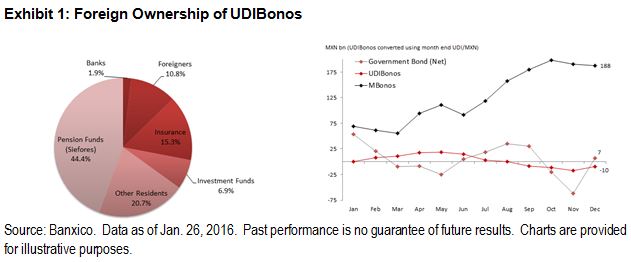

- In January, foreign investors rotated positions back into UDIBonos, adding about 1.2% market share—a significant allocation to this investor base.

- Flows into government bonds as a whole remain muted—in net, foreign investors withdrew about MXN 9 billion over the same period. (CETES: decreased MXN 32 billion; MBonos: increased MXN 7 billion).

- January inflation surprised analysts at 0.38% vs. expectation of 0.28% according to the Banamex survey released on Feb. 5, 2016. Additionally, the survey shows that analysts expectation for full year 2016 inflation to be at 3.07%.

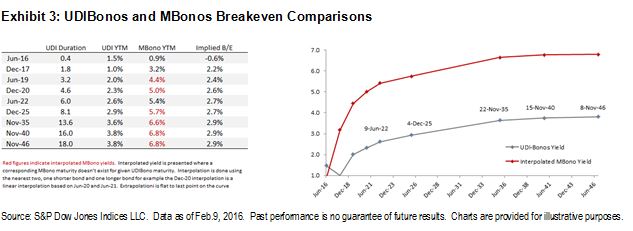

- UDIBonos performance has lagged: current breakeven-inflation levels are below analysts’ expectations for inflation.

Throughout most of 2015, inflation in Mexico surprised analysts with its downside, finishing the year at a historical low of 2.13% (year-over-year). By mid-year 2015, foreign investors began to pare back exposure to inflation-linked UDIBonos, which they had been allocating aggressively to over the 12-month period prior. While foreigners are not the dominant price setters for UDIBonos, the reduction in position, which amounted to about 3% (May-December 2015) of market share, or MXN 37 billion (using the average UDI/MXN), weighed on performance of the inflation-linked instruments.

It is worth noting that although net foreign flows into government bonds have been muted, investors rotated out of both nominal and real rates, adding to bills (Chart pack available on request) and keeping exposure to Mexican pesos.

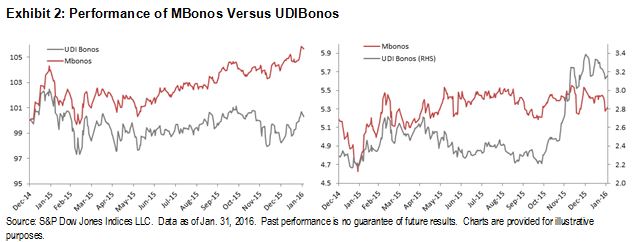

Over the year, average UDIBonos yields, as measured by the , were up 110 bps, eroding coupon and inflation carry on the bonds, leading to a 1.8% loss in terms of total return in pesos. This is compared to yields on MBonos (nominal bonds), as measured by the S&P/Valmer Mexico Sovereign Bond Index, which moved up only 32 bps, with the index returning 4.3%, buoyed by its coupon carry.

As of January 26, 2016, foreign investors added MXN 15.7 billion (UDI 2.9 billion) YTD to UDIBonos and MXN 7 billion YTD to MBonos, while they reduced CETES positions by MXN 32 billion. Although the addition to UDIBonos doesn’t seem outsized in cash terms, we note that foreigners own about 60% of the MBonos market, versus 11% of the UDIBonos market. This highlights the important increase in relative terms to allocations in the inflation-linked bonds. Both MBonos and UDIBonos have benefited, as yields have declined by as much as 50 bps on UDIBonos and 30 bps on MBonos.

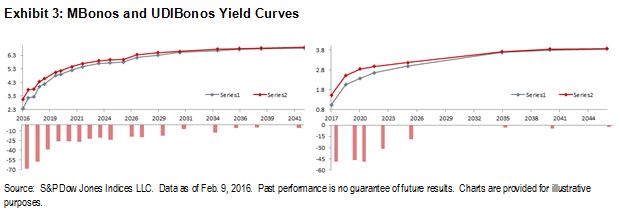

The relative performance leaves break-even points only marginally wider and below the 3% handle. January 2016 inflation in Mexico surprised analysts at 0.38%, versus the expectation of 0.28% (Banamex survey), with base effects driving the year-over-year figure to 2.61% from 2.13% in December 2016. Although seasonality of inflation (February-March) warrants caution, year-end inflation is expected to rise to 3.1% (Banamex survey), while break-even points calculated using the June-2022 bond from the S&P/Valmer Mexico Sovereign Bond Index versus June-2022 bond from the S&P/Valmer Mexico Government Inflation-Linked UDIBONOS Index are pricing 2.7%, or 37 bps, below current year-end inflation expectations.

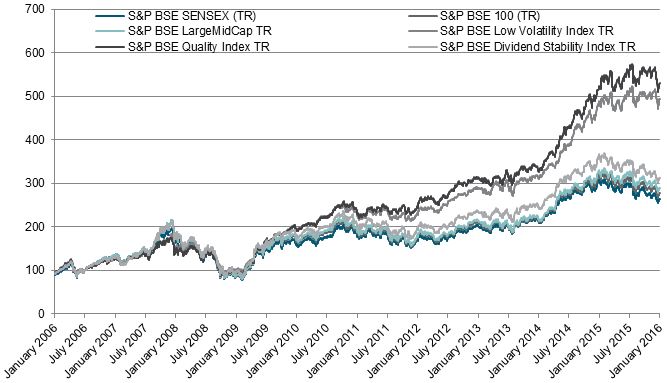

Source: Asia Index Private Limited. Data from Jan. 31, 2006, to Feb. 1, 2016. Past performance is no guarantee of future results. Chart is provided for illustrative purposes and reflects hypothetical historical performance.

Source: Asia Index Private Limited. Data from Jan. 31, 2006, to Feb. 1, 2016. Past performance is no guarantee of future results. Chart is provided for illustrative purposes and reflects hypothetical historical performance.  Source: Asia Index Private Limited. Data as of Jan. 29, 2016. Table is provided for illustrative purposes and reflects hypothetical historical performance. TR refers to Total Return and includes dividends.

Source: Asia Index Private Limited. Data as of Jan. 29, 2016. Table is provided for illustrative purposes and reflects hypothetical historical performance. TR refers to Total Return and includes dividends.  Source: S&P Dow Jones Indices LLC. Charts are provided for illustrative purposes.

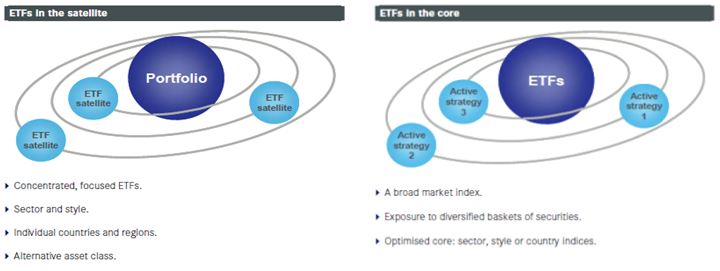

Source: S&P Dow Jones Indices LLC. Charts are provided for illustrative purposes.