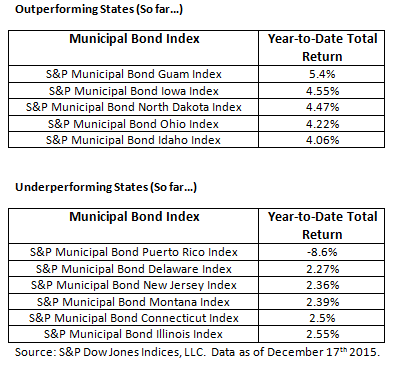

Some parts of the U.S. municipal bond market is doing well in 2015 but others are struggling. Let’s start with which states are hot and which are not. Guam is the leader but that tiny issuer is really not a far measure. Smaller issuers like municipalities in Iowa, North Dakota have done well and supply may play a factor. Underperformers have been led by Puerto Rico. The S&P Municipal Bond Puerto Rico Index is down 8.6% year-to-date. Despite the negative headlines about pension shortfalls Illinois and New Jersey bonds are both are underperforming the overall bond market but not by all that much. By comparison the investment grade tax-free muni market tracked in the S&P National AMT-Free Municipal Bond Index is up 2.98%.

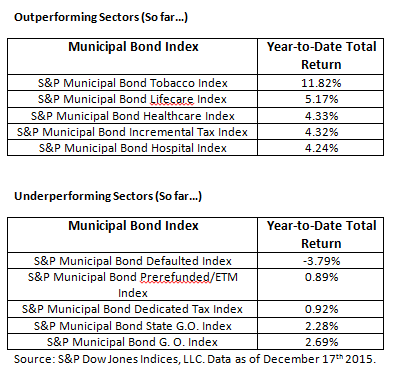

Sectors of the municipal bond market outperforming include the much tobacco settlement bond sector up 11.8% year-to-date. These bonds have huge obligations in the future but they often are long dated so the short term risks are very different then the long term prospects of repayment. Healthcare related sectors of the bond market have outperformed the rest of the market as well. Underperforming is the defaulted sector down nearly 3.8% but what is extremely telling is the performance of the U.S. Government Bond backed Prerefunded and Escrowed to Maturity sector. These bonds have done little in 2015 due to the low yields of these high quality and often short term bonds.

The posts on this blog are opinions, not advice. Please read our Disclaimers.