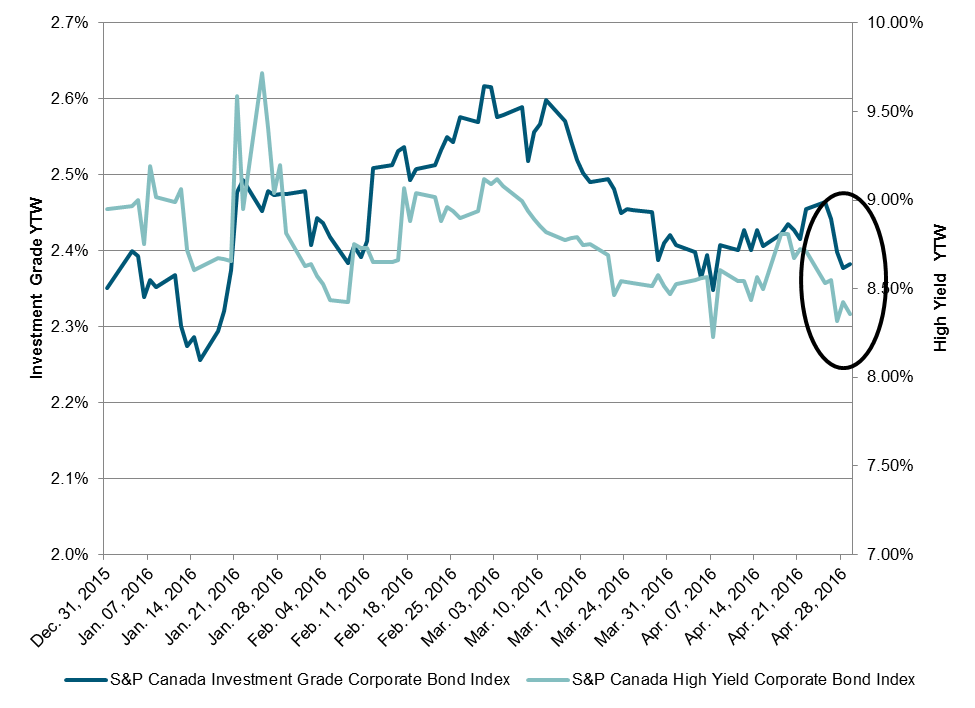

Yields of Canadian corporate investment-grade and high-yield bonds have been trending lower (up in price) since the beginning of March 2016. Year-to-date, the S&P Canada Investment Grade Corporate Bond Index returned 1.59% while the S&P Canada High Yield Corporate Bond Index returned 4.54% as of April 30, 2016.

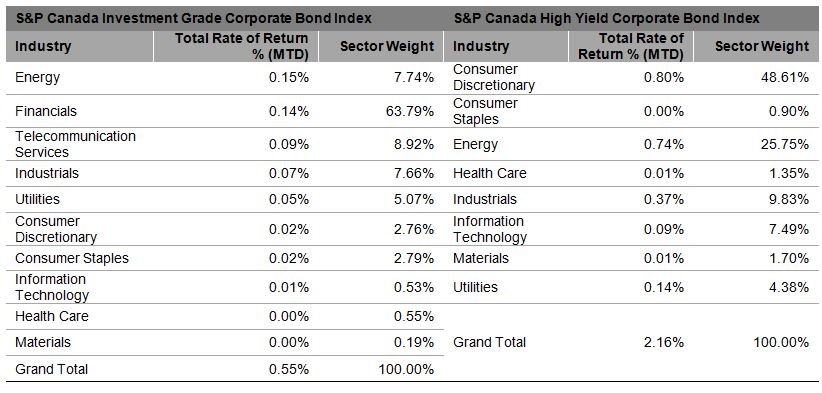

The beginning of April saw yield increase by 9 bps for investment grades and 58 bps for high yield from April 7-19, 2016, as measured by the S&P Canada Investment Grade Corporate Bond Index and the S&P Canada High Yield Corporate Bond Index. In spite of the one-week increase in yields, the indices rallied after April 19, 2016, going into the end of the month. Investment-grade bonds moved tighter by only 4 bps, but high yield stepped it up by tightening 32 bps. In the end, the April index returns were 0.55% for investment grade and 2.16% for high yield.

The performance by industry sectors shows that all sectors had positive returns for the month. Energy, which is a significant weight in both investment grade (7.7%) and high yield (25.7%), has recently been a notable contributor after past months of negative headlines. Up until April 25, 2016, investment-grade financials had returned -0.06% for the month, but performance during the last week of the month pushed the large sector (63.8%) up for a return of 0.14% in April. High-yield consumer discretionary, which accounts for 48.6% of the index, and returned 0.80% for April; this sector contains issuers such as Golf Town Canada, Mattamy Group, Quebecor Media, Brookfield, and AutoCanada, Inc.

The posts on this blog are opinions, not advice. Please read our Disclaimers.