Factor-based investing has gained popularity in the global investment community. While the long-term risk premia of factors have been evidenced in developed equity markets, some believe the inefficiencies in emerging markets could create better opportunities for factor-based investing.

In our recently published paper, “How Smart Beta Strategies Work in the Chinese Market,” we examined the effectiveness of six well-known equity risk factors—size, value, low volatility, momentum, quality, and dividend—in the China A-share market from July 31, 2006, to Nov. 30, 2018. To reflect the latest market changes, we updated the performance of factor quintile portfolios through April 30, 2019, and observed similar performance across different factors. As shown in Exhibit 1, all factors examined generated positive absolute and risk-adjusted return spreads between their top and bottom quintile portfolios in the China A-share market. Among the six factors, low volatility, value, and small cap were the best-performing factors over the period in absolute and risk-adjusted terms.

Passive investing is a common way to implement factor strategies. Factor indices are usually designed with different indexing techniques such as weighting methods, rebalancing buffers, and diversification constraints to calibrate different levels of factor exposure and portfolio investability.[i]

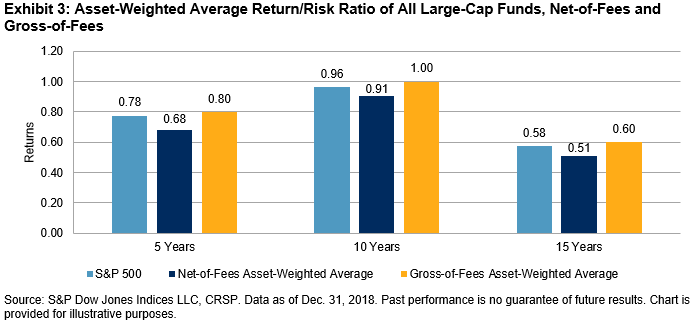

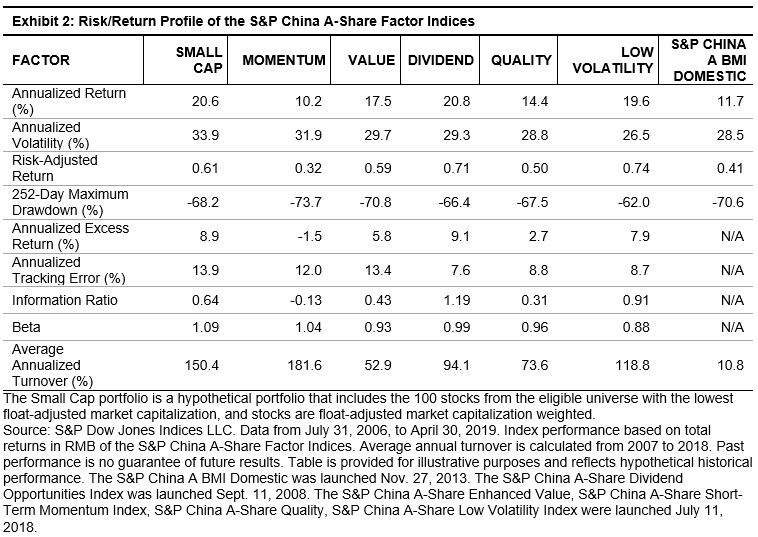

Based on the performance of the S&P China A-Share Factor Indices, all factors except momentum delivered excess returns on an absolute and risk-adjusted basis versus the broad market-cap-weighted benchmark, S&P China A BMI Domestic, (see Exhibit 2). Among various S&P China A-Share Factor Indices, the S&P China A-Share Dividend Opportunities Index and S&P China A-Share Low Volatility Index had the highest risk-adjusted returns and information ratios over the entire examined period. In contrast, the S&P China A-Share Short-Term Momentum Index failed to generate excess returns in the long run.

From a risk perspective, only the S&P China A-Share Low Volatility Index recorded lower volatility and smaller return drawdowns than the S&P China A BMI Domestic, while the S&P China A-Share Short-Term Momentum Index had the most volatile returns.

Although most of the factor indices delivered excess returns in the long run, there were periods of underperformance in the short term. As shown in Exhibit 3, the S&P China A-Share Factor Indices took turns leading and lagging between 2006 and 2019, with return spreads among the best- and worst-performing factors ranging from 12% to 124%. The distinct performance characteristics of factors were seen when we separated factor returns during up and down markets. Momentum and small-cap indices tended to have better performance in up markets, but low volatility, value, quality, and dividend indices performed better in down markets (see Exhibit 4). The distinct cyclicality of factor performance in China could be useful tools for the implementation of active views or exploited by factor-rotation strategies in an attempt to achieve better returns.

[i] All portfolio constituents are drawn from the combined universe of the S&P China A BMI Domestic and S&P China A Venture Enterprises Index, except for the S&P China A-Share Dividend Opportunities Index. To ensure investability, eligible stocks must have a float-adjusted market capitalization no less than RMB 1 billion and a three-month average daily value traded not below RMB 20 million. The S&P China A-Share Enhanced Value Index, S&P China A-Share Short-Term Momentum Index, and S&P China A-Share Quality Index include the 100 stocks with the highest factor scores, and the stocks are weighted by their score-tilted market cap, subject to security and sector constraints. The S&P China A-Share Low Volatility Index includes the 100 stocks with the lowest realized return volatility, and the stocks are weighted by the inverse of volatility. The S&P China A-Share Dividend Opportunities Index includes the 100 stocks from the S&P China A Composite Index with the highest dividend yield, while meeting EPS growth criteria, with all the stocks weighted by their dividend yield. The S&P China A-Share Small Cap portfolio is a hypothetical portfolio that includes 100 stocks with the lowest float-adjust market capitalization, and stocks are weighted by float-adjust market capitalization. All indices were rebalanced semiannually apart from the S&P China A-Share Low Volatility Index, which was rebalanced quarterly.

The posts on this blog are opinions, not advice. Please read our Disclaimers.