On Aug. 1, 2022, S&P Dow Jones Indices (S&P DJI) launched a series of S&P GSCI Freight Indices, the first investible shipping indices of their kind in the market and an expansion of the single-commodity offering of indices based on the S&P GSCI. Refer to this blog for background on the indices.

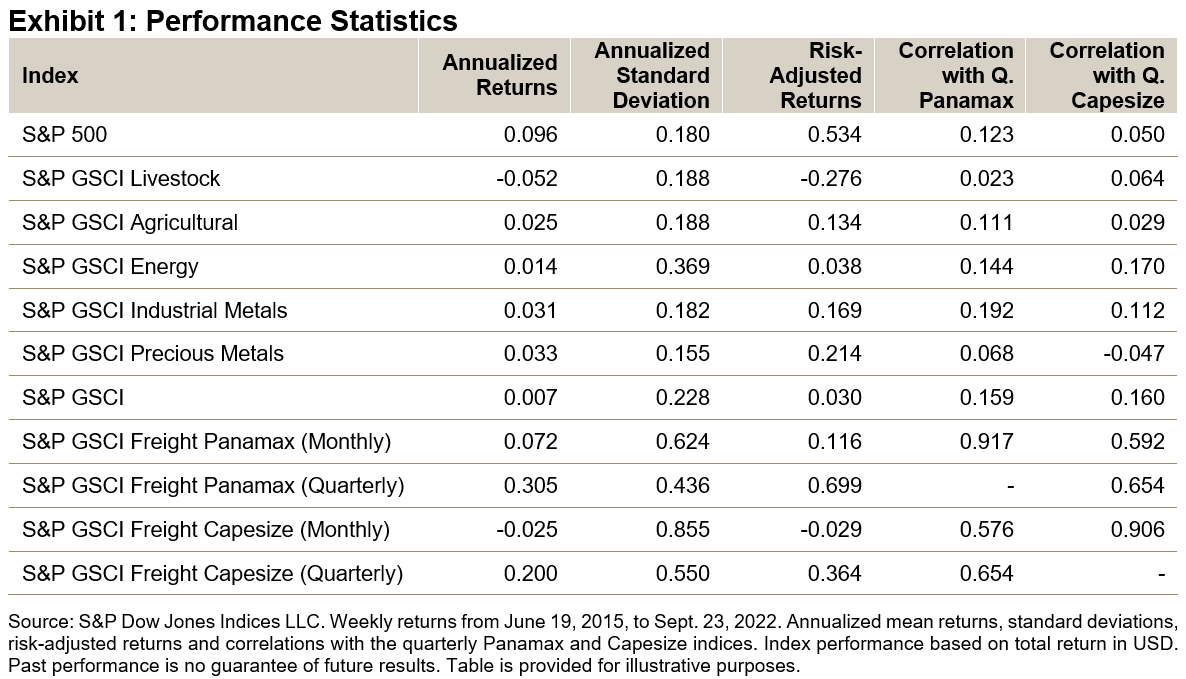

Freight rates have historically enjoyed higher average returns and are more volatile compared to equity, fixed income and other commodities (Exhibit 1). Interestingly, Panamax freight rates are more volatile than the prices of the commodities they typically transport (mostly agricultural commodities and industrial metals). Monthly and quarterly freight rates have similar statistical properties, reflecting the common fundamentals that drive the market and each sector. At the same time, the front end of the futures curve is more volatile and is driven by short-term factors, including repositioning booms and regional supply-demand imbalances, while long-term rates are less sensitive to those events and thus less volatile.

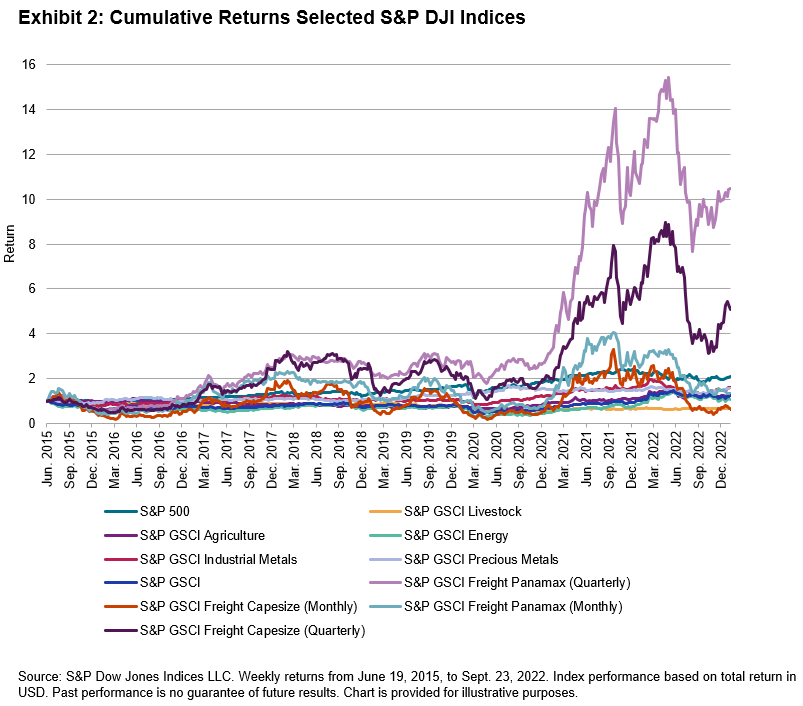

Cumulative returns suggest that Panamax and Capesize freight rates have historically outperformed other commodity indices as well as other asset classes, on the back of a very strong and buoyant freight market in 2020 and 2021 (Exhibit 1).

As global investors increasingly seek to diversify their investments and look for alternative vehicles to tap into niche market segments, the S&P GSCI Freight index series may be a meaningful gauge of global economic activity, seaborne trade and individual commodity, and geographic market dynamics.

Freight rates reflect the balance between supply and demand. Although strong demand for commodities and subsequently high commodity prices may trigger stronger demand for shipping services, the supply of shipping services moves independently. As a result, freight rates can fall in an environment of expanding commodities demand, if the supply of vessels grows faster than the demand for shipping services. Equally, freight rates may increase in an environment of low commodity demand. For those reasons, the correlation between freight rates and other commodities is historically weak.

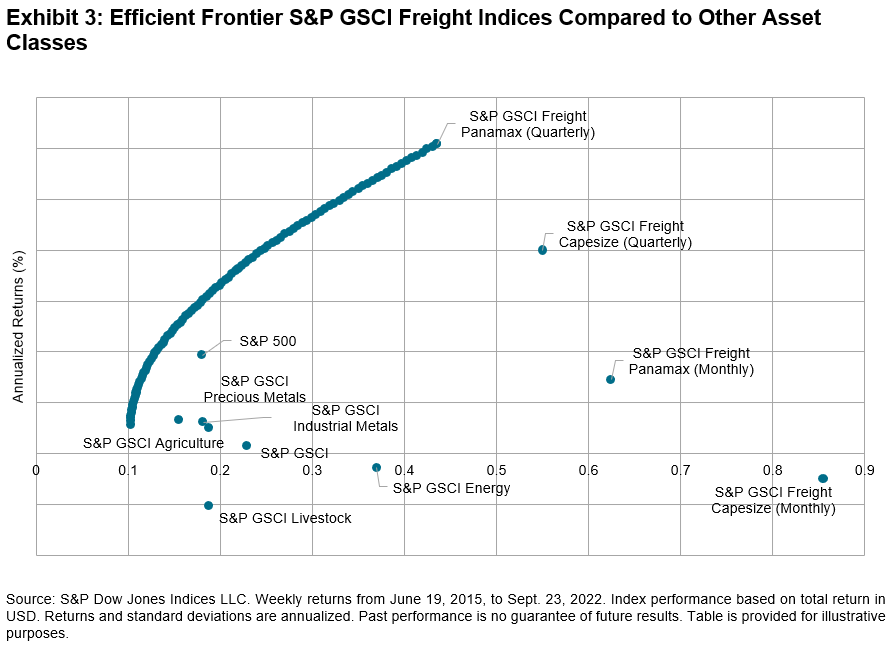

This is suggestive of freight rates contributing to the diversification properties of a typical portfolio consisting of commodities and stocks and this is confirmed visually by looking at the shape of the efficient frontier and the position of the Panamax and Capesize base assets, especially the quarterly ones (Exhibit 3).

Global shipping is a unique asset class. In this blog, we demonstrated the low correlation between freight rates and other commodities and the potential benefits of including freight in a diversified portfolio. The introduction of the S&P GSCI Freight Indices offers the opportunity to investors to access this unique asset class and be able to include products tracking these indices in their portfolios.

The posts on this blog are opinions, not advice. Please read our Disclaimers.