What is the appropriate observational period for evaluating an investment strategy?

This question is important, because different observational periods can produce different conclusions. For example, for the first 11 weeks of 2022, one of our better-performing factor indices has been the S&P 500® Low Volatility Index. Through March 18, 2022, Low Vol had declined 4.7%, versus a 6.1% decline for the S&P 500. This incremental value, however, did not accrue smoothly. Low Vol outperformed in only six of the year’s first 11 weeks; in mid-February, in fact, its year-to-date performance lagged that of the S&P 500 by more than 100 basis points.

At some level, this is a silly comparison; no sensible analyst would worry about performance over a period as short as a week. But to say that a week is not an appropriate observational period does not tell us what an appropriate period is.

We reconstitute Low Volatility and other factor indices periodically; for Low Volatility, these changes take place quarterly in February, May, August, and November. Over the course of a year, therefore, Low Volatility holds four distinct baskets of stocks, and the holding period of each basket does not correspond to a neat unit of calendar time. When we look at February’s performance, for example, we’re looking at the performance of two different baskets, since a rebalancing transaction took place on Feb. 18, 2022.

Rather than using calendar units, therefore, a logical alternative is to make our observational period coincide with the index’s rebalancing schedule. We can ask not how Low Vol performed over a month or a quarter, but how each individual basket of low volatility stocks performed during its time in the index.

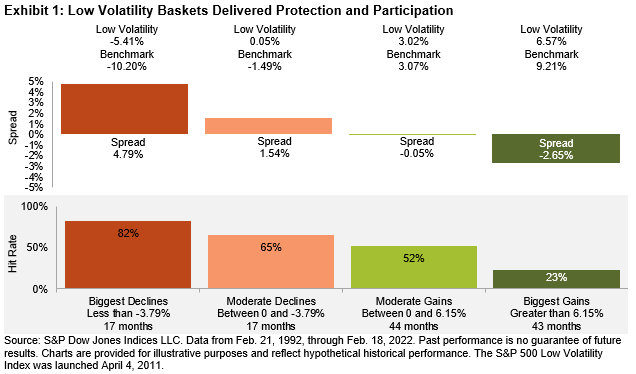

Low volatility strategies aim to dampen the returns of the parent index from which they are derived—to offer protection when the parent index declines and to participate (although regrettably not fully) when the parent index rises. If we examine months when the S&P 500 declines, Low Vol typically outperforms, and vice versa when the market rises. We’ve observed this result in low volatility strategies globally, and they confirm what our initial backtests of the low vol concept led us to expect.

We see the identical pattern when we observe distinct low volatility baskets rather than calendar months. The upper graph in Exhibit 1 shows that, for baskets held during periods when the S&P 500 declined significantly, Low Vol outperformed by an average of 4.79%; the lower graph shows that 82% of those baskets outperformed. As market performance improved, the relative performance of Low Volatility declined.

All observational periods are arbitrary, but some are more arbitrary than others. Using basket holding periods is arguably the least arbitrary option available. Its results support our understanding of the low volatility factor.

The posts on this blog are opinions, not advice. Please read our Disclaimers.