It comes as no surprise that the COVID-19 pandemic had a profound effect on global markets in the first quarter of 2020. The S&P 500® suffered steep declines, and U.S. Treasury yields fell (prices rose) as investors favored a flight to quality. In commodities, the S&P GSCI ended March down an extraordinary 29.4%, the largest monthly drop in performance in its almost 29-year history.

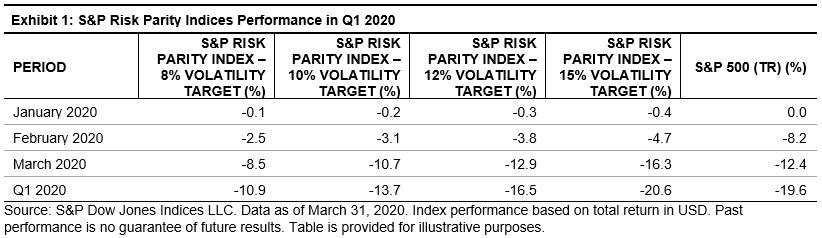

Similarly, the first quarter proved a challenging one for the S&P Risk Parity Indices, with all of the volatility targets posting double-digit losses (see Exhibit 1). This was to be expected given the sudden and dramatic decline in the aforementioned asset classes.

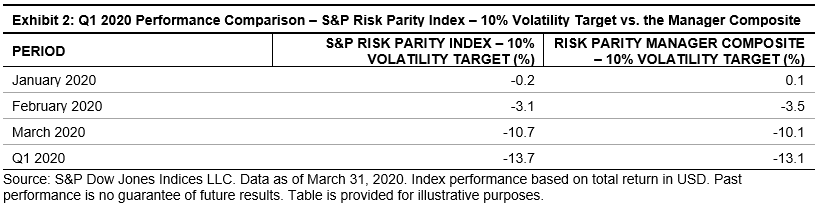

Since their launch in 2018, the S&P Risk Parity Indices have been adopted by several asset owners and asset managers as a benchmark for active risk parity funds. As Exhibit 2 shows, the performance of the S&P Risk Parity Index – 10% Volatility Target was very much in line with the manager composite for the first quarter.

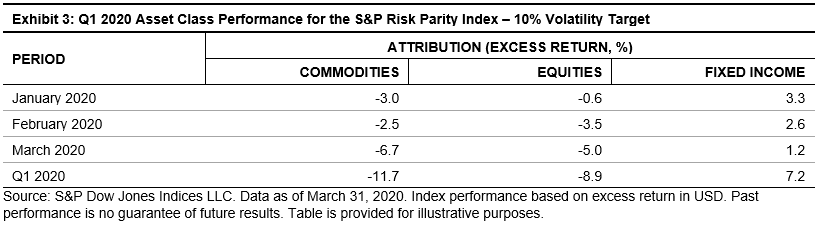

As we continue to analyze the S&P Risk Parity Index – 10% Volatility Target, let’s examine the asset class performance attribution (using excess returns). The S&P Risk Parity Indices comprise three asset class sub-components: equities, fixed income, and commodities.

As Exhibit 3 shows, negative performance for the first quarter was driven by commodities and equities, down 11.7% and 8.9%, respectively. Fixed income finished the quarter up 7.2%, which, despite its comparative weight advantage, was not enough to offset losses in the other two asset classes.

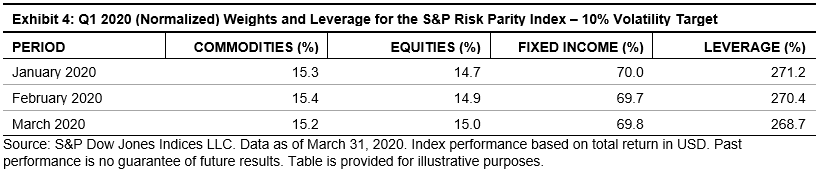

When it comes to weighting assets, risk parity attempts to maximize the diversification benefits by allocating capital such that each asset class contributes an equal amount of volatility to the total volatility of the portfolio. Thus, less-volatile asset classes, like fixed income, are typically assigned a higher weight. Additionally, the index is typically leveraged to meet the stated volatility target to achieve a stable risk profile.

As Exhibit 4 shows, the leverage decreased only slightly in March, but it is anticipated that April will be more pronounced as the impact of March is fully absorbed. That being said, dramatic changes are not expected given the fact that the look-back window on the volatility calculation is fairly long (15 years).

While markets started April on the front foot, we are not out of the woods yet when it comes to uncertainty over the coronavirus. Although the first quarter was a challenging one for the S&P Risk Parity Indices, they still offer the potential to help improve risk-adjusted returns over the long term. By placing each asset class on an equal volatility footing, the diversification benefits have a better chance of shining through compared to traditional fixed allocation approaches.

The posts on this blog are opinions, not advice. Please read our Disclaimers.