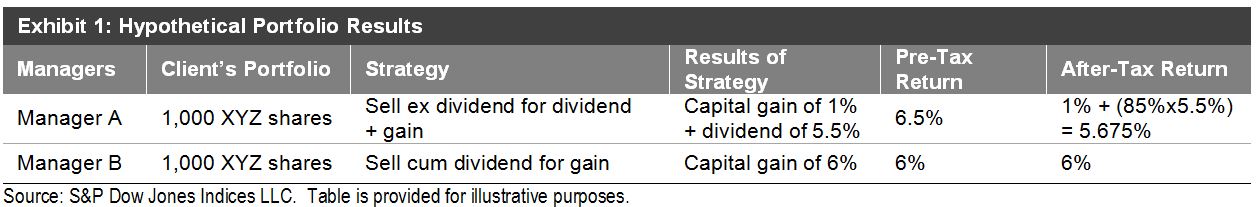

Part 1 of this article looked at the ways in which superannuation funds and other institutional investors build “multi-manager” equity portfolio structures in an attempt to spread the benefits of diversification within, and not just across, asset classes. We noted that, astonishingly, the performance track records of managers are typically compared only on a pre-tax basis, despite the fact that earnings from investments by most investors in Australia are subject to tax.

We turn now to show how this pre-tax focus can mislead superannuation funds and other investors. In Exhibit 1, we present the 10-year excess returns (alpha) of 198 U.S. mutual fund managers over a period ending Dec. 31, 2013, from the perspective of an Australian complying superannuation fund. We will explain the colored data points later.

Funds above 0% on the y-axis (plotted between -6% and 6%) appear to have outperformed by generating returns in excess of the 4.84% per year benchmark return we used over the 10-year period. Those high on the y-axis indicate the most outstanding strategies based on performance track record. The y-axis is typically the only kind of performance information considered when evaluating strategies and choosing between alternative managers.

That approach misses a significant point. It is also important to consider the x-axis, which shows the tax cost of achieving the managers’ pre-tax excess returns. It is concerning to think that many institutional investors and advisors take a “one-dimensional view.” By fixating on the y-axis, which focuses only on pre-tax performance, they are not considering the important dimension of tax (the x-axis), which can give these decision makers a much more complete picture of each manager’s performance. A few forward-thinking institutions have the ability to focus solely on pre-tax manager returns, because they employ a sophisticated overlay approach to tax management (centralized portfolio management), but most do not have that luxury.

Without a “two-dimensional” after-tax view of manager performance it is hard to see that:

- Strategies and managers that look similar pre-tax can look different on an after-tax basis—this is illustrated by comparing the two funds highlighted in black in Exhibit 1;

- Strategies and managers that look like they are adding value can actually erode wealth on an after-tax basis—this is illustrated by the funds highlighted in green in Exhibit 1; and

- A strategy or manager that looks superior to another strategy pre-tax can actually be inferior when compared after tax—this is illustrated by comparing the two funds highlighted in purple in Exhibit 1. The fund that generated an annual pre-tax excess return of 3.60% (compared to its competitor that returned 3.09%) in fact returned only 2.88% after tax, which is less than the 2.98% after-tax return of its competitor.

The simplistic one-dimensional analysis of the performance histories of the complete set of funds shows that 132 of the 198 funds outperformed the broader market; that is, generated positive pre-tax alpha. This looks like good news. However, the two-dimensional analysis, factoring in tax, shows that only 99 (about one-half of the funds) actually added value above market. So, in fact, the news is not quite so good, and it is certainly not good for a superannuation fund invested in one or more of the 33 managers whose performance looked healthy pre-tax but performed no better or worse than the market on an after-tax basis.

This is a cautionary message for superannuation funds and advisors engaging in the important task of choosing investment managers to achieve the right multi-manager and strategy mix: always check that performance is evaluated with the investor’s tax profile in mind and beware of traditional pre-tax analyses and their potential to mislead.

The posts on this blog are opinions, not advice. Please read our Disclaimers.