How are index-based strategies helping insurers measure and address liquidity in their portfolios? Take a closer look at the why index liquidity matters with S&P DJI’s Nick Godec, Morgan Stanley’s Meredith Shaw, and BlackRock’s James Winslow.

The posts on this blog are opinions, not advice. Please read our Disclaimers.What Fixed Income Index Liquidity Means for Insurers

Steep Declines for Islamic Benchmarks in Q2, Lagging Conventional Indices YTD

A Risk Control Approach to Cryptocurrencies: A Tool for a Crypto Winter

Commodities: Inflation, Interest Rates and the U.S. Dollar

S&P Global Commodity Insight’s Mining Data Lays Foundation for the S&P Global Core Battery Metals Index

What Fixed Income Index Liquidity Means for Insurers

Steep Declines for Islamic Benchmarks in Q2, Lagging Conventional Indices YTD

- Categories Equities, Thematics

- Tags DJIM, Dow Jones Islamic Indices, GCC indices, global equities, islamic benchmarks, Islamic equities, Islamic indices, MENA, MENA Equities, S&P Global BMI Shariah, S&P Pan Arab Composite, Shariah, shariah index performance, Shariah Scorecard, Shariah-compliant benchmarks

Global equities fell 15.7% during Q2, as measured by the S&P Global BMI, accumulating losses of 20.4% YTD. Shariah-compliant benchmarks, including the S&P Global BMI Shariah and Dow Jones Islamic Market (DJIM) World Index, continued to underperform their conventional counterparts YTD in part due to continued weakness in the Information Technology sector, which fell 30.1% during the period.

Major regional broad-based Shariah and conventional benchmarks likewise concluded with steep negative performance YTD, as central bank actions to contain runaway inflation weighed on markets. The Pan Arab region, meanwhile, vastly outperformed, as the Shariah benchmark finished with only marginal losses.

Drivers of YTD Shariah Index Performance

While global equities declined broadly over the first half of 2022, sector performance played a part in the relative underperformance of Shariah-compliant equity benchmarks. Information Technology, which is heavily represented in Islamic indices, fell 30.2%, contributing most heavily to the broad underperformance over the period, as growth-oriented tech shares have suffered during the recent downturn. Consumer Discretionary likewise fell 31.4%, representing the next greatest negative contribution to returns, as inflation and economic concerns worried consumers.

Despite a June pullback, Energy remained the sole positive sector YTD, outpacing the broader market by strides, as supply constraints bolstered shares (see Exhibit 2). Due to its low weight in Islamic indices, however, the performance impact remained relatively muted.

MENA Equities Lose Ground

MENA regional equities reversed in Q2, following several quarters of positive performance. The regional S&P Pan Arab Composite sank 12.7% in Q2, leading to a minor gain of 0.4% YTD. All GCC country indices besides Oman suffered losses during the recent quarter, led by the S&P United Arab Emirates BMI (down 17.1%) and the S&P Saudi Arabia BMI (down 13.0%). Meanwhile, the S&P Oman BMI eked out a 0.2% gain during the quarter. Year-to-date, there was high dispersion of returns across countries, as Oman gained 10.4% and Egypt lost 34.3% in U.S. dollar terms.

For more information on how Shariah-compliant benchmarks performed in Q2 2022, read our latest Shariah Scorecard.

This article was first published in IFN Volume 19 Issue 28 dated July 13, 2022.

The posts on this blog are opinions, not advice. Please read our Disclaimers.A Risk Control Approach to Cryptocurrencies: A Tool for a Crypto Winter

- Categories Thematics

- Tags Bitcoin, crypto, Cryptocurrency, digital assets, Ethereum, institutional investor, risk control, S&P Bitcoin Dynamic Rebalancing Risk Control 40% Index, S&P Bitcoin Index, S&P Cryptocurrency, S&P Ethereum Dynamic Rebalancing Risk Control 40% Index, S&P Ethereum Index, US FA

Earlier this year, we reported on the volatility of Bitcoin and cryptocurrencies overall. In February 2022, the market was slightly down from its all-time high in November 2021. S&P Dow Jones Indices had just launched the new S&P Bitcoin and Ethereum Dynamically Rebalancing Risk Control 40% Indices (CET Close), and we saw that risk-adjusted performance over time of the Bitcoin risk control index exceeded that of the underlying S&P Bitcoin Index.

Since then, the crypto market has experienced a significant downturn, while equities officially entered a bear market. For crypto, the collapse of Terra and its sister coin Luna,1 the halt of withdrawals from the Celsius network2 and the contagion to other firms such as crypto hedge fund Three Arrows Capital and crypto lender Babel3 created difficult conditions in the second half of the Q2.

Why not review how the crypto risk control indices performed through this time period and see how they met the index methodology goals of mitigating volatility?

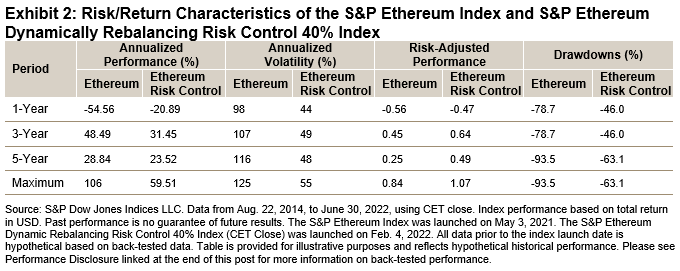

Exhibits 1 and 2 show the performance for the S&P Bitcoin and S&P Ethereum Dynamically Rebalancing Risk Control 40% Indices and their underlying benchmark indices.

Specifically, for the Bitcoin risk control index, during the June market drop, the rebalance was triggered three times. The rebalance adjusts the exposure to the underlying index and allocates to U.S. dollars on any given day when the 10% threshold based on exposure is crossed. While the benchmark S&P Bitcoin Index was down 40% in June, the S&P Bitcoin Dynamically Rebalancing Risk Control 40% Index was down just 21%. This demonstrates how responsive the dynamic nature of the risk control index is to the current market conditions, and the methodology mitigated the effects of volatile, declining markets.

However, not all is gloom and doom in the crypto space. It is worth noting that the S&P Bitcoin Index was up 15% in the first week of July (as of July 7, 2022), and the S&P Bitcoin Dynamically Rebalancing Risk Control 40% Index was up 4% during this period. As expected with this asset class, volatility continues, and risk control can help mitigate it.

For additional details, please refer to the S&P Risk Control Indices Methodology & Parameters for current parameters and to the S&P Risk Control Indices section of the S&P DJI Index Mathematics Methodology.

For S&P DJI, this is another innovative way to bring tools and transparency to this emerging asset class.

3 https://www.coindesk.com/layer2/2022/06/29/why-the-crypto-unwind-wasnt-contagious-this-time/; https://www.coindesk.com/business/2022/07/01/troubled-crypto-lender-babel-finance-looking-to-hire-restructuring-specialist-houlihan-lokey-sources/

The posts on this blog are opinions, not advice. Please read our Disclaimers.Commodities: Inflation, Interest Rates and the U.S. Dollar

After last week’s highest inflation print in over four decades, the U.S. dollar (USD) rose to its strongest level in 20 years, as measured against a broad basket of currencies. The euro also hit parity with the USD for the first time since 2002 as a consequence of Europe’s front-line exposure to the Russia-Ukraine conflict and the perception that the European Central Bank has been slow to raise interest rates. Most major commodities included in the headline commodity benchmark, the S&P GSCI, are still showing positive gains YTD, even with the global recession fears permeating market sentiment. Some traditional inflation hedging assets are not performing as expected, with negative YTD performance for real estate, gold, and U.S. Treasury Inflation Protected Securities (TIPS) (see Exhibit 1), but commodities have recently been offering inflation protection amicably.

Commodities’ outperformance can be explained by the energy sector commodities. The worst-performing energy constituent within the S&P GSCI, S&P GSCI Crude Oil, was up 41.36% YTD. While gasoline prices have been getting the headlines in the U.S., gasoil, heating oil and natural gas were all up nearly 100% in 2022. A cooling off of these energy commodities could be a leading indication for cooling of inflation in the near term.

USD strength has traditionally been a headwind for commodities. Most major commodities around the world are priced in USD, so when the currency strengthens, buying commodities becomes more expensive in non-USD currencies. As one strengthens, the other weakens. But this has not been the case recently, and there are previous periods in history where this relationship has faltered (see Exhibit 2). In this case, commodities moved first, and the USD strength has been more recent in response to an abrupt switch in global monetary policy aimed at cooling inflation. Something will have to give soon if this unusual situation based on history continues in the short run. If inflation finally starts to ease, it’s possible the U.S. Federal Reserve might ease up on its rate hiking regime, thereby cooling off the red-hot USD.

Where does this leave us in the current environment compared to similar situations historically? During two similar periods where skyrocketing inflation was met with interest rate tightening (in the 1980s and 2000s), commodities still tended to outperform, although eventually the high cost of goods caused the U.S. consumer to suffer and recessions to ensue. Commodities have posted double-digit percentage gains during high inflationary regimes, as can be seen in Exhibit 3. Allocating aggressively to commodities and away from equities during these times has tended to produce favorable risk-adjusted returns, as can be seen by our S&P Multi-Asset Dynamic Inflation Strategy Index, with a 6.4% gain YTD. For more information on this index, please read our prior blog.

Where does this leave us in the current environment compared to similar situations historically? During two similar periods where skyrocketing inflation was met with interest rate tightening (in the 1980s and 2000s), commodities still tended to outperform, although eventually the high cost of goods caused the U.S. consumer to suffer and recessions to ensue. Commodities have posted double-digit percentage gains during high inflationary regimes, as can be seen in Exhibit 3. Allocating aggressively to commodities and away from equities during these times has tended to produce favorable risk-adjusted returns, as can be seen by our S&P Multi-Asset Dynamic Inflation Strategy Index, with a 6.4% gain YTD. For more information on this index, please read our prior blog.

Commodities have been known as an inflation hedging asset mostly because they are raw materials that go into the production of the goods that tend to rise in lockstep with inflation. Much of the recent strength in commodities prices can be attributed to supply shocks, including the Russia-Ukraine conflict and post-COVID-19 supply chain disruptions. Longer term, there are additional supply constraints imposed by the energy transition. Interest rates are a blunt monetary instrument and can do little to directly address these supply constraints, but they can slow demand. Similarly, USD strength may eventually hamper commodity demand from non-U.S. consumers.

The posts on this blog are opinions, not advice. Please read our Disclaimers.S&P Global Commodity Insight’s Mining Data Lays Foundation for the S&P Global Core Battery Metals Index

As mentioned in a previous post, S&P Dow Jones Indices (S&P DJI) partnered with S&P Global Commodity Insights (S&P GCI) to leverage its over 30 years of industry-leading Metals & Mining data and expertise in order to launch the S&P Global Core Battery Metals Index. As the index seeks to identify the key players in the upstream battery metals supply market, S&P GCI is proud to be a contributor of back-end data and industry expertise.

Hosted on the S&P Capital IQ Pro platform by S&P Global Market Intelligence, the detailed asset and company-level data coverage, combined with deep industry research and analysis, provides a comprehensive view of the mining sector worldwide. The Metals & Mining solution covers worldwide exploration, discoveries, development, production, mine cost analysis, acquisitions activity and commodity market forecasts and analysis, and it connects its customers to global opportunities on a single platform (see Exhibit 1).

An Asset-Level Approach to Company Production

A key input that drives the S&P Global Core Battery Metals Index is company production and its derived production value for core battery metals—nickel, cobalt and lithium.

A company’s commodity production plays a central role when benchmarking mining companies’ standing, as well as understanding the upstream supply affecting global commodity markets. For the manufacturing of downstream battery-related products, such as electric vehicles, understanding the mined output/supply of the core battery commodities is crucial, and that all begins with the output at the mine level (see Exhibit 2).

S&P GCI aggregates (or sums) asset-level production data up to the company level, based on the equity ownership stake in each property, and both ownership and production data sets are sourced primarily from public company filings. Also, standardization is applied to adjust production into a single unit of measurement per commodity and a single 12-month period ending in December of each year.

With S&P DJI’s core expertise in licensing indices to more than 550 financial institutions worldwide and S&P GCI’s strong offerings across the commodities sector, the formation of the S&P Global Core Battery Metals Index is a natural partnership between the two divisions to accelerate progress in the energy transition via battery metals.

If you are interested in learning more about the data that fuels the index, please don’t hesitate to contact S&P GCI. Keep an eye out for a future blog that will further delve into the index’s methodology and provide an overview of historic performance.

The posts on this blog are opinions, not advice. Please read our Disclaimers.