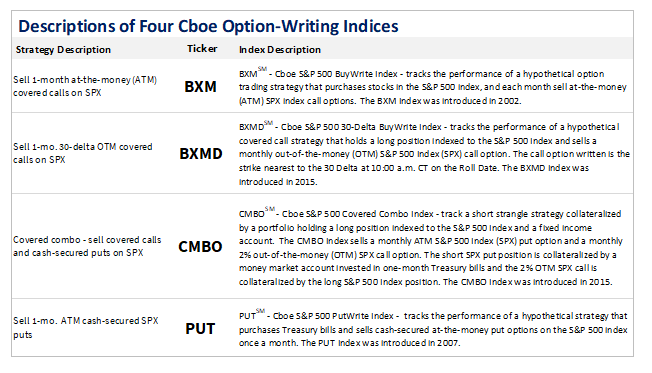

Four Option Benchmark Indices

In order to assess how hypothetical options strategies performed in various market regimes over the past 35 years, investors use some or all of these four key benchmark indices that sell S&P 500 options as part of the their index methodology and that have histories going back to June 30, 1986. As shown in the table below, the four options indices were announced in either 2002, 2007 or 2015, and the data histories before the announcements are backtested.

Use of S&P 500 Cash-Settled Options

All four of the above benchmark indices incorporate a methodology pursuant to which the indices “sell” S&P 500 options. In the past quarter (1) the average daily volume in notional terms for the large-sized S&P 500 (SPX® and SPXW) cash-settled index options topped $500 billion, and (2) the average daily open interest was 14.4 million contacts for the S&P 500 (SPX and SPXW) options, and 400,511 for the Mini-SPX (XSPSM) cash-settled index options.

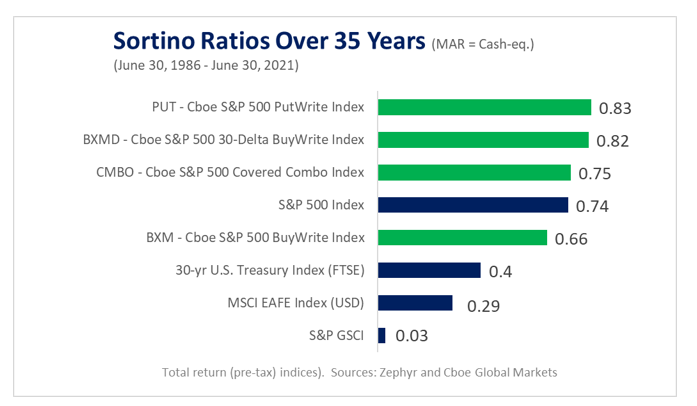

Risk-Adjusted Returns

When looking at back-tested data for the past 35 years, three of the “option-writing” indices – PUT, BXMD, and CMBO – reflected higher risk-adjusted returns (as measured by the Sortino Ratio) than the other six indices in the table below. For discussions of option-writing indices, and the Sortino Ratio and other measures of risk-adjusted returns, please see the white papers by Wilshire, Callan, and Ibbotson Associates. The papers also have discussions of the volatility risk premium that may facilitate long-term risk-adjusted returns by index option-writing strategies.

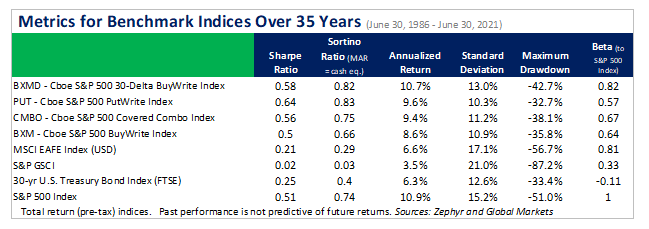

Table with Metrics for “Option-Writing” Indices

Key highlights in the table below with the back-tested 35-year performance of four Cboe option-writing indices and four other indices:

- Lower Standard Deviations: All 4 Cboe S&P indices had lower standard deviations than the stock and commodity indices.

- Less Severe Maximum Drawdowns: All 4 Cboe S&P indices had less severe maximum drawdowns than the stock and commodity indices.

- Risk–Adjusted Returns: Three of the Cboe S&P indices (BXMD, PUT, and CMBO) had higher risk-adjusted returns (as measured by the Sharpe and Sortino Ratios) than the other 5 indices.

- Annualized Returns: The annualized returns of the 4 Cboe S&P indices were higher than those of the MSCI EAFE Index (USD), the 30-Year US Treasury Bond Index (FTSE), and S&P GSCI (for commodities), but less than that of the S&P 500 Index.

- Lower Betas: The four Cboe S&P indices had betas to the S&P 500 that ranged from 0.57 to 0.82, indicating that they may be examined for potential to help diversify certain portfolios.

To Learn More

- Please register for Webinar on 35 Years of Options Index Performance on July 28, 2021, featuring four speakers, including Gaurav Sinha, Managing Director, Head of Americas, Global Research & Design, at S&P Dow Jones Indices (S&P DJI)

++++++++++++++++++++

Disclaimer

Options involve risk and are not suitable for all investors. Prior to buying or selling an option, a person must receive a copy of Characteristics and Risks of Standardized Options. Copies are available from your broker or from The Options Clearing Corporation, One North Wacker Drive, Suite 500, Chicago, Illinois 60606 or at www.theocc.com. The BXMSM, BXMDSM, PUTSM, CMBOSM, and PPUTSM indexes (the “Indexes”) are designed to represent proposed hypothetical options strategies. The actual performance of investment vehicles such as mutual funds or managed accounts can have significant differences from the performance of the Indexes. Investors attempting to replicate the Indexes should discuss with their advisors possible timing and liquidity issues. Like many passive benchmarks, the Indexes do not take into account significant factors such as transaction costs and taxes. The four Cboe S&P indexes in this blog were announced in either 2002, 2007, or 2015. information presented prior to the announcement dates is back-tested. Back-tested performance is not actual performance, but is hypothetical. A limitation of back-tested information is that it reflects the application of the Index methodology in hindsight. No theoretical approach can completely account for the impact of decisions that might have been made during the actual operation of an index. Cboe Global Indices, LLC calculates and disseminates the Indexes pursuant to an agreement with S&P Dow Jones Indices LLC (“S&P DJI”). BXMSM, PUTSM, CMBOSM and BXMDSM are service marks of Cboe Exchange, Inc. or its affiliates. S&P®, S&P 500® and SPX® are registered trademarks of Standard & Poor’s Financial Services, LLC (“S&P”) and have been licensed for use S&P DJI and sublicensed by Cboe Exchange, Inc. The S&P 500 and S&P GSCI are products of S&P DJI. Any products (including options) that have the S&P Index or Indexes as their underlying interest are not sponsored, endorsed, sold or promoted by S&P DJI or S&P and neither S&P DJI nor S&P makes any representations or recommendations concerning the advisability of investing in products that have S&P indexes as their underlying interests.

The posts on this blog are opinions, not advice. Please read our Disclaimers.