The past few months have served as a timely example of why it is beneficial for real estate to stand alone as its own equity sector.

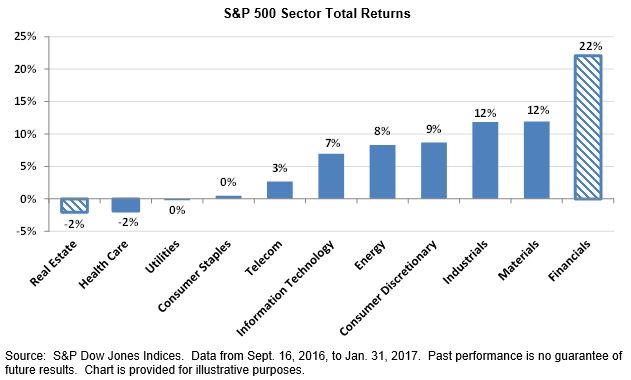

Between Sept. 16, 2016, when real estate was carved out of financials as its own GICS sector, and the end of January 2017, the S&P 500® Financials gained 22%, leading all 11 sectors. Meanwhile, the S&P 500 Real Estate declined 2%—the worst-performing sector (see Exhibit 1).

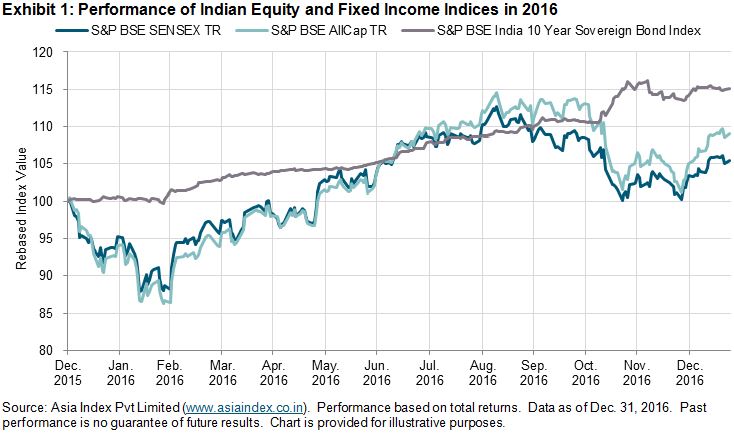

Exhibit 1: Financials Sector Has Vastly Outperformed Real Estate Since the GICS Structure Change

Why has this happened? In short, financials has been buoyed by prospects for higher interest rates and expectations of reduced regulation from the new Trump administration. On the other hand, rising interest rates have weighed on the real estate sector, which had benefited from the low interest rate environment of the past several years. This divergence is not all that surprising given the fundamental differences between real estate and financials businesses and the macroeconomic drivers that affect these industries.

The recent separation of real estate from financials facilitates greater transparency into sector performance trends and allows market participants to have greater precision in asset allocation decisions. The past few months have been a clear sign of why it was time for a change.

The posts on this blog are opinions, not advice. Please read our Disclaimers.