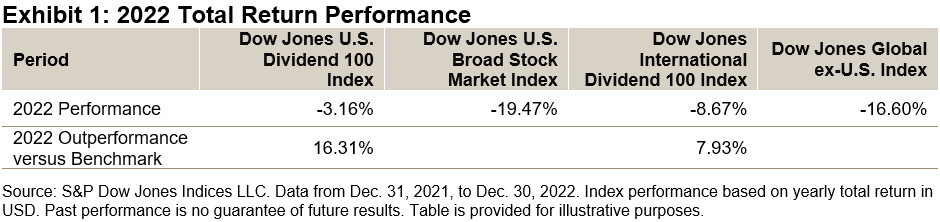

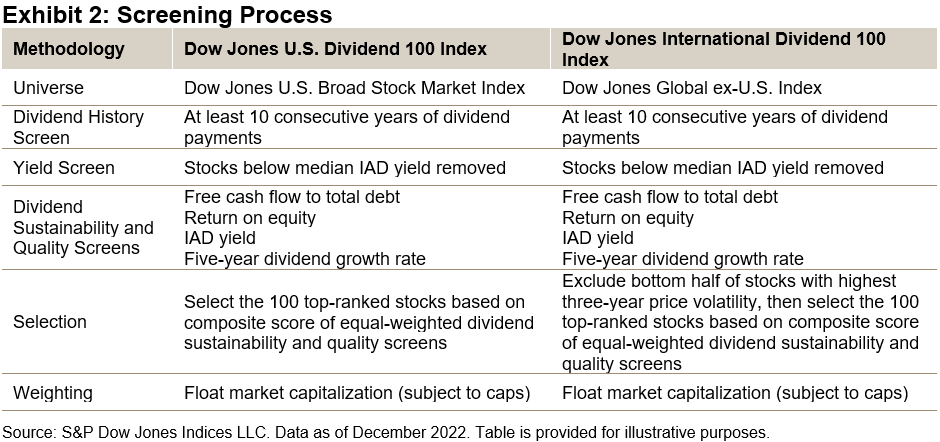

In part one of this series, we highlighted how the stringent dividend sustainability and quality screens of the Dow Jones U.S. Dividend 100 Index and Dow Jones International Dividend 100 Index may have led to their outperformance in 2022 and other inflationary periods.

In this installment, we will analyze the positive effects that these screens had on the fundamentals of both indices, as well as examine examples of combining the U.S. and international indices to harness possible diversification benefits.

Comparing Fundamentals

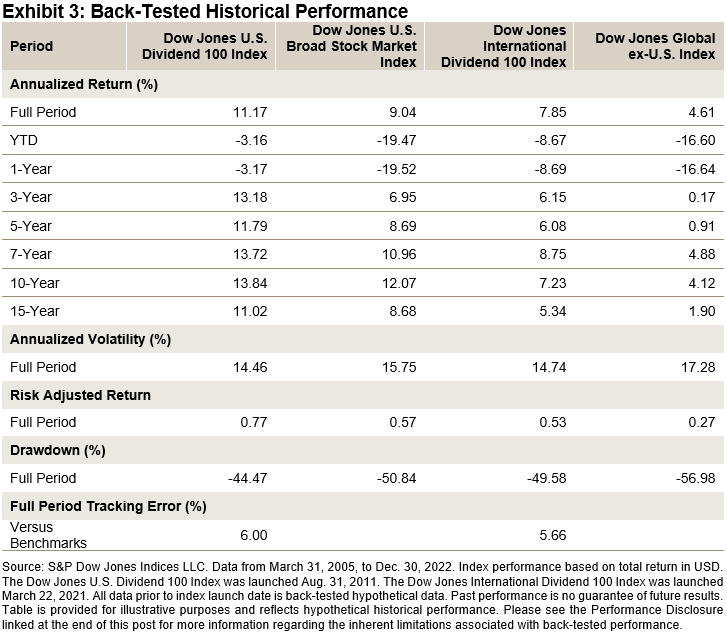

Exhibits 1, 2 and 3 show the significantly improved value and quality metrics that both Dow Jones 100 Indices had compared with their respective benchmarks. Exhibit 1 shows that both Dow Jones Dividend 100 Indices traded at a discount to their respective benchmarks on every valuation metric. A value tilt may prove important in a rising interest rate environment, because value stocks tend to receive larger cash flows in the near term, and therefore typically have lower durations relative to growth stocks. Holding all else equal, value stocks may perform better in a rising interest rate environment compared with growth stocks.1

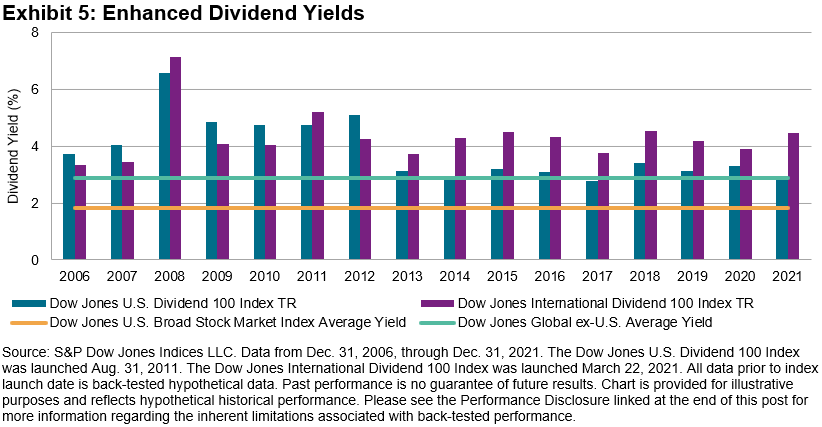

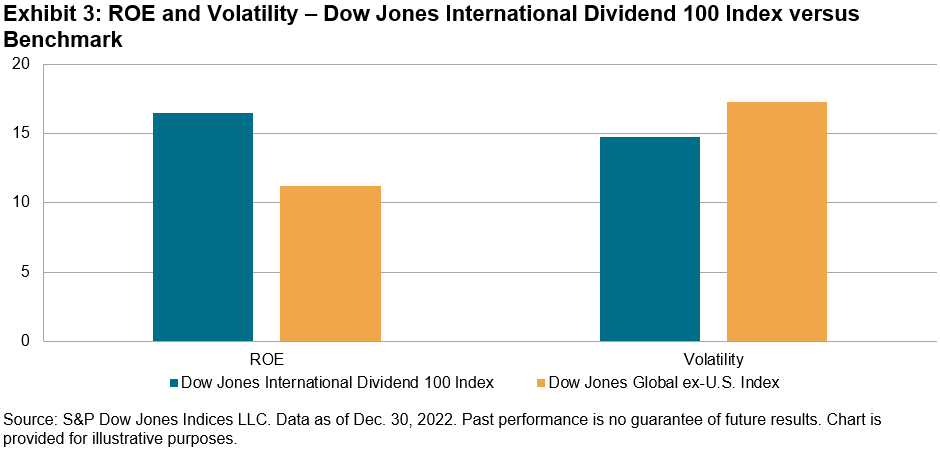

Furthermore, as Exhibits 2 and 3 show, both Dow Jones Dividend 100 Indices held a quality advantage and volatility reduction compared with their respective benchmarks. These features may have proved particularly beneficial amid 2022’s rapidly rising interest rates and deteriorating economic environment.

Potential Diversification Benefits

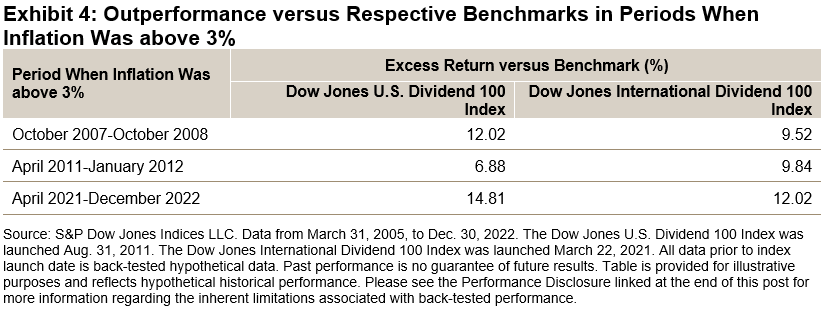

An interesting option for those wanting to reduce volatility while potentially enhancing dividend yield is to pair the Dow Jones International Dividend 100 Index with the Dow Jones U.S. Dividend 100 Index. Exhibit 4 illustrates two hypothetical weighting scenarios and their simulated performance. The first scenario allocates 70% weight to the U.S. index and 30% to the international index, while the second scenario allocates 80% weight to the U.S. index and 20% to the international index.

When observing the back-tested period of this hypothetical combined index starting in March 2005, the 70%/30% scenario had a full period of annualized 10.25% performance, exceeding both benchmarks, with volatility reduced to 14.02%. In the 80%/20% scenario, the annualized performance was to 10.56%, while the volatility was 14.11%. the back-tested hypothetical risk-adjusted return and maximum drawdown were significantly improved versus both benchmarks.

Conclusion

As discussed in part one, the Dow Jones U.S. Dividend 100 Index and Dow Jones International Dividend 100 Index performed well versus their benchmarks in 2022, despite a difficult economic environment. This may in part be due to their higher yields and fundamentals relative to their benchmarks.

For institutions only, not for retail investors.

l https://www.institutionalinvestor.com/article/b1wd19khdzwj89/In-an-Inflationary-Environment-Value-Stocks-Offer-a-Refuge

The posts on this blog are opinions, not advice. Please read our Disclaimers.