Despite the weakness in local currencies, the S&P Pan Asia Bond Index, which is designed to track local currency bonds in 10 countries and is calculated in USD, delivered a total return of 1.45% for 2015. The S&P Pan Asia Corporate Bond Index rose 2.54% in the same period, outperforming the S&P Pan Asia Government Bond Index.

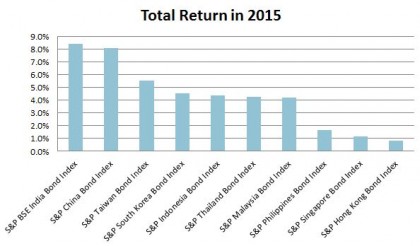

Among the 10 countries tracked by the S&P Pan Asia Bond Index, India was the best-performing country for the year; the S&P BSE India Bond Index rose 8.40% in 2015, while its yield-to-maturity closed at 7.89%. The S&P China Bond Index went up 8.05%, despite the equity market volatility and slowdown in China. Though these returns were shy of their double-digit gains of 2014, the gains were robust given the challenging market conditions. Indonesia had a volatile year, the S&P Indonesia Bond Index managed to reverse its earlier loss in Q3 2015 and ended the year with a 4.35% total return; its yield-to-maturity reached 8.88% and it was the highest-yielding country in the region.

The size of Asia’s local currency bond markets, as measured by the S&P Pan Asia Bond Index increased 21% to USD 8.40 trillion in 2015, which reflected the continuous market expansion. The market value tracked by the S&P China Bond Index expanded 40% to RMB 36.9 trillion, fueled by the municipal bond replacement program and the growth in the corporate market.

Exhibit 1: Total Return of the S&P Pan Asia Bond Index Series in 2015

Source: S&P Dow Jones Indices LLC. Data as of Dec. 31, 2015. Chart is provided for illustrative purposes only.

Exhibit 2: Yield-to-Maturity of the S&P Pan Asia Bond Index Series

Source: S&P Dow Jones Indices LLC. Data as of Dec. 31, 2015. Chart is provided for illustrative purposes only.

The posts on this blog are opinions, not advice. Please read our Disclaimers.