Commodities, represented by the broad-based S&P GSCI, fell 1.7% in November on the back of weakness in the petroleum and grains complexes. Global commodities markets were particularly hit this month by worries over rare demonstrations in China against COVID-19 curbs, with oil and grains falling to multi-month lows and safe-haven gold rising. After 11 months, the S&P GSCI was up 27.8% YTD, defying higher interest rates and growing fears of a prolonged global economic slowdown.

The S&P GSCI All Crude has lost over a third of its value since peaking in early March (and giving up all gains following the Russia-Ukraine conflict); it might be said that oil prices are nodding in agreement with Treasury yields regarding an approaching economic slowdown. In the petroleum complex, a relatively tight global supply picture is competing with fears of an economic slowdown, a strong U.S. dollar, government intervention to address skyrocketing retail energy prices and signs that energy consumers have taken steps to limit consumption. A drop in financial market participation in the major oil derivative markets has contributed to higher levels of volatility. Market participants will be eagerly awaiting a decision from EU member countries regarding a price cap on Russian oil in early December, as well as the Dec. 4, 2022, OPEC+ meeting to provide further market direction.

The S&P GSCI Grains declined 4.3% in November. In the wheat market, cheap supplies from Russia and elsewhere in the Black Sea region have kept a lid on prices. In contrast, soybeans were supported by strong onshore soymeal demand in China. Argentina’s decision to give a temporary exchange rate for soy exporters until the end of the year will likely encourage a surge of exports in December. The S&P GSCI Cotton rose 20.4% in November but remained more than 50% off its May high. As apparel sales contract, the collapse in cotton prices has been attributed to weaker Chinese demand for cotton yarn, in what could be a sign that core inflation has started to wane. The S&P GSCI Livestock was unchanged over the month.

Industrial metals have so far avoided the malaise caused by Chinese unrest, and expectations of a global slowdown instead focused on steps announced by China aimed at bailing out its struggling real estate sector. The S&P GSCI Industrial Metals rose 12.2% over the month, while nickel rallied 23.9%.

The S&P GSCI Gold gained 6.8% in November, ending a seven-month losing streak. Signs that the U.S. Fed could scale back the pace of its interest rate hikes, along with the ongoing failures in the cryptocurrency ecosystem, helped support the so-called safe-haven asset.

To learn more about the S&P GSCI and related indices, check out our Commodities Theme Page.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

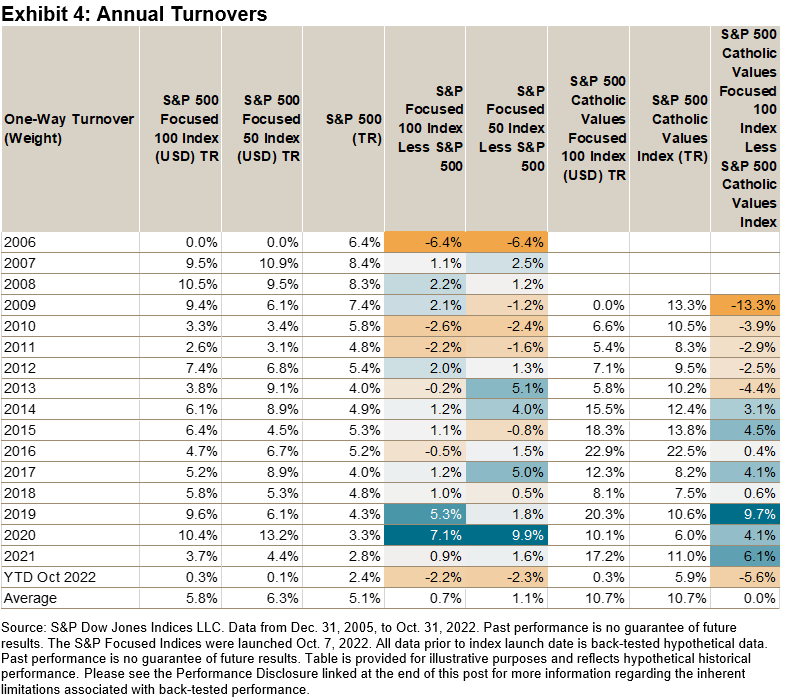

Exhibit 4 shows that the S&P Focused Indices’ construction provided similar turnover figures as their benchmarks, historically.

Exhibit 4 shows that the S&P Focused Indices’ construction provided similar turnover figures as their benchmarks, historically.