In April 2020, we launched the S&P PACTTM Indices (S&P Paris-Aligned & Climate Transition Indices). The indices aim to align with the following: a 1.5oC climate scenario, the relevant aspects of the EU Low Carbon Benchmark regulation (BMR), and recommendations from the Task Force on Climate-related Financial Disclosures (TCFD), while maintaining a broad, diversified exposure. The S&P PACT Indices consist of the S&P Paris-Aligned (PA) Climate Indices and S&P Climate Transition (CT) Indices.

In this blog, we try to answer a simple question: what drives the S&P PACT Indices’ weights?

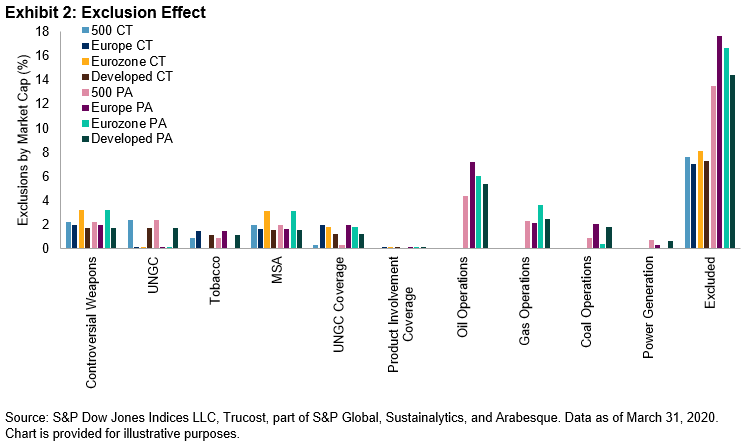

First, companies are excluded (exclusion effect) due to business activities, public controversies,1 and a low alignment score with the principals of the UN Global Compact—these companies receive zero weight.

Second, companies that remain are reweighted (reweighting effect) to achieve climate-related objectives.2 Companies that perform well from a climate perspective receive an overweight, while those that perform poorly receive an underweight or zero weight, as shown in Exhibit 1.

The S&P CT Indices (i.e., the indices that align with the EU’s minimum standards for EU Climate Transition Benchmarks) have fewer exclusions than their PA counterparts (i.e., the indices that align with the EU’s minimum standards for EU Paris-Aligned Benchmarks), with fossil fuel-based exclusions being the difference. Oil operations are particularly impactful in excluding companies. The additional exclusions are evident in the excluded columns in Exhibit 2, where the S&P PA Indices show more of their market cap is excluded.

When reweighting eligible companies to meet the climate objectives, we observe (see Exhibit 3) company performance on four climate metrics to have the largest and most significant impact on the change of company weights, across regions:

- S&P DJI Environmental Score;

- 1.5oC alignment via the transition pathway dataset;

- Physical risk score; and

- High climate impact revenues.

So how can companies improve the climate metrics that have the largest influence on their S&P PACT Indices weight? Ineligible companies can reduce undesirable exposures (e.g., public controversies and UNGC misalignment [as measured by the Arabesque GC Score]). Eligible companies can gain increased weight in the S&P PACT Indices by significantly reducing carbon intensity year-on-year (to improve their 1.5oC alignment), disclosing more information regarding environmental policies and metrics (to improve their S&P DJI Environmental Score3), improving performance against environmental policies and metrics (to improve their S&P DJI Environmental Score), divesting assets in locations highly exposed to physical risks and reduce assets’ physical risk sensitivity factors (to improve their physical risk score).

For further detail, please see our paper on S&P PACT Indices weight attribution.

1 Public controversies are judged by the SAM, part of S&P Global, Media Stakeholder Analysis (MSA), which monitors ongoing controversies from companies.

2 Climate-related objectives include the 7% year-on-year decarbonization, carbon intensity reduction, 1.5oC alignment using the Trucost, part of S&P Global, transition pathway dataset, S&P DJI Environmental Score improvement, green-to-brown share control/improvement, physical risk mitigation, high climate impact revenue constraint, carbon disclosure overweight cap, Science-Based Target overweight, and fossil fuel reserve exposure control/reduction.

3 The environmental score is the environmental pillar from the S&P DJI ESG Scores.

The posts on this blog are opinions, not advice. Please read our Disclaimers.