- The May 2016 IIF Portfolio Allocation Trends report confirms the generally defensive tone among market participants, with investors balancing between higher quality and higher yield.

- The S&P 500 Corporate Bond Index is the corporate bond counterpart to the market bellwether, the S&P 500 equity index.

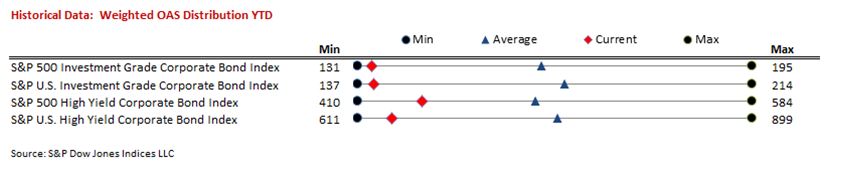

- With an average option-adjusted spread (OAS) of approximately 425 bps, the S&P 500 High Yield Corporate Bond Index presents a unique credit alternative, bridging the gap between investment grade (approximately 150 bps) and traditional high yield (approximately 650 bps).

Directional Uncertainty Driving Decisions

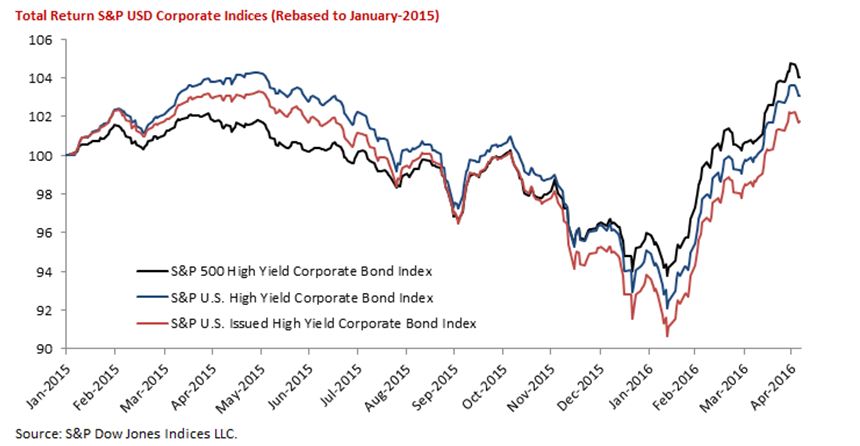

Portfolio flow data reveals that market participants have generally been favoring fixed income over equity, favoring emerging markets over developed markets, and favoring emerging market high grade over emerging market high yield. Since the strong rally starting in mid-February 2016, appetite for risky assets appears to have increased, but market participants have been differentiating more on quality. This demand pattern may be a reflection of a defensive tone of market participants who want exposure to higher yields but lack conviction in directionality of the market in the coming months.

One way for market participants to express this is to incorporate exposure to the S&P 500 High Yield Corporate Bond Index which can enhance yields with quality in mind.

The S&P 500 Corporate Bond Index is designed to measure the performance of the debt issued by the companies that constitute the S&P 500. The index tracks both investment-grade and high-yield issuers. Generally speaking, the constituents are of higher quality than those of traditional corporate indices such as the S&P U.S. Investment Grade Corporate Bond Index and the S&P U.S. High Yield Corporate Bond Index.

The S&P 500 High Yield Corporate Bond Index presents a unique credit alternative to bridge the gap between existing investment grade, which offers spread levels of around 150 bps, and high-yield corporate credit, which offers north of 600 bps in spread. Returns on the S&P 500 High Yield Corporate Bond Index have a high correlation to the S&P U.S. High Yield Corporate Bond Index as well as other peer indices while the constituents of the index have had a lower instance of default historically.

Recent Performance

The weighted average of OAS of the S&P 500 High Yield Corporate Bond Index is 438 bps, which sits roughly halfway between traditional investment-grade indices, with OAS of 134 bps, and the traditional, broad high-yield corporate index, with OAS of 636 bps. Since the peak levels seen on Feb. 11, 2016, U.S. dollar credit spreads have tightened dramatically, with the high yield indices registering returns of over 10% since.