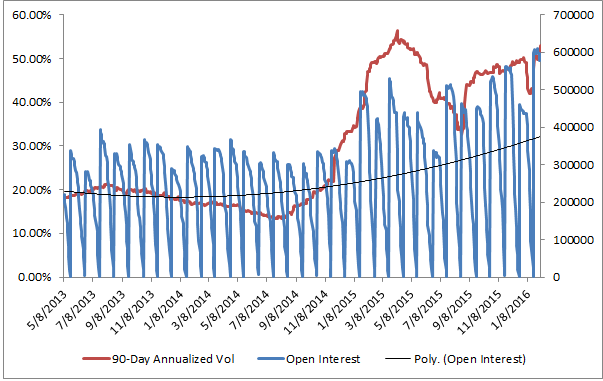

Gold is on the rise this year as investors seek shelter from the volatility in the stock and oil markets. While 90-day annualized volatility of oil, around 50%, is the highest since April last year, and is near its 2001 peak, it’s not near the high levels of 2008 or 1991. Also, the open interest that usually collapses near peak volatility and oil bottoms continues to be high.

This may indicate there will be further trouble in the oil market so is bad news. It’s not only bad news for oil but as commodities and stocks have become more correlated, the fear is spreading across all risky assets. Many times when this happens, investors turn to gold, as they are now. Just as stocks and commodities are each on the brink of a 10% loss year-to-date, gold is up 13% in 2016.

Given the near zero correlation of gold to the S&P 500, it makes sense to use gold for diversification, but given its near 30% loss in 2013, viewing it as a safe haven is arguable. However, when the S&P 500 loses more than 10% over 12 months, gold has returned positive 62% of the time with an average of 2.7%.

Another asset class with near zero correlation to stocks is real estate. In particular, the S&P/Case-Shiller 20-City Composite Home Price Index that measures the value of residential real estate in 20 major cities in the U.S., has 0.08 correlation to the S&P 500 using monthly data since Jan. 2000.

So, can your home price protect as well as gold in a stock market crash?

It depends where you live, but seven of the twenty cities gain on average during stock declines bigger than 10%. The cities include Boston, Dallas, Denver, Minneapolis, New York, San Diego and Washington, D.C. The home prices gain on average 6.0% in Boston and 4.7% in New York that far exceed the 2.7% gold offers. Washington D.C. and Denver are close seconds to gold, gaining 2.4% and 2.3% on average when the S&P 500 loses more than 10% in 12 months.

If you are in Las Vegas, you may be better off betting on gold for safety as their local housing market loses 7.4% on average, only behind Phoenix that loses 8.8% on average when stocks lose.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Source: S&P Dow Jones Indices LLC. Data from February 2016. Chart is provided for illustrative purposes.

Source: S&P Dow Jones Indices LLC. Data from February 2016. Chart is provided for illustrative purposes.