. Overall, the year-end 2022 scorecard showed a “game of two halves” for active managers in broad Australian equities—with a good H1 followed by a challenging H2—and emphasized the challenge of persistent outperformance in rapidly evolving market environments.

The posts on this blog are opinions, not advice. Please read our Disclaimers.