In the first 5 days of 2016, the S&P GSCI Crude Oil Total Return lost 10.5%, making it the worst start for oil in history. This oil mess has spilled into other commodities, driving the 3rd worst overall commodity start in history since 1970, losing 5.5% in 5 days. It is the worst start in almost a decade when the S&P GSCI Total return lost 6.4% in the first 5 days of 2007, and that was the worst start since 1975, when the index began with a 7.4% loss.

Energy is now down 8.8% driven by double digit losses in crude oil (-10.5%) and unleaded gasoline (-11.3%). If it weren’t for the cold weather supporting natural gas (+5.8%,) the whole sector might be down double digits. It seems the middle east tensions may have driven the likelihood for a supply increase rather than disruption, but the focus has shifted to the dollar strength and Chinese demand weakness.

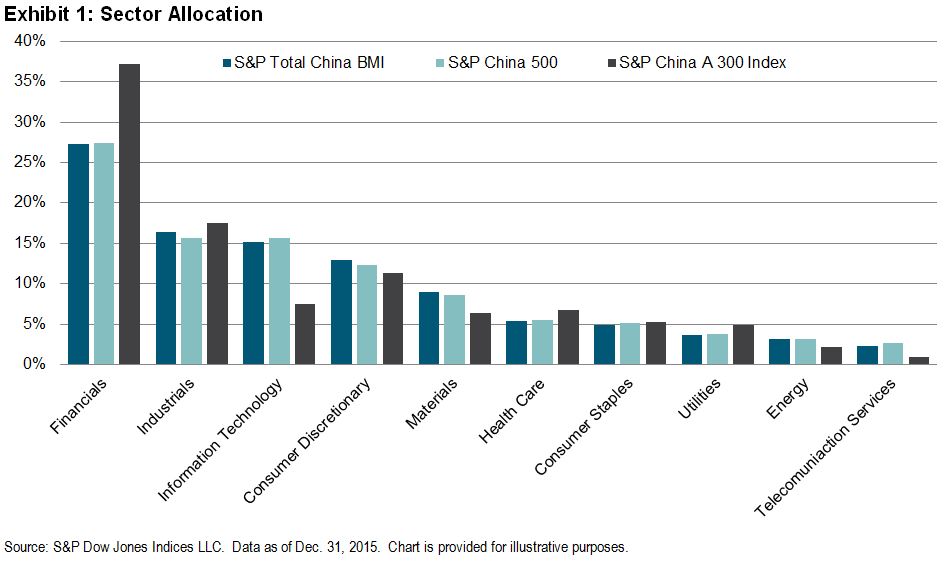

The slowing Chinese demand and currency weakness are problematic for all commodities, not just energy. Already in 2016, there are 17 losers of 24 commodities with 4 of 5 sectors down. All five constituents in the Industrial Metals (-4.0%) are getting hammered with the S&P GSCI Lead Total Return down 9.9%, although energy is still the worst of the sectors.

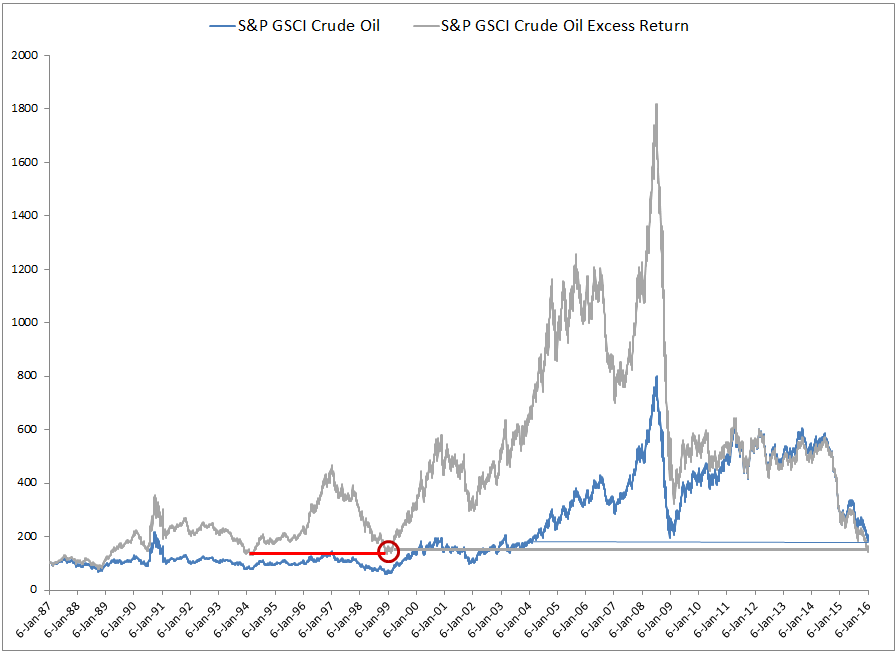

Many of today’s reports pointed out that oil hit a new 12-year low, but the pace at which the price is falling is alarming. Now the S&P GSCI Crude Oil (Spot) level is the lowest since Feb 2004 and the price would need to be cut in almost in half to lose another multi-year leg that would put oil down to the bottom seen in Nov 2001. That’s not bad news.

The concern is for futures investors that need to pay rolling costs. The S&P GSCI Crude Oil Excess Return that includes rolling costs is down far past a 2004 low, reaching its lowest since Feb 1999, and is on the verge of another multi-year loss. If the S&P GSCI Excess Return loses just another 5.5%, it will shed another 5 years of gains.

This is happening at the most important time in the year for the indices, precisely at the rebalance. Not only is the timing important but (WTI) Crude Oil is taking over Brent Crude as the biggest index constituent in 2016. Maybe there is a silver lining that index investors are rebalancing back to crude with a 10% discount from the start of 2016. It is the “best buy” the index has ever seen at its annual rebalance based on the worst start for crude ever.

The posts on this blog are opinions, not advice. Please read our Disclaimers.

Not all weeks are equally important

Not all weeks are equally important