When international stock returns lag, investors may feel tempted to double down on their home market. Historical data suggests the long-term benefits of diversifying globally.

With US stocks outperforming non-US stocks in recent years, some investors have again turned their attention toward the role that global diversification plays in their portfolios. In the five-year period ending March 31, 2020, the S&P 500 Index had an annualized return of 6.73%, while the S&P Developed Ex-US BMI (broad market index) lost 0.05% and the S&P Emerging BMI added 0.07%.

While there may be reasons why US-based investors would prefer a degree of home bias in their equity allocation, using return differences over a relatively short period as the sole input into this decision may result in missing opportunities that the global markets offer. It is important to remember that:

1) Non-US stocks help provide valuable diversification benefits.

2) Recent performance is not a reliable indicator of future returns.

There’s a World of Opportunity in Equities

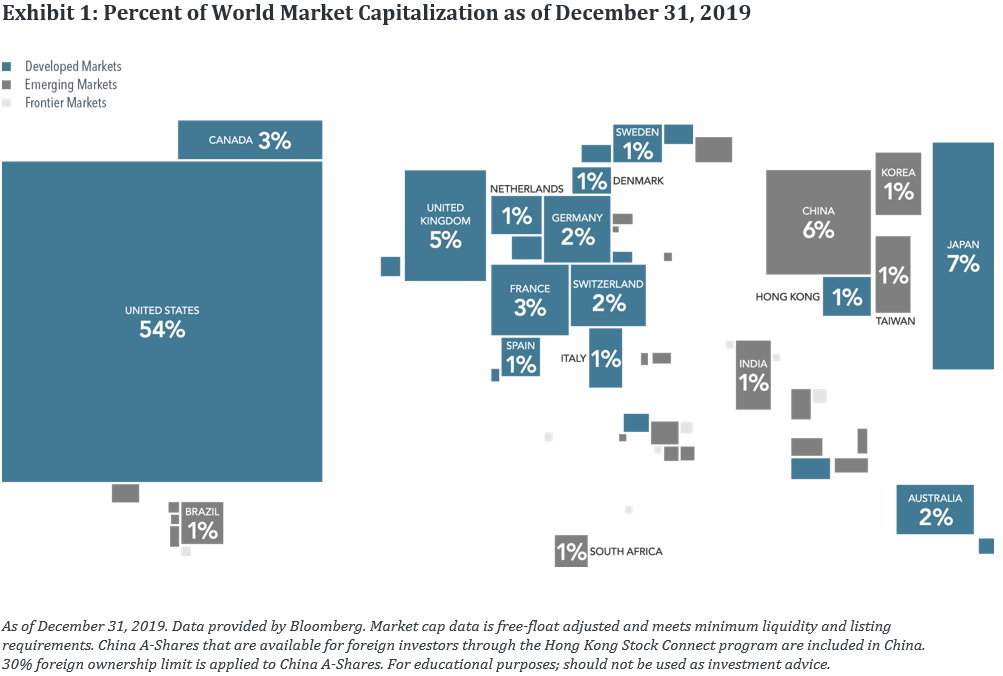

The global equity market is large and represents a world of investment opportunities. As shown in Exhibit 1, nearly half of the investment opportunities in global equity markets lie outside the US. Non-US stocks, including developed and emerging markets, account for 46% of world market capitalization1 and represent thousands of companies in countries all over the world. A portfolio investing solely within the US would not capture the performance of those markets.

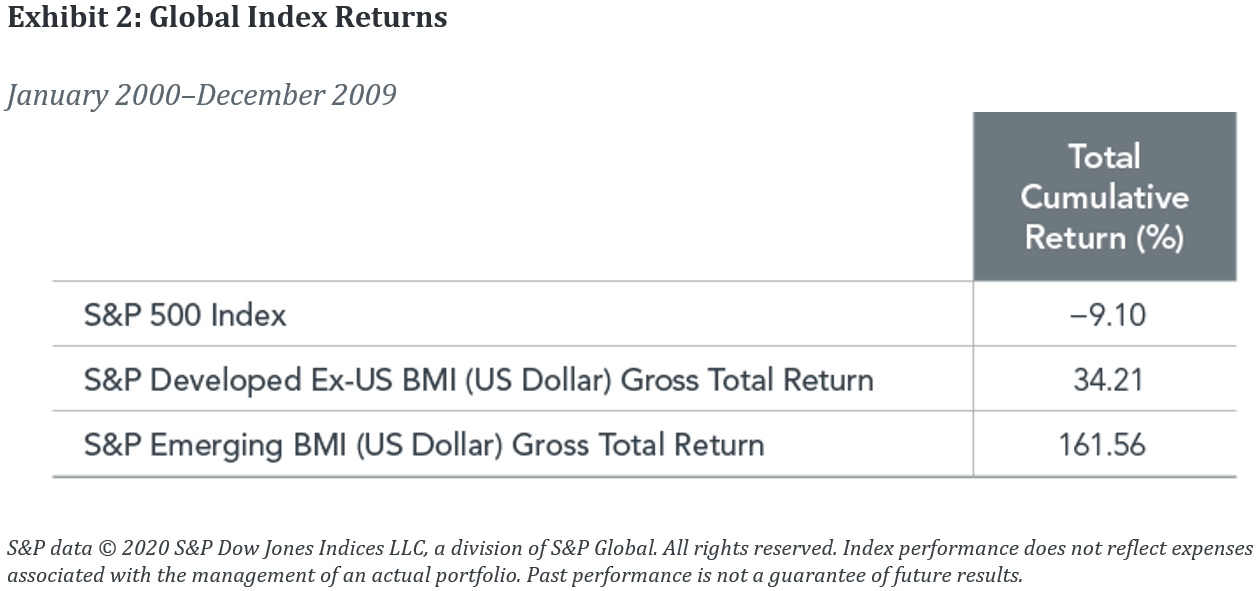

The Lost Decade

Recent history provides us with a valuable lesson on the importance of diversifying globally. The period from January 2000 to December 2009 is often called the “lost decade” by US investors, as the S&P 500 Index recorded one of its worst 10-year performances with a total cumulative return of –9.1%. However, looking beyond US equities, conditions were more favorable for global equity investors as major indexes outside the US generated positive returns over the course of the decade (see Exhibit 2.)

Pick a Country?

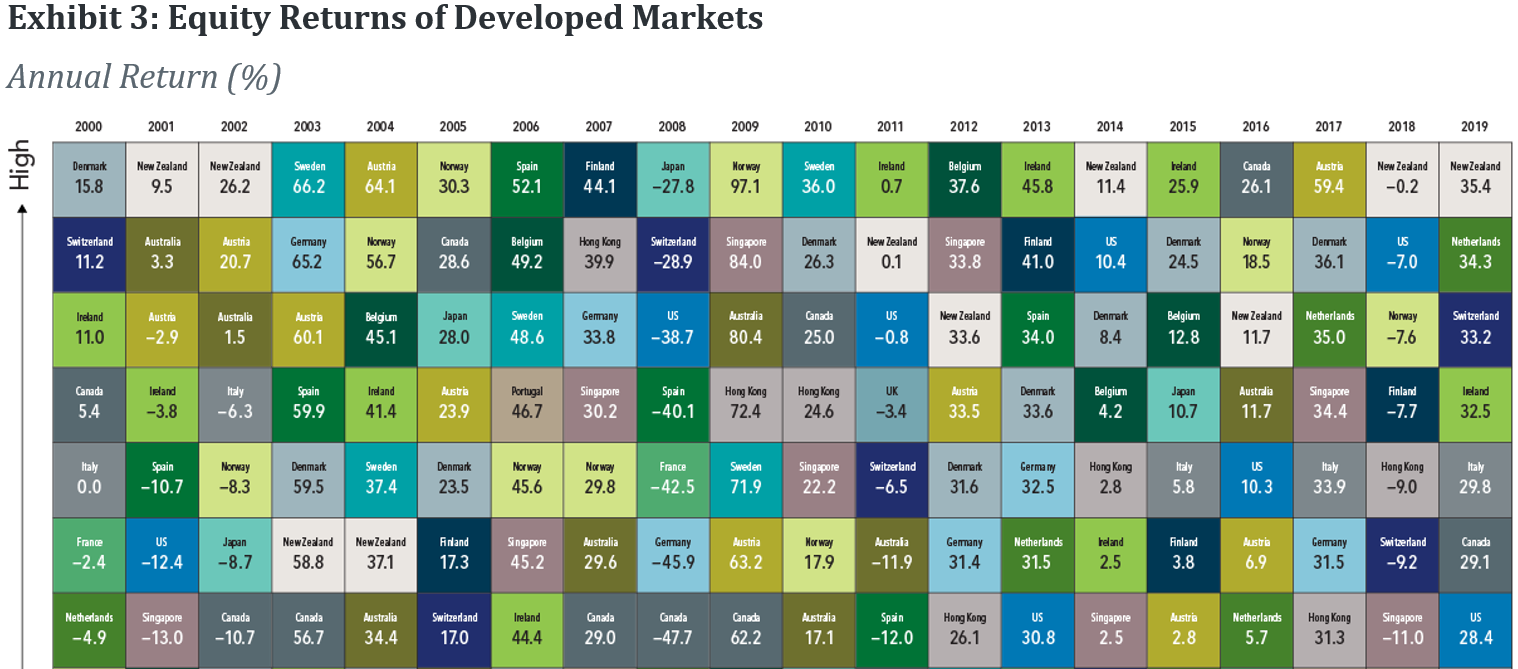

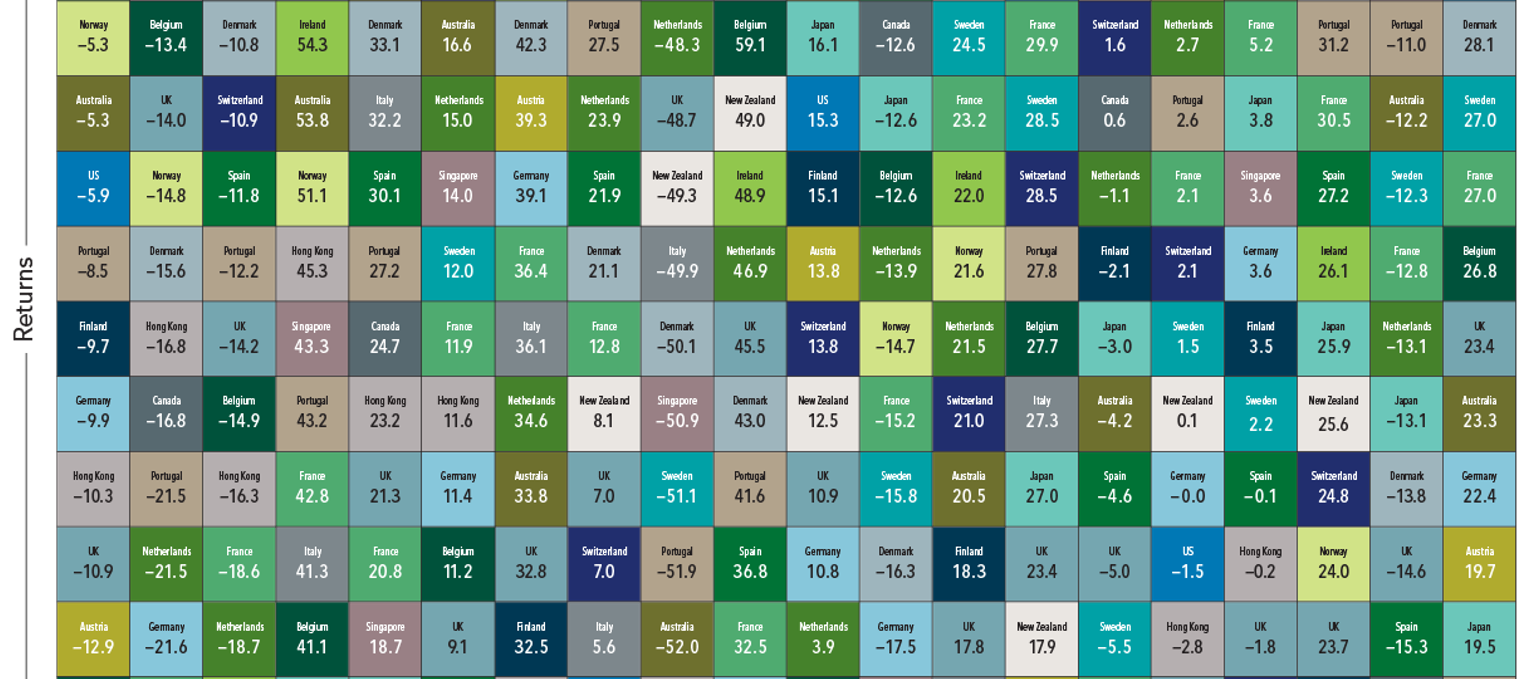

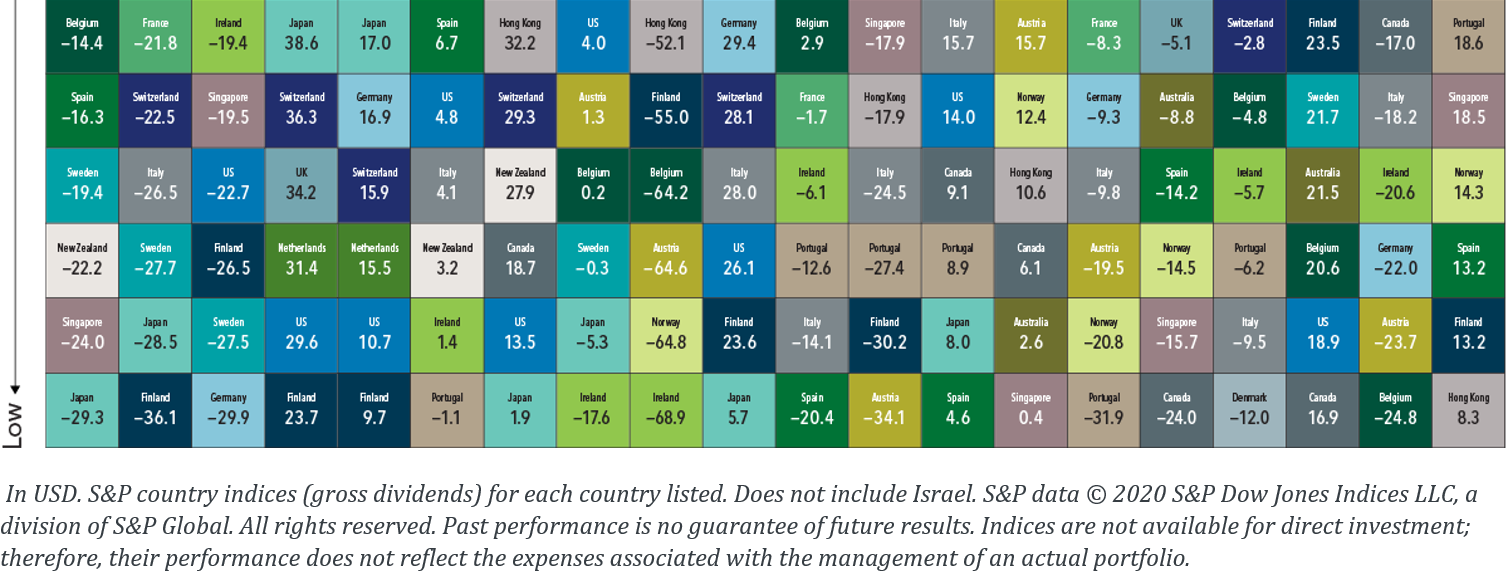

It only takes a cursory glance at the randomness of country stock market performance to understand the futility of using past performance as an input to asset allocation decisions. Exhibit 3 illustrates country equity market rankings (from highest to lowest) for 22 different developed market countries over the past 20 years. Notably, US stocks never once placed at the top over this period and finished in the bottom half in 10 of the 20 years.

In addition, concentrating a portfolio in any one country can expose investors to large variations in returns. The difference between the best- and worst‑performing countries can be stark. For example, since 2000, the average return of the best‑performing developed market country was approximately 33% while the average return of the worst-performing country was approximately –13%. Diversification can spare investors the most extreme outcomes, helping provide more consistent returns.

A Diversified Approach

Over long periods, investors saving for retirement may benefit from consistent exposure in their portfolios to both US and non-US equities. While both asset classes offer the potential to earn positive expected returns in the long run, they may perform quite differently over short periods. While the performance of different countries and asset classes will vary over time, there is no reliable evidence that this performance can be predicted. An approach to equity investing that uses the global opportunity set available to investors can provide diversification benefits as well as potentially higher expected returns.

- The total market value of a company’s outstanding shares, computed as price times shares outstanding.