Canadian investors have long participated in U.S. equity markets, but are materially underweight in U.S. mid- and small-cap companies.

In this respect, Canadians resemble their European counterparts, whose investments in the U.S. rarely range beyond those companies included in the S&P 500®. This underinvestment is surprising for several reasons. European market participants are no stranger to U.S. equities, nor the case for global diversification, and small- and mid-cap U.S. stocks compose, in aggregate, a significant segment within the global equity opportunity set. Last but not least, S&P DJI’s U.S. small- and mid-cap indices—the S&P SmallCap 600® and the S&P MidCap 400®—have outperformed the more internationally-famous S&P 500 since their launch in the 1990s; typically no deterrent to fund flows. Canadians show a similar, if somewhat less extreme, hesitancy in venturing beyond blue chips.

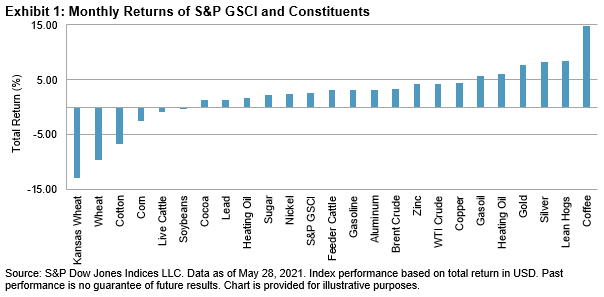

Exhibit 1 illustrates the estimated relative weights of various geographic and U.S. size segments in the global equity market and Canadian fund market. The left-hand chart shows weights in the S&P Global BMI, a broad-based gauge of developed and emerging equities. On the right, we combined assets under management in Canadian equity funds to estimate aggregate allocations to the same segments.

Like their counterparts across the Atlantic (and other oceans), Canadian investors demonstrate a “home bias”. Notwithstanding this common and, some argue, quite rational feature of international portfolios, Exhibit 1 illustrates that Canadians are quite comfortable investing in their neighbor’s exchanges, with an aggregate allocation to U.S. large caps of 37%, versus a market weight of 39%.

However, in aggregate, the small- and mid-cap segments only received an aggregate allocation of 5%, less than one-third of the global weight of 17%. Mid caps were most underweighted in absolute terms, with a 7% difference between Canadian and market weights, but smaller companies were the more underweighted in relative terms, with a 1% allocation to U.S. small caps versus a 6% global weight.

One factor that could explain the historical lack of international participation in U.S. mid- and small-cap segments is that investors’ performance may not have been as good as that of S&P DJI’s benchmarks. Smaller stocks are more expensive to trade, and the in-category record of active managers has been relatively poor over the past decades. However, an alternative is now available. With index funds for U.S. mid- and small-cap segments developing track records across global markets, including in Canada, a broader range of market participants may feel comfortable accessing this previously overlooked source of returns.

If you’d like to dig deeper into the topic, I’ll be presenting this research along with some related thoughts at an upcoming S&P DJI webinar for Canadian professional investors. Experts from the fund management and advisor industries will also be there to discuss efficient access to U.S. equity markets beyond the blue-chip names, and whether the forward returns of smaller stocks might be expected to help diversify or damage Canadian investor portfolios. The sign-up link is here.

Note: Thanks and credit for Exhibit 1 are due to Sherifa Issifu, co-author on the earlier European work.

The posts on this blog are opinions, not advice. Please read our Disclaimers.