Thursday’s Brexit vote and subsequent market reactions have helped push U.S. bonds higher as investors continue to seek shelter from volatility and the uncertainty of what the future holds for the global economy.

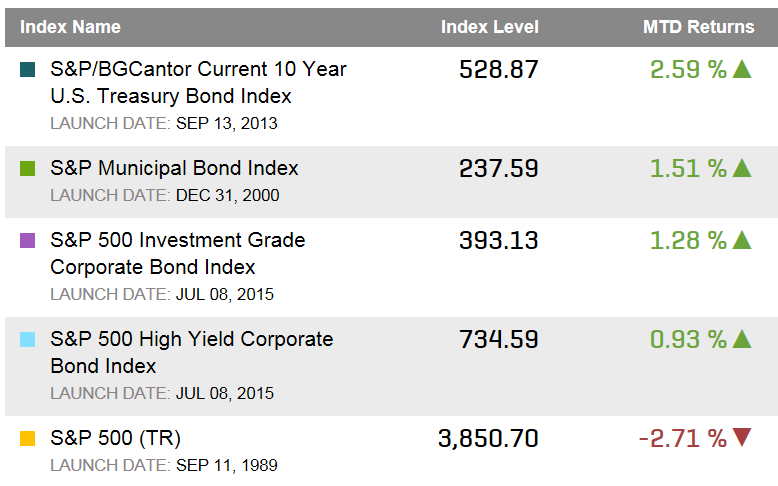

While the S&P 500 Index has seen a decline of over 2.7% in June, the 10 year U.S. Treasury Bond has returned over 2.5% for the month so far as the “risk off” mindset helps push yields lower and bond prices higher.

In the credit markets, U.S. municipal bonds tracked in the S&P Municipal Bond Index have returned over 1.5% in June as the diversity, yield, historical stability and quality of the municipal bond market has made it a “risk off” destination asset class. The corporate bonds of the companies in the S&P 500 have also seen positive returns with the S&P 500 Investment Grade Corporate Bond Index returning over 1.25% for June so far.

Table 1: Select indices and their returns through June 24, 2016:

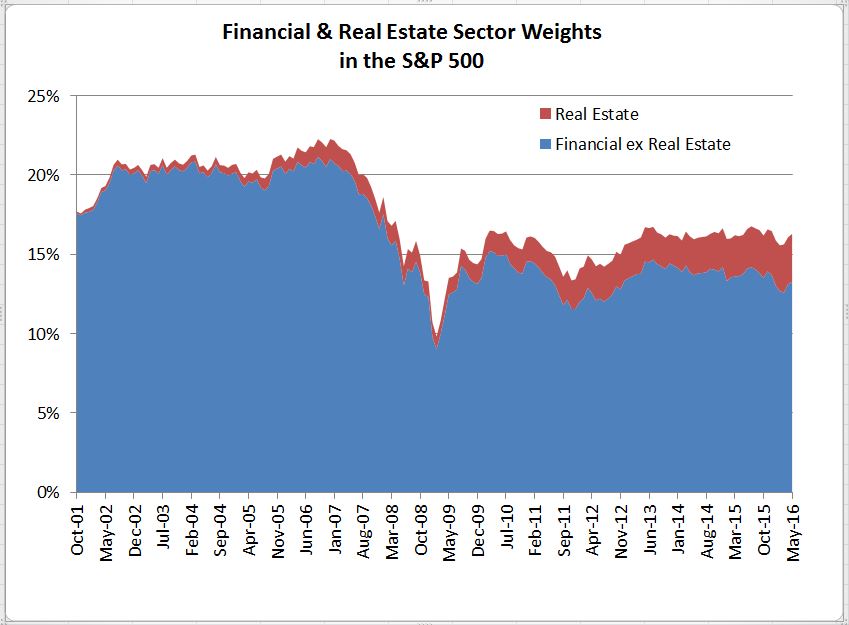

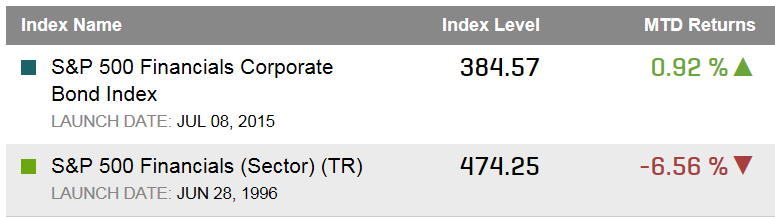

As a result of the Brexit vote, the financial sector to a beating. However, the bonds of the financial companies in the U.S. have stayed in positive territory with the S&P 500 Financials Corporate Bond Index returning just under 1% through June while the equity market sector tracked in the S&P 500 Financials (TR) has seen extreme volatility to the down side of more than 6.5%.

Table 2: Select financial sector indices and their returns through June 24, 2016:

The posts on this blog are opinions, not advice. Please read our Disclaimers.