How did active managers respond to record volatility and soaring spreads in 2020 as the pandemic brought Europe to a halt? Tim Edwards and Andrew Innes of S&P DJI join Rebecca Chesworth of State Street Global Advisors and Pio Benetti of Kairos Partners SGR to explore the latest results from SPIVA Europe and the active and passive landscape.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Unpacking SPIVA Europe: Did Volatility Provide Opportunity?

When Active Management Looks Easier

Equity: Diversity and Inclusion

Mean Reversion and Momentum

Equal Weight Indexing during Economic Recovery

Unpacking SPIVA Europe: Did Volatility Provide Opportunity?

When Active Management Looks Easier

How can style bias impact the perception of active manager outperformance? S&P DJI’s Craig Lazzara and Anu Ganti discuss how a better understanding of style bias can help market participants interpret active manager performance and our SPIVA results.

Learn more: https://www.spglobal.com/spdji/en/research/article/style-bias-and-active-performance/

The posts on this blog are opinions, not advice. Please read our Disclaimers.Equity: Diversity and Inclusion

We can think of an active equity portfolio as a combination of a benchmark (the S&P 500®, for example) and a set of active bets that measure the portfolio’s deviation from the benchmark. The relative size of the active bets is sometimes called “active share,” and is a convenient way to judge a manager’s aggressiveness. An active share of 0% is associated with an index fund; an active share of 100% implies that the manager has no holdings in common with his benchmark. (It may also imply that we’re using the wrong benchmark for the manager in question, but that’s another story.)

It’s been suggested that high active share is associated with outperformance, although the evidence on the question is far from conclusive. Although high active share may (or may not) be a necessary condition for active success, it cannot be a sufficient condition. Can an underperforming manager improve his results by randomly selling half the names in his portfolio, thus creating more concentration? Doing so will increase active share for sure, but it stretches credulity to think that such a course would automatically improve performance.

In our view, the stronger argument runs the other way: other things equal, more names are better than fewer. This is because stock market returns tend to be positively skewed. Rather than being symmetrically distributed around an average, return distributions typically have a very long right tail; a relatively small number of excellent performers has a disproportionate influence on the market’s overall return.

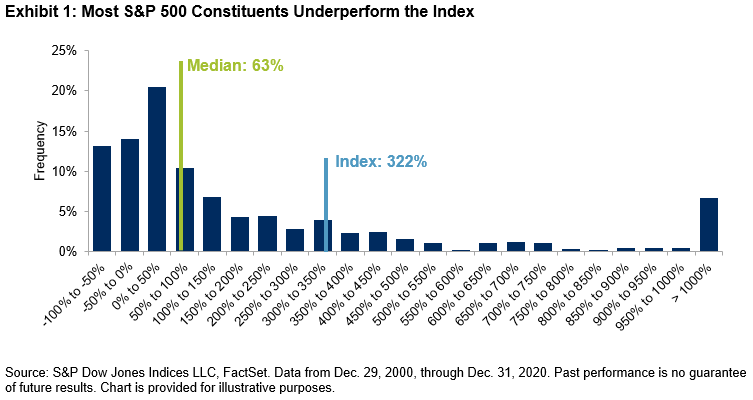

Exhibit 1 illustrates the skewness of the S&P 500 over the last 20 years. The median stock in the index returned 63%, while the index’s return was 322%. Only 22% of the names outperformed the index, which helps explain why active results have been so disappointing. When a randomly chosen stock has roughly one chance in five of beating an index fund, successful stock selection is very difficult. A portfolio manager who opts to concentrate his holdings will need a level of predictive accuracy that most portfolio managers demonstrably do not have.

Instead, the implication of Exhibit 1 is that more diversified portfolios, by including more stocks, stand a better chance of outperformance. Skewed returns mean that an active portfolio’s success depends on whether it is overweight a relatively small number of names. The more names a portfolio holds, the more likely it is to own one of the relatively small number of big winners.

Otherwise said: rather than picking the 50 stocks she likes the best and holding them, an investor benchmarked against the S&P 500 might be better served by eliminating the 50 stocks she likes the least and holding the other 450. True, active share would be lower for the larger portfolio. But the likelihood of owning one of the relatively rare big winners would be nine times as high. When returns are skewed, increasing diversity increases the odds of success.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Mean Reversion and Momentum

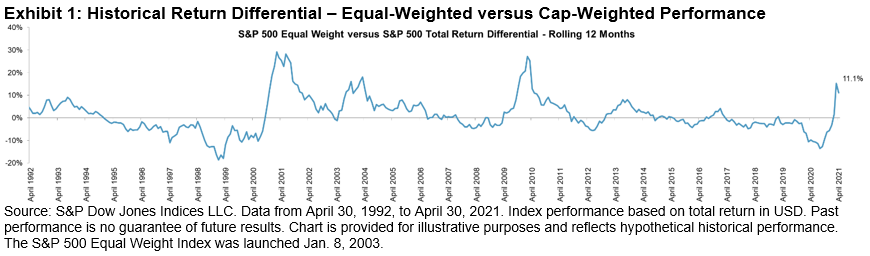

After almost four years of underperformance, we witnessed a change in fortune in February 2021, as the relative performance of the S&P 500® Equal Weight Index turned positive. By the end of April, Equal Weight had outperformed the S&P 500 by 11% over the prior 12 months, as we see in Exhibit 1.

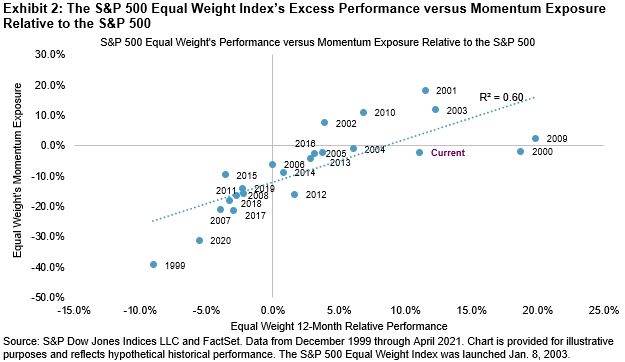

Equal Weight’s recent rebound naturally had an impact on its factor exposures, particularly for the momentum factor. To provide context, in Exhibit 2, we plot the annual relative performance of Equal Weight on the x-axis and Equal Weight’s (risk-adjusted) momentum exposure on the y-axis, including the most recent 12-month period, as of April 30, 2021.

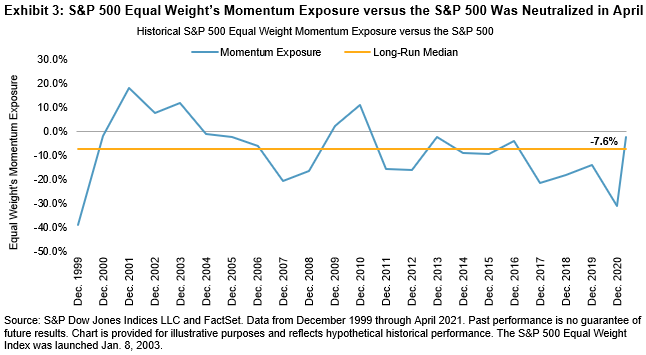

There is a strong positive relationship between relative performance and momentum, with an R2 of 0.60. Unsurprisingly, when Equal Weight is doing well, its momentum score rises. But over time, despite Equal Weight’s outperformance (averaging 2.5% over 22 calendar years), its momentum score is typically negative, at a median of -7.6%. This is a function of the way Equal Weight rebalances—every quarter, it sells its relative outperformers and buys more of its relative underperformers, which has the effect of muting its exposure to the momentum factor.

Interestingly, Equal Weight’s momentum exposure is currently flat. This last occurred at the end of 2016, as Equal Weight’s relative performance turned positive. Equal Weight experienced the strongest positive momentum exposures when its outperformance was at a peak, such as in 2001, 2003, and 2010.

To provide further context, Exhibit 3 shows a time-series of the historical momentum exposures of the S&P 500 Equal Weight Index. What is striking is the speed with which Equal Weight’s tilt against momentum in December 2020 was neutralized by the end of April 2021, paralleling the swiftness of its performance rebound.

The recent comeback of smaller caps and Equal Weight, resulting in a neutral exposure to momentum, indicates a moderately strong relative return environment. It is important to remember that factor exposures are not constant and experience fluctuations as we experience reversals in performance. If Equal Weight’s outperformance continues, we can anticipate a further increase in its exposure to momentum. We can look to history to provide perspective on these changing relationships.

The posts on this blog are opinions, not advice. Please read our Disclaimers.Equal Weight Indexing during Economic Recovery

2020 was a year for the history books – especially from a finance perspective. With COVID-19 ripping throughout the globe, we saw equity markets decline rapidly as several countries closed their borders. At the same time, however, we saw some companies flourish as people spent more time at home. Companies like Apple, Microsoft, and Google1 shined brightly and became larger than ever before. Central banks globally introduced measures that aided this appreciation by reducing rates to record lows, fueling most growth-oriented stocks upward at a rapid pace.

However, over three months into 2021, we are now seeing signs of recovery towards normalcy, with continued supportive measures by many central banks and governments, along with a growing number of people being vaccinated.

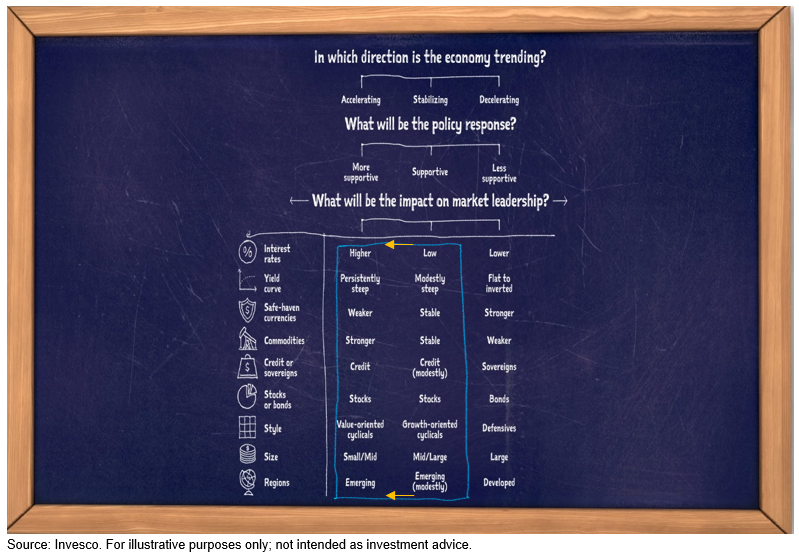

So, what does that look like from a market leadership perspective? As the recovery unfolds and economic activity accelerates, we would expect market leadership to align with that of the left column of the chart below.

We have already seen a steepening yield curve with longer-dated bond rates rising – this could temper the strong run up in growth-oriented stocks. Near the end of last year, the move from growth stocks to more value-oriented cyclical stocks, and the move from large-cap stocks to small/mid-cap stocks started to occur. Many of these stocks, especially names in the S&P 500®, will tend to benefit more from the economy and society reopening.

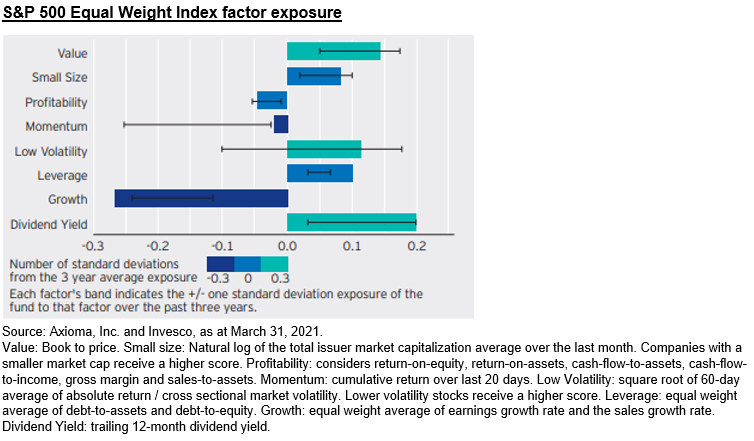

We take a look at the S&P 500® Equal Weight Index with respect to this reopening and potential for economic recovery. By equal-weighting the S&P 500®, one aims to remove the biases to the mega-cap names (like Apple, Microsoft, Google) and allocates more to the rest of the index constituents. This inherently gives more exposure to the smaller names in the S&P 500®, along with increased exposure to value-oriented sectors.

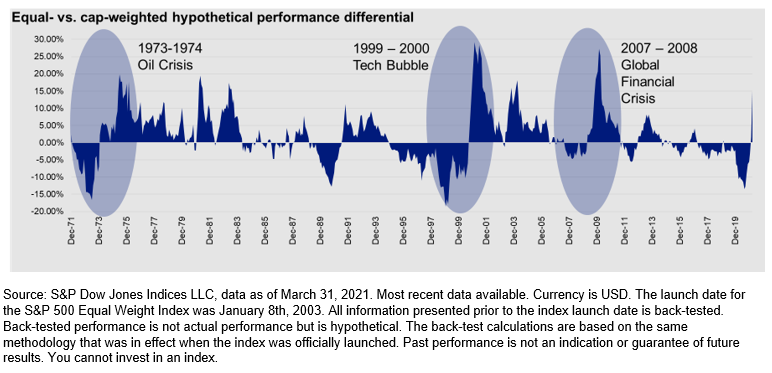

Historically, equal-weight indexing has provided outperformance during periods of recovery, relative to the broader market-cap weighted S&P 500® Index. In significant down periods, like the global financial crisis and tech bubble, the S&P 500® Equal Weight Index saw significant outperformance after the trough.

The chart above shows historical 12-month rolling excess return of the S&P 500® Equal Weight Index and the S&P 500 ® Index. After the significant decline from the tech bubble and global financial crisis, the S&P 500 ® Equal Weight Index showed significant excess return, as cyclical stocks, along with smaller names in the index, outperformed the mega-cap stocks in the index.

1 The above companies were selected for illustrative purposes only and are not intended to convey specific investment advice.

Important Information:

Commissions, management fees and expenses may all be associated with investments in exchange-traded funds (ETFs). Unless otherwise indicated, rates of return for periods greater than one year are historical annual compound total returns including changes in unit value and reinvestment of all distributions, and do not take into account any brokerage commissions or income taxes payable by any unitholder that would have reduced returns. ETFs are not guaranteed, their values change frequently and past performance may not be repeated. There are risks involved with investing in ETFs and mutual funds. Please read the prospectus before investing. Copies are available from Invesco Canada Ltd. at www.invesco.ca.

Limitations on use of hypothetical data: Performance data for the period before the creation date for the relevant index has been reconstructed and is calculated on a basis consistent with each index’s current basis of calculation. An investor cannot invest directly in an index. Performance for an index does not reflect fees and expenses that might be applicable to a fund. The hypothetical performance data for these Indices should not be taken as indicating that if the Index had, in fact, existed during the shown time periods, that this index would have achieved the hypothetical results shown. Actual results might have differed from the shown results.

The views expressed on this document are based on current market conditions and are subject to change without notice; they are not intended to convey specific investment advice. Forward-looking statements are not guarantees of future results. They involve risks, uncertainties and assumptions, there can no assurance that actual results will not differ materially from expectations. Diversification does not guarantee a profit or eliminate the risk of loss. Investments cannot be made directly in an index.

There are risks involved with investing in ETFs. Please read the prospectus for a complete description of risks relevant to the ETF. Ordinary brokerage commissions apply to purchases and sales of ETF units.

Most Invesco ETFs seek to replicate, before fees and expenses, the performance of the applicable index, and are not actively managed. This means that the sub-advisor will not attempt to take defensive positions in declining markets and the ETF will continue to provide exposure to each of the securities in the index regardless of whether the financial condition of one or more issuers of securities in the index deteriorates. In contrast, if an Invesco ETF is actively managed, then the sub-advisor has discretion to adjust that Invesco ETF’s holdings in accordance with the ETF’s investment objectives and strategies.

The S&P 500® Equal Weight Index (in this section referred to as the “Index”) is designed to track the equally weighted performance of the 500 companies in the S&P 500®. The S&P 500® is a capitalization-weighted index that is used as a benchmark of the large cap U.S. equity market. The Index has the same constituents as the S&P 500®; however, the S&P 500®’s constituents are weighted by market capitalization, while each company is allocated a fixed weight of 0.20% at each quarterly rebalancing of the Index. The Index is rebalanced quarterly to coincide with the quarterly rebalancings of the S&P 500®. The Index is rebalanced quarterly and weighted so that each company in the Index is assigned an equal weight of 0.20%.

S&P®, S&P 500® and S&P 500® Equal Weight Index are registered trademarks of Standard & Poor’s Financial Services LLC and have been licensed for use by S&P Dow Jones Indices LLC. The S&P Equal Weight Index is a product of S&P Dow Jones Indices LLC and has been licensed for use by Invesco Canada Ltd. This Invesco ETF is not sponsored, endorsed, sold or promoted by S&P Dow Jones Indices LLC, and S&P Dow Jones Indices LLC makes no representation regarding the advisability of investing in such a product.

Invesco® and all associated trademarks are trademarks of Invesco Holding Company Limited, used under license.

Invesco Canada Ltd., 2021

NA3631

Published date April 23, 2021

The posts on this blog are opinions, not advice. Please read our Disclaimers.