The debate on active versus passive investing is endless, and there are strong arguments on both sides. The active side argues on the advantages of alpha, star fund managers’ year-over-year record performances, better market timing, and better stock picking backed by thorough research.

On the other side, there is a strong passive argument for capturing market beta at significantly lower costs due to lower investment management fees, as passive investing does not require fund manager expertise or expensive research costs. Further contesting the benefits of active management, passive investing has the argument that a fund manager’s consistent performance can be debated and that the continuity of the fund manager’s association with an investment plan or fund is not guaranteed.

Passive, or index-based, investing is investing in products linked to underlying indices. Indices have transparent methodologies, thereby providing rules that ensure that the key criteria to good representation are captured. The index can be a plain vanilla market benchmark like the S&P BSE SENSEX or a broader index, like the S&P BSE LargeMidCap, the S&P BSE 100, etc. The variety of indices is exhaustive, cutting across sectors, geographies, strategies, themes, and factors. Factor-based, or smart beta indices have increased in popularity in recent years. But what, exactly, do smart beta indices do? They capture factors which vary between fundamental and other risk factors to formulate rules that provide variable performance (see Smart Beta on the Rise in India).

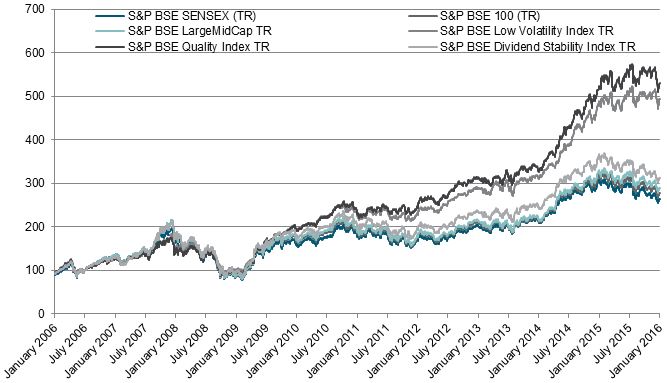

Passive investing also offers the advantage of diversification. The comparison of a select few indices effectively demonstrates the advantages of diversification, which can be achieved via exposure to different broad and factor indices (see Exhibit 1).

Exhibit 1: Index Returns

Source: Asia Index Private Limited. Data from Jan. 31, 2006, to Feb. 1, 2016. Past performance is no guarantee of future results. Chart is provided for illustrative purposes and reflects hypothetical historical performance.

Source: Asia Index Private Limited. Data from Jan. 31, 2006, to Feb. 1, 2016. Past performance is no guarantee of future results. Chart is provided for illustrative purposes and reflects hypothetical historical performance.

Source: Asia Index Private Limited. Data as of Jan. 29, 2016. Table is provided for illustrative purposes and reflects hypothetical historical performance. TR refers to Total Return and includes dividends.

Source: Asia Index Private Limited. Data as of Jan. 29, 2016. Table is provided for illustrative purposes and reflects hypothetical historical performance. TR refers to Total Return and includes dividends.

However, why not get the best of both worlds?

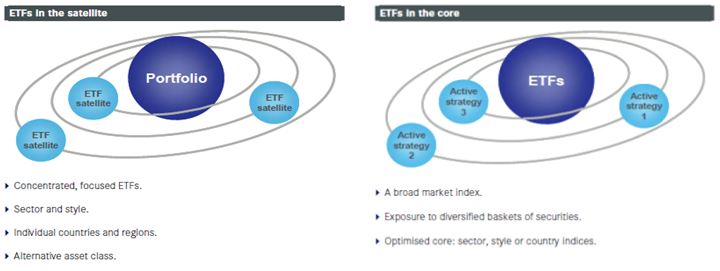

Portfolio managers employ various asset allocation strategies that span styles like conservative, moderate, aggressive, or alternatively strategic or tactical allocations. A familiar strategy often spoken about is core-satellite investing, which is a hybrid of both strategic and tactical allocation. The main objective of investors or portfolio managers is to adopt a strategy that will ensure they achieve their specific goals. If this entails using two strategies and they achieve the same goal, so be it! The core-satellite approach is used to combine active strategies with passive. Hence, those who favor passive investing can use that as their core strategy through index funds and ETFs, and they can support it with active management, and vice versa, to potentially meet their goals and thereby use both active and passive styles to their benefit.

Exhibit 3: Core-Satellite Investment Strategy

Source: S&P Dow Jones Indices LLC. Charts are provided for illustrative purposes.

Source: S&P Dow Jones Indices LLC. Charts are provided for illustrative purposes.

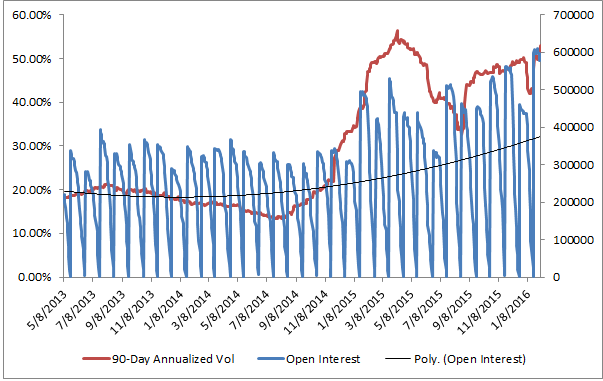

Source: S&P Dow Jones Indices LLC. Data from February 2016. Chart is provided for illustrative purposes.

Source: S&P Dow Jones Indices LLC. Data from February 2016. Chart is provided for illustrative purposes.