It is difficult to accurately express the magnitude of the health, societal, and economic costs of the COVID-19 pandemic. Through the lens of the commodities markets, the economic impact has been swift and severe. The broad-based S&P GSCI ended March down an extraordinary 29.4%, the largest monthly drop in performance in the index’s nearly 29-year history. While it remains valuable to review past performance during times of such extremes, it is also imperative that market participants identify the longer-term trends that may emerge in the wake of this devastating economic shock. In this sense, commodities markets can offer valuable insight into real-time economic impacts and, as such, may be the first to offer confirmation of conditions in the real economy.

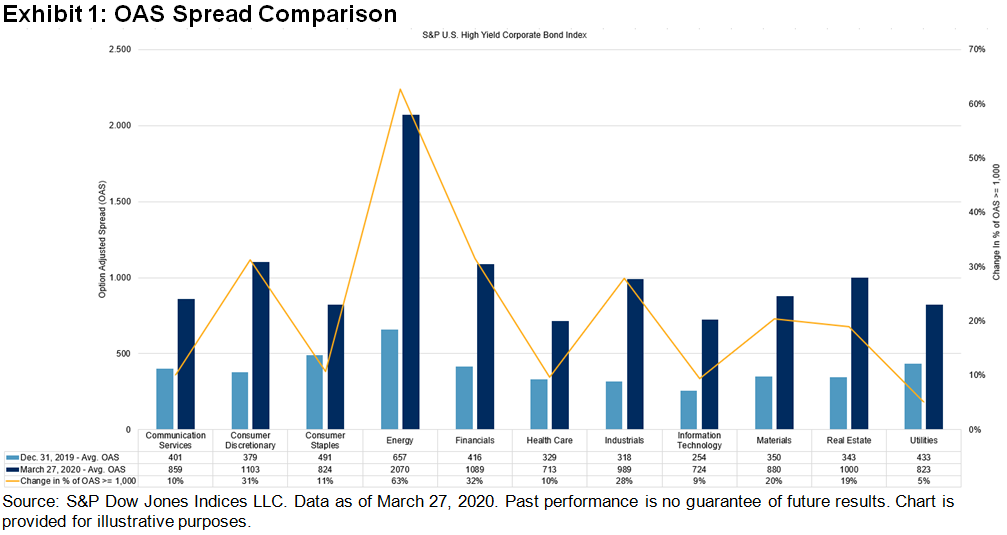

The energy sector was decimated in March, with the S&P GSCI Petroleum down a staggering 49.6%. The market has faced an unprecedented, simultaneous demand and supply shock. The next step for the energy complex is to achieve some level of price stability and for the difficult process of restructuring to commence, but at this point, it is almost impossible to predict how long it will take for the current oil surplus to be eliminated. The only light on the horizon is the fact that at some point, lower energy prices should act as a mechanism to stimulate demand, especially consumer demand in countries such as the U.S.

Metals prices outperformed energy but did not escape the high volatility and general risk-off sentiment across all asset classes in March. Bellwethers for economic growth, metals experienced broad weakness as the cuts to GDP forecasts cascaded through the financial ecosystem. The S&P GSCI Industrial Metals fell 10.2% for the month. However, outside of the traditional industrial metals, one commodity performed admirably. The S&P GSCI Iron Ore continued to outperform, down only 0.2% for the month, benefiting from China restarting some of its manufacturing capacity. The dislocation between individual asset price performance even within the same broad asset class or sector will likely persist as the scale, geographic scope, and impact of the pandemic ebb and flow.

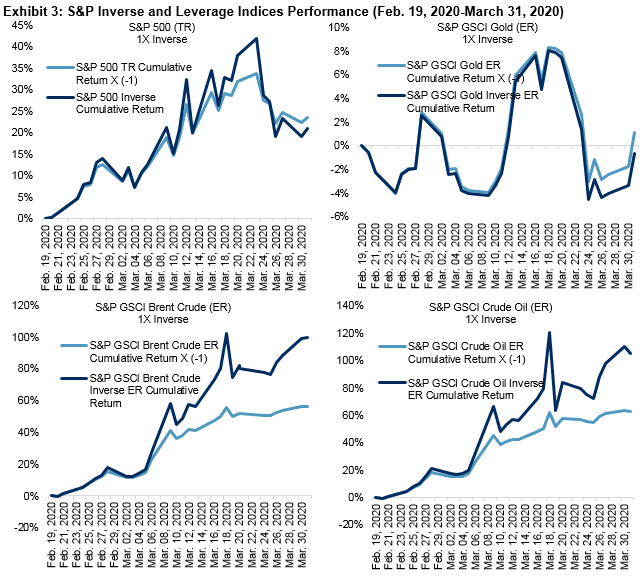

The S&P GSCI Gold continued to outperform in March, highlighting its safe-haven status, but it likely did not outperform to the extent that many market participants would have expected. The level of liquidity in the gold market made it an attractive asset to liquidate in order to access cash during the market turmoil. In addition, gold had already enjoyed a surge in investor interest prior to the current crisis on the back of low to negative interest rates across the globe, geopolitical flare-ups, and a global rush for assets that retain their value. Even when conditions for an asset remain favorable, asset prices do not necessarily react positively.

A variation on the so-called breakfast trade—long wheat, coffee, and orange juice—was the highlight of the agriculture market in March. The S&P GSCI Orange Juice rallied 25.3%, the S&P GSCI Wheat returned 8.4%, and the S&P GSCI Coffee was up 7.4% over the month, as demand for consumer staples surged and top suppliers mulled export restrictions to protect domestic supplies. The longer and more severe the global pandemic, the more likely global food supply chains become stressed and the more likely agricultural commodity prices dislocate from the broader commodity complex.

Finally, it is worth pointing out that, while the focus of market participants since the start of the COVID-19 pandemic has rightly been on the scale and longevity of demand destruction, supply disruptions will increasingly be a factor in price discovery. Companies involved in the production of commodities are undoubtedly cutting production as a function of government-enforced shutdowns and in response to collapsing prices. As levels of economic activity start to pick back up, supply should play an increasingly important role in the price discovery process for commodities.

The posts on this blog are opinions, not advice. Please read our Disclaimers.