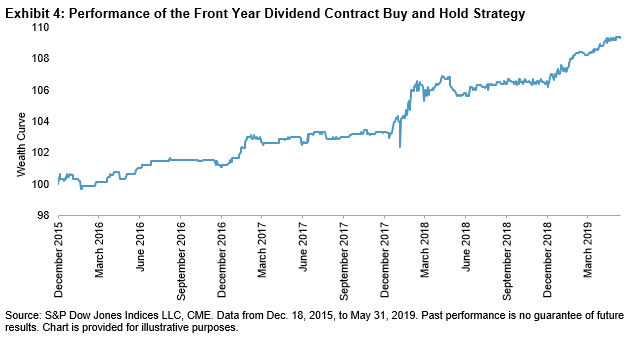

The S&P/ASX 200, widely considered a performance barometer for the Australian equities market, comprises 200 of the most liquid and highest market capitalization stocks listed on the Australian Securities Exchange (ASX). Nevertheless, the performance of this index is not solely influenced by Australian economic activities, but also by global economic conditions, depending on the individual securities’ geographical revenue exposure. As of May 17, 2019, 64% of S&P/ASX 200 members’ revenue was sourced domestically, while 36% of their revenue was exposed to foreign markets such as the U.S., Europe, New Zealand, and China (see Exhibit 1).

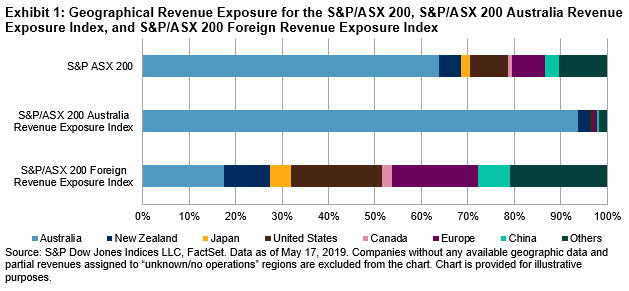

Apart from the Utilities sector, where revenue was not exposed to foreign markets, all other sectors were exposed to foreign markets at varying degrees. The Information Technology sector had the highest foreign revenue exposure (63%), followed by Health Care (56%) and Materials (52%). Foreign revenue exposure in the Health Care and Information Technology sectors was dominated by the U.S. and Europe, while foreign revenue in the Materials sector had the highest market exposures to China and the U.S. In contrast, revenue in the Real Estate and Financials sectors was predominantly domestic, with only 13% and 24% coming from foreign markets, respectively (see Exhibit 2).

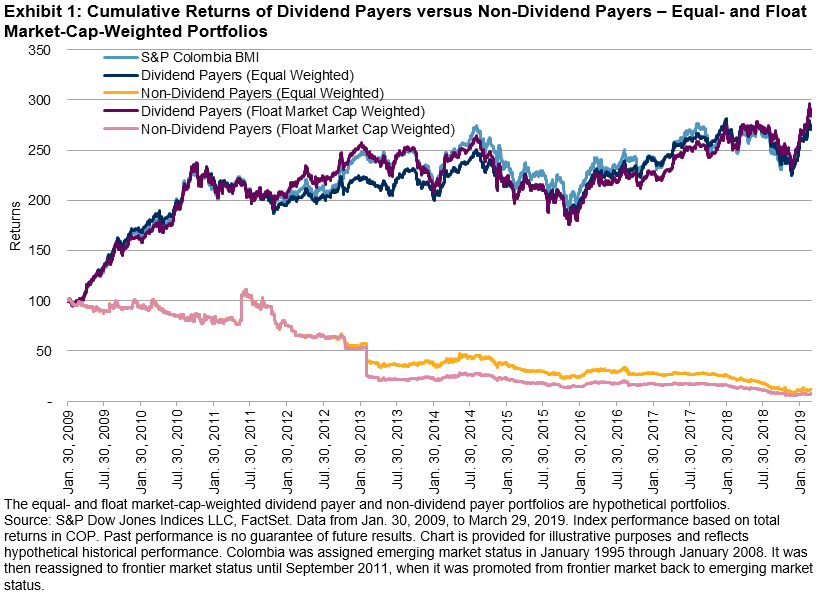

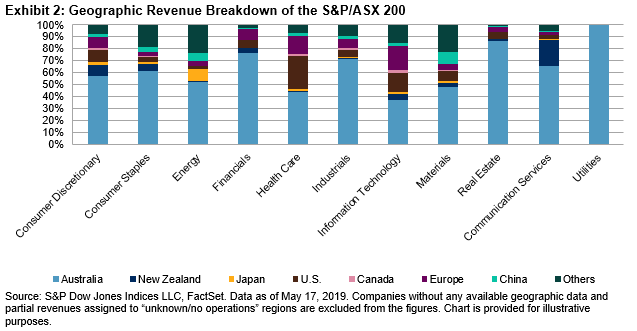

When domestic and international macroeconomic conditions diverge, investors may want to manage the geographical revenue exposure of their portfolios to capture more favorable returns or to lower the risk of macroeconomic shocks. Based on the S&P/ASX 200 Australia Revenue Exposure Index and S&P/ASX 200 Foreign Revenue Exposure Index,[i] which comprise S&P/ASX 200 companies with high domestic and foreign revenue exposures, respectively, we observed that Australian companies with different revenue exposures had short- and long-term performance divergence historically (see Exhibit 3).

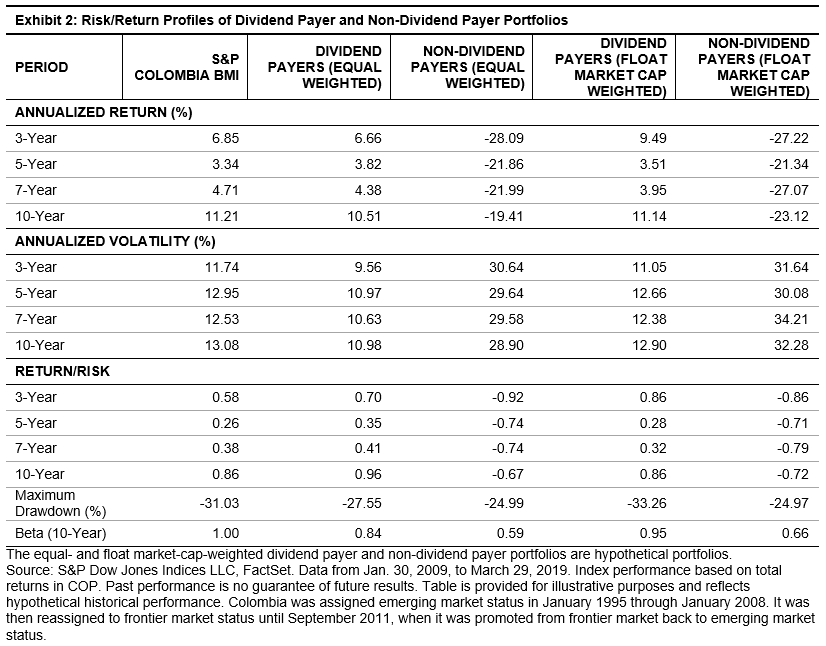

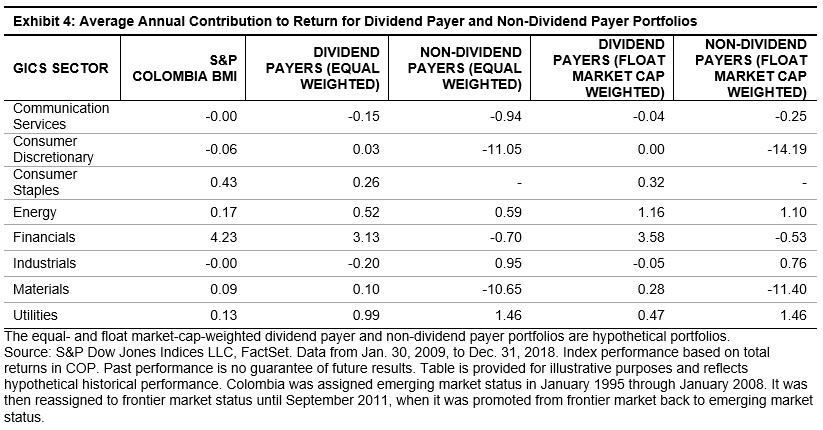

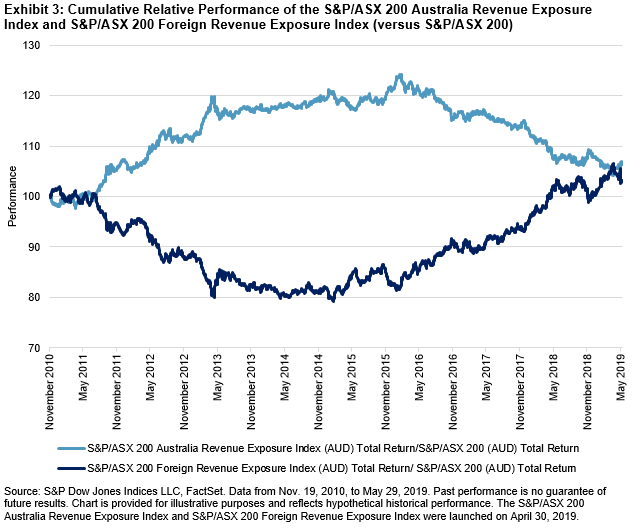

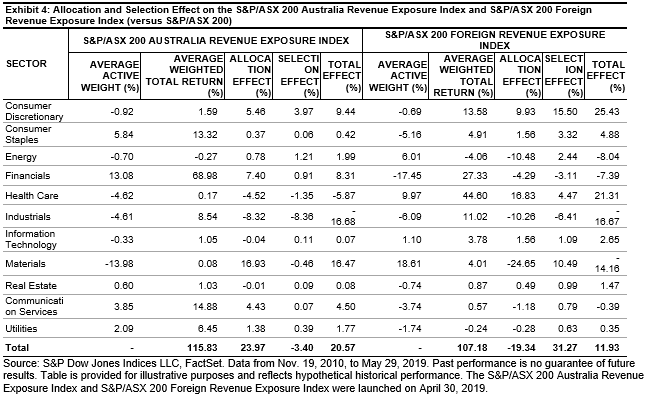

Over the long term, the S&P/ASX 200 Australia Revenue Exposure Index outperformed the S&P/ASX 200 since the index’s inception (November 2010) until January 2016, while the S&P/ASX 200 Foreign Revenue Exposure Index outperformed the S&P/ASX 200 most of the time since February 2016. Based on the return attribution analysis for these two indices relative to the S&P/ASX 200 (see Exhibit 4), the performance differences were not solely explained by sector allocation biases, but also by stock selection within sectors, especially for the S&P/ASX 200 Foreign Revenue Exposure Index.

Compared to the S&P/ASX 200, the S&P/ASX 200 Australia Revenue Exposure Index had the highest active weights in Financials and Consumer Staples and had the largest underweights in Materials, Health Care, and Industrials historically. The total sector allocation bias of the index had a dominating effect on its performance relative to the S&P/ASX 200. The underweight in Materials and overweight in Financials were the major drivers of the index outperformance, while the underweight in Industrials dragged the index returns.

On the other hand, the S&P/ASX 200 Foreign Revenue Exposure Index had the biggest overweight in Materials and Health Care, which had a contrasting impact on the index’s relative return, while the underweight in Financials and Industrials both dragged down the return of the index. Unlike what we observed in the S&P/ASX 200 Australia Revenue Exposure Index, the overall stock selection effect was much more pronounced than the total sector allocation effect in explaining the S&P/ASX 200 Foreign Revenue Exposure Index performance versus the S&P/ASX 200. Stock selections in Consumer Discretionary and Materials were positive contributors to the index’s relative return, indicating that companies with high foreign revenue exposure had performed better than their peers in these two sectors for the overall examined period.

In summary, managing geographical revenue exposures for portfolios resulted in significant performance differences in the Australian equities market and was observed in more than just sector allocation differences. Constructing a portfolio based on quantitative revenue exposure measures is an alternative way for investors to implement their active views on macroeconomic conditions.

[i] The S&P/ASX 200 Australia Revenue Exposure Index is designed to measure the performance of companies within the S&P/ASX 200 universe with higher-than-average revenue exposure to Australia. Similarly, the S&P/ASX 200 Foreign Revenue Exposure Index is designed to measure the performance of companies within the S&P/ASX 200 universe with higher-than-average revenue exposure to countries, excluding Australia. Index constituents are weighted by the product of float-adjusted market capitalization and targeted geographic revenue exposure percentage, subject to the single stock cap of 10%.

The posts on this blog are opinions, not advice. Please read our Disclaimers.